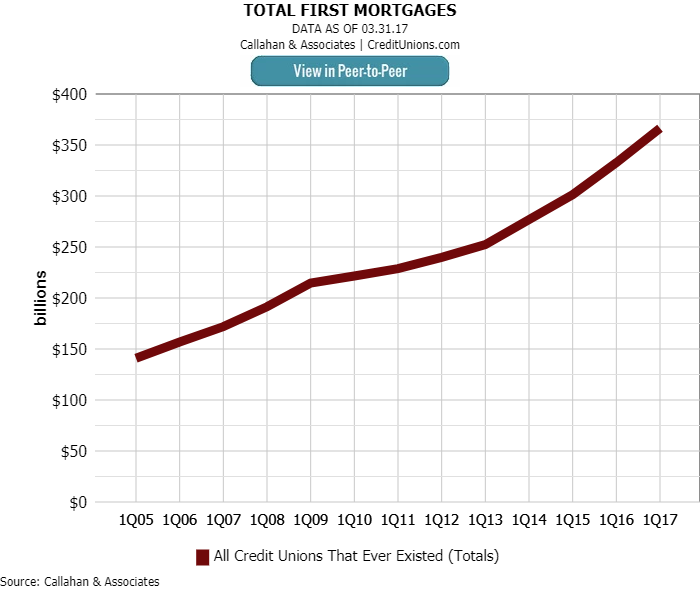

Credit unions wrote almost $34 billion more in first mortgage loans than they did one year ago, reporting year-over-year growth of 10.2% as of March 31, 2017. By comparison, the 5,856 U.S. banks in Callahan & Associates’ Peer-to-Peer database issuedmore than $330 billion in additional loans and reported first mortgage loan growth of 5.7%.

First mortgage loan growth has slowed slightly at both credit unions and banks versus one year ago; however, it is nearing pre-recession steadiness within the credit union industry.

Credit union first mortgage loan growth outpaced that of banks and other depository institutions in first quarter 2017, and industry market share reached a record high of 8.6%. That’s 2.7 percentage points higher than the 5.9% posted in first quarter2013.

Asset Quality

Credit union first mortgage delinquency dropped 11 basis points in the past year to 0.44%.

Real estate delinquency at commercial banks dropped 72 basis points in that timeframe, according to the Federal Reserve. However, the 2.93% delinquency rate of commercial banks is still almost 2.5 percentage points higher than the credit union industryaverage.

A more conservative approach to underwriting at credit unions has protected institutions as well as members. Credit unions have thus far tamed the risk in first mortgage lending, taking advantage of significant growth and performance opportunities.

How does your loan portfolio compare? Dive in deep with Callahan’s analytics software. Learn more.

Interest Rates And Portfolio Composition

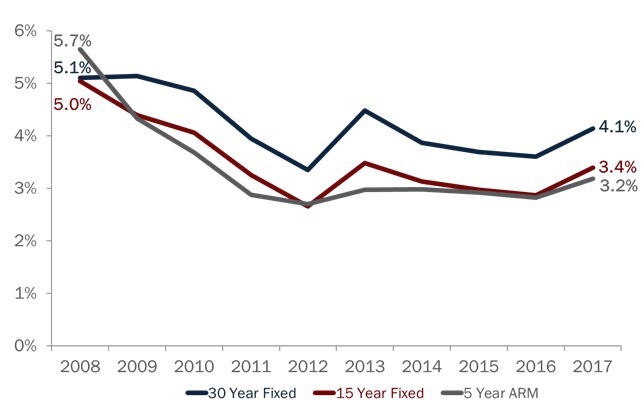

National mortgage rates increased from fourth quarter 2016 to first quarter of 2017, with fixed rates rising at the fastest rate. The 30-year and 15-year fixed rates increased 50 and 40 basis points, respectively, year-over-year.

National Mortgage Rates Data

FOR ALL FINANCIAL INSTITUTIONS | DATA AS OF 03.31.17

Source: Freddie Mac | freddiemac.com

Although dollar amounts increased across all real estate lending products in the past year, the share of products as a percentage of total first mortgage originations has shifted. Fixed-rate first mortgages in the first quarter posted the largest sharedecrease, dropping 74 basis points year-over-year to 66.5%. Adjustable-rate mortgages dropped 14 basis points to 11.19%, whereas balloon and hybrid loans increased 89 basis points. These accounted for 22.4% of total first mortgage originations asof March 31, 2017.

ContentMiddleAd

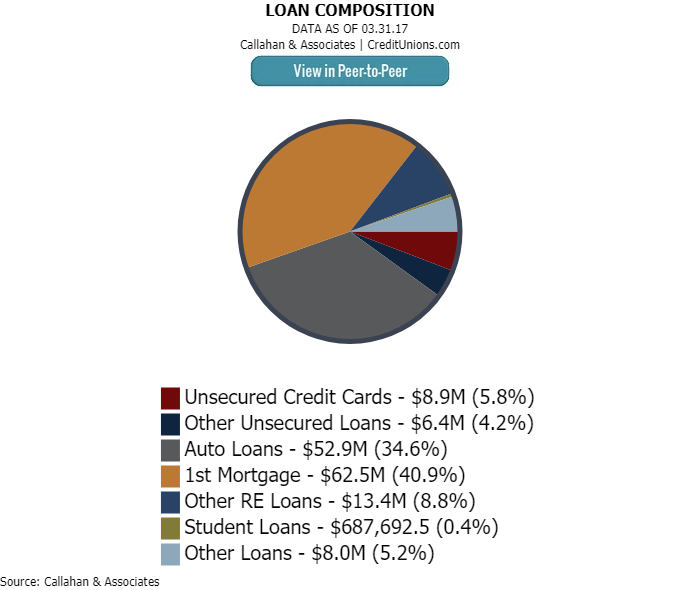

More broadly, first mortgages comprised 40.9% of the credit union loan portfolio as of March 31, 2017. That’s the largest share of the portfolio; however, that share has shrunk year-over-year amid the more rapid growth of other loan products. Whentaking into consideration other real estate loans, almost half of the credit union loan portfolio is composed of real estate loan products, making these loans an integral product in the market today.

Secondary Mortgage Market

Sales to the secondary market as a percentage of first mortgage originations decreased 1.8 percentage points year-over-year to 35.1% as of March 31, 2017.

Sales to the secondary market should continue to decrease as interest rates rise. Historically, sales to the secondary market have a lagging, inverse relationship to interest rates. The metric hit a high of 58.1% in 2013 following interest rate low pointsof 3.35% and 2.66%, respectively, in the 30-year and 15-year fixed rate loan.