As COVID-19 swept the country, many consumers moved their savings into deposit accounts and reduced spending in the face of economic uncertainty. This flight to safety, coupled with government relief programs, led to a significant increase of total deposits at credit unions across the country.

But even as cash balances grew, credit unions were adapting their operations and interpersonal interactions to accommodate a new normal. Pandemic-induced lockdowns prompted credit unions nationwide to implement additional digital functionalities to reduce the need for in-person transactions. In some cases, credit unions permanently closed branches. In other cases, the reduced foot traffic forced the shutdown of the entire institution.

Between June 30, 2019 and June 30, 2020, 150 credit unions merged or liquidated and ceased operations 462 branches closed as a result during the period. On a larger scale, 569 credit unions including the 150 that ceased operations closed at least one branch during that year. On the flipside, 340 credit unions opened at least one branch during the time period, bringing the total number of physical credit union branches in the United States to 20,529 as of June 30, 2020.

Despite the decrease in brick-and-mortar locations, deposits increased significantly at U.S. credit unions. Average deposits per branch climbed $12.4 million, or 20.3%, year-over-year. Comparatively, average bank deposits per branch increased $36.6 million, or 24.1%, year-over-year.

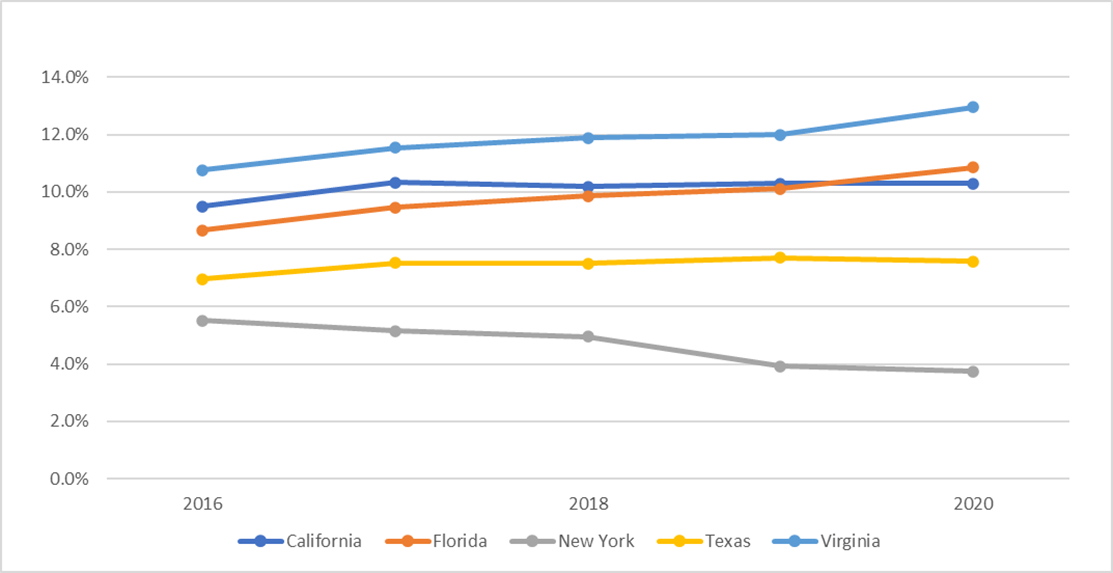

Market Share For States With The Largest Deposits

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

SOURCE: Callahan & Associates | FDIC

The top five states with the largest reported total deposits fluctuated in market share growth. Virginia and Florida gained, Texas and New York slightly decreased, and California held steady.

As of June 30, 2020, five states together comprised 45.5% of the total deposit market for U.S. credit unions. Those states in order of largest to smallest deposit balances were California, Virginia, Texas, New York, and Florida.

Collectively, deposits in these states grew 16.4% or $87.1 billion year-over-year. California reported the largest increase in market share; it was up 99 basis points year-over-year. New York lost the most market share; it was down 19 basis points. All five states shuttered branches. California closed 168, Florida closed 56, New York closed 206, Texas closed 112, and Virginia closed 32. Arkansas, Idaho, and Colorado reported the largest net growth in credit union branches 9, 7, and 7 branches, respectively.

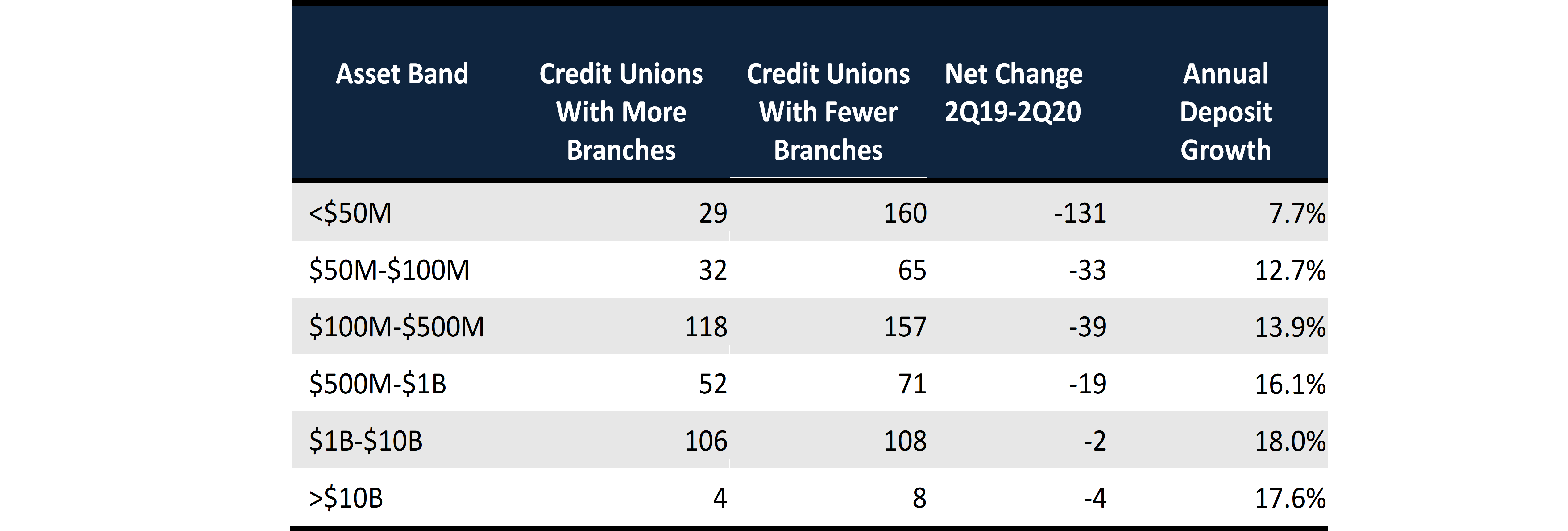

Branch Numbers And Annual Deposit Growth By Asset Band

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

SOURCE: Callahan & Associates | FDIC

From June 30, 2019, to June 30, 2020, credit unions in all asset bands decreased their physical footprint. Despite this, they reported record growth in deposits.

Data as of June 30, 2020, shows average deposit growth is increasing relative to asset size. Possibly because of more efficient operations and wider reach, larger institutions are reporting stronger growth. Smaller credit unions have struggled to keep pace with brick-and-mortar as well as new technology costs, a problem compounded by the unprecedented economic environment. Today more than ever, it is crucial for executives at smaller cooperatives to carefully weigh their options regarding physical branching and technological enhancements to operations.

The pandemic has presented many hardships across the board, no doubt, but credit unions have continued to serve members and support local economies. For example, despite operating fewer locations, credit unions have increased the number of full-time equivalent employees 1.8% year-over-year. The addition of 5,733 new employees brought industrywide employment to more than 316,000. What’s more, compensation and benefit expenses increased 8.6%, or $13.4 billion, year-to-date, as credit unions provided additional staff training and hired specialized personnel to increase digital offerings or otherwise augment member service.

These employment factors along with increased membership, deposit growth, and market share signal an industrywide expansion. In a time when many Americans are struggling financially, credit unions are investing in resources to ensure services are available to members.