This is part of the Callahan Financial Performance Series. Presented by the analysts at Callahan & Associates, the series helps leaders interpret data to drive smarter decisions and uncover new approaches to measure performance.

Operating expenses at U.S. credit unions have been on the rise as cooperatives reward staff, invest in technology, and pay for strategic guidance. Unfortunately, this has come at the expense of stronger earnings.

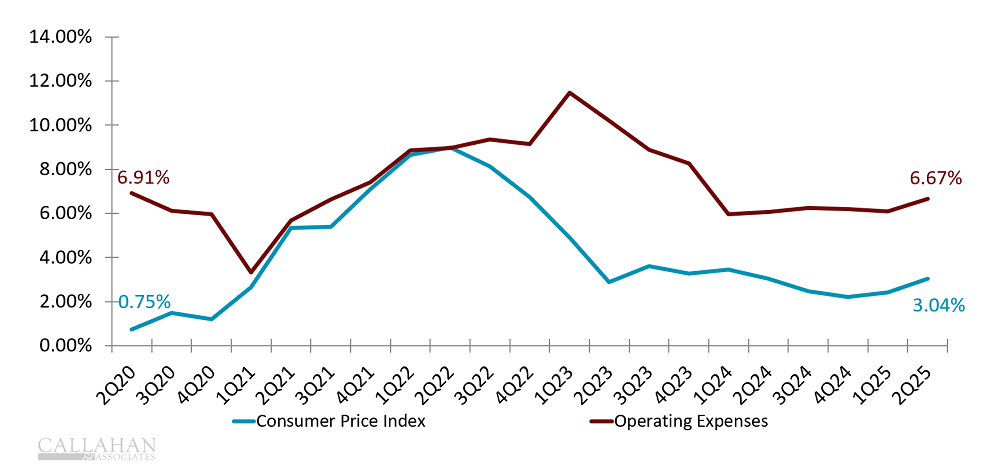

Operating expense has jumped nearly 7% annually in the past five years. It has risen as a percentage of average assets for 13 consecutive quarters as inflation makes its mark on employee compensation, office operations, and professional services. Smaller credit unions, which typically do not benefit as much from returns of scale, have been hit particularly hard.

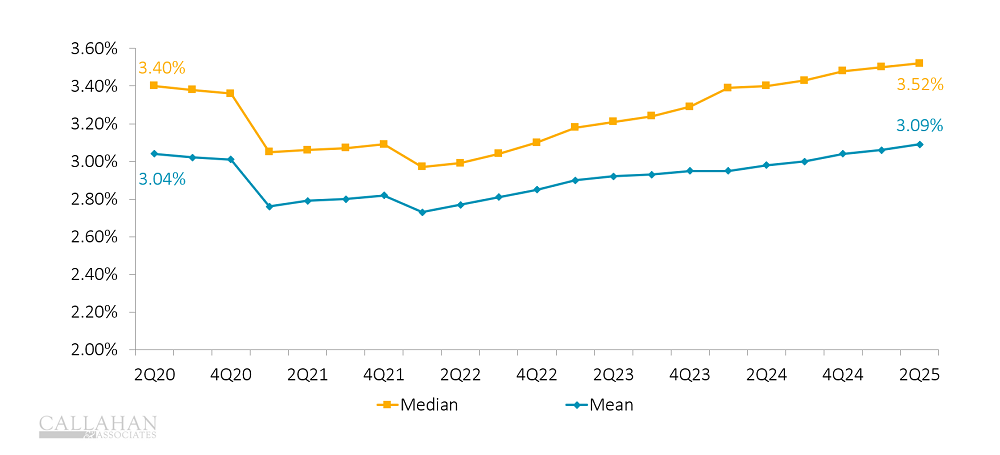

Currently, the rise in the net interest margin has more than offset the rise in operating expense; however, net interest margins are currently benefitting from the elevated interest rate environment. If rates come down, expect net interest margins to drop, too.

OPERATING EXPENSE RATIO

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

Increased spending is not inherently bad — in fact, strong operations are a crucial part of quality member service. Credit unions must invest in their operations to remain competitive in the marketplace and give members the financial experience they deserve. The key, however, is efficient expenses. Are the increased costs generating proportional returns and value for members?

U.S. INFLATION AND CREDIT UNION OPERATING EXPENSES

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

Diving Into OpEx Trends

Inflation peaked at 7% in 2021 and has hovered around 3% since 2023. Today, rising prices have trickled into compensation, travel, office costs, and more, yet the efficiency ratio — calculated as operating expenses divided by operating income — at U.S. credit unions improved for the first two quarters of 2025 and stood at 70.79% as of June 30. Although this is promising, a rate cut from the Fed would dig into interest income and erode the efficiency ratio.

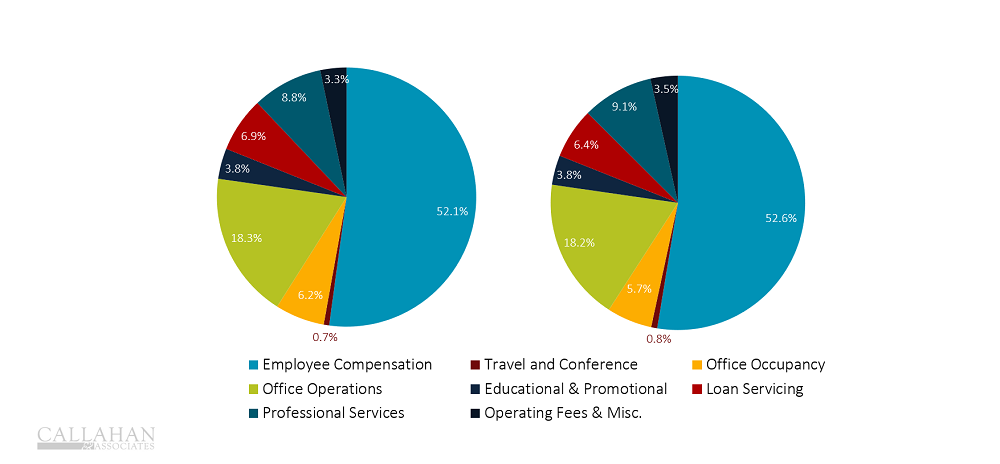

OPERATING EXPENSE COMPOSITION

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

At 52.6%, employee compensation and benefits constitute the majority of a credit union’s expenses. To retain and reward experienced talent, credit unions have increased average salaries 7.8% per year for the past 10 years.

A happy staff is one of the keys to superior member service, but in addition to monetary compensation, it is important to provide appropriate resources, which come at a cost, too. In the past decade, costs for professional and outside services have risen faster than other expenses and comprise more of the operating expense budget with each passing year. Investing in these services, particularly new technologies, is essential. It would be costly, inefficient, or downright impossible for a credit union to provide many of them in-house, yet they are necessary in today’s competitive, commoditized financial services market. What’s less necessary is physical office space. Although office operation costs have remained fairly flat the past few years, office occupancy has declined. This is likely the result of post-pandemic adjustments in response to realigned office space needs.

In addition to the right tools, the right messaging goes a long way in winning over members. Although educational and promotional budgets comprise a small part of operating expenses, their impact can be outsized. Getting the word out about a credit union’s purpose is one way to draw in existing as well as potential new members and efficiently deepen relationships down the road.

Bottom Line

Unchecked operating expenses hurt a credit union’s ability to grow and return maximum value to members, yet keeping up with currents needs and expectations comes at a cost. Whether today’s investments pay off will depend on how well credit unions can leverage new resources to deliver meaningful benefits for members.

For now, credit unions must ensure investments in necessary services don’t constrain their ability to fulfill their member-driven missions. It’s a difficult balance, but credit unions have a secret weapon: their purpose. If they can clearly communicate why they exist, consistently deliver on that promise, and prove themselves to be trusted financial partners, they can build lasting loyalty rooted in strategy and service.