Together Credit Union ($2.3B, St. Louis, MO) has grown and changed a lot during the past 30 years. Paula Anderson has been an integral part of that progress.

Anderson joined the cooperative as a marketing and communications coordinator in 1991. Now, in the newly created position of vice president of strategic initiatives and impact, she plays a central role in guiding the cooperative’s data- and culture-driven plans for the future.

Here, she talks about her new role.

Why did Together create this title and role? Were they crafted around you?

Paula Anderson: The need and desire for intentional focus on direction, strategy formulation, activation, and communication has been growing the past several years. Corporate strategy was added to my brand and communications role in 2019. As of the first of 2021, it became my full-time focus.

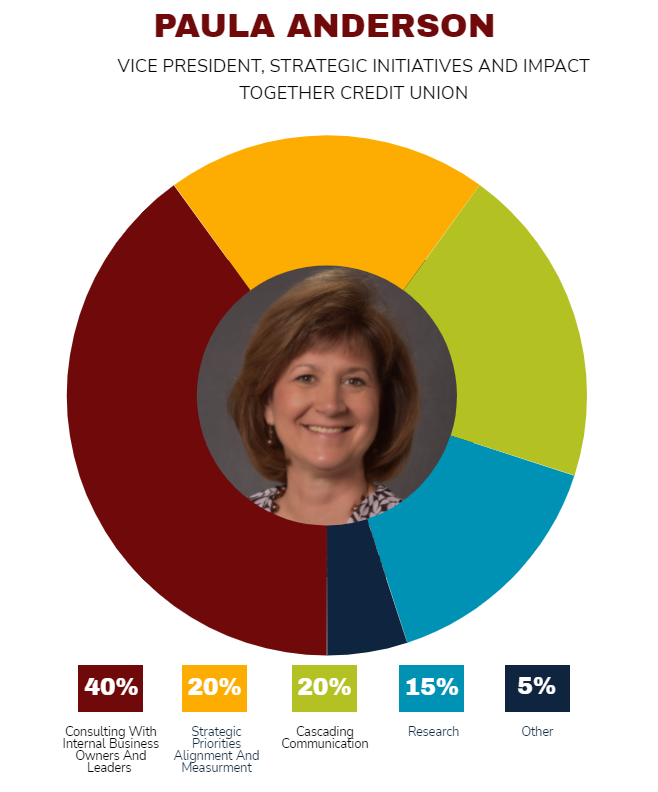

What are your areas of responsibility?

PA: I’m responsible for guiding the development, facilitation, and communication of our five-year strategic plan and corresponding insights and innovation. My role is highly consultative, working with all business units to actively identify ongoing strategic needs and new growth opportunities, communicating related plans and priorities, and developing a strategic-thinking culture as well as working with our strategic partners to leverage those relationships.

What does the role of vice president of strategic initiatives and impact look like at Together Credit Union? Click here to download the job description. This and many more are available in the Callahan Policy Exchange.

Describe the strategic initiatives part of your job.

PA: The foundation of our five-year plan is built on three strategic pillars Member Experience and Expectations, Operational Excellence, and Owning Our Markets that are constructed with a strong focus on people and culture as well as business intelligence. My role is focused on ensuring these pillars are not silos but are instead interdependent and contributing in tandem. I meet regularly with the many pillar leads to scope existing and identify new initiatives, prioritize, and analyze progress and results.

Describe the impact part of your job.

PA: Moving the credit union from point A to point B takes much more than an annual planning session and a formal strategic plan, it takes everyone employees and leaders understanding and accepting strategy, applying and internalizing strategy, and living strategy in their experiences. Impact is when strategy produces results and evolves into future-forward business-as-usual. My vision of ultimate impact is having the entire team balancing and reacting to what must happen today in direct alignment with what we strive to happen tomorrow.

To whom do you report? Who reports to you?

PA: I report to our chief people officer and work closely with our board of directors, CEO, and entire executive leadership team. I currently have no direct reports.

What makes you a great fit for this job?

PA: My marketing, communicating, and branding experience have certainly shaped my strategic thinking and execution skills. Balancing internal drivers such as mission, growth, and profit with external drivers such as competition, consumer needs, wants and expectations, and innovation plays a huge role in gaining a competitive advantage, share of wallet, and market share, especially in marketing. This experience translates easily to corporate strategy, just broadening it to an organization-wide perspective.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

What challenges and opportunities for the credit union does your role address? How do you address them?

PA: I think the ever-dynamic data environment one in which we have greater access than ever to data regarding member behaviors, consumer demand and expectations, competition, productivity, capacity, markets, etc. represents both challenges and opportunities for our cooperative.

Business intelligence touches every one of our strategic priorities and impacts our culture. Data is knowledge, and with knowledge comes power or, better said, success. I enjoy creating conversation and awareness across business units and helping identify common challenges and opportunities where data and business intelligence can influence outcomes.

What’s your daily routine at Together?

PA: No two days at the credit union are ever the same. Whether I’m working on strategic priorities, communicating strategy and results, helping develop and activate strategy, or consulting with co-workers and industry partners, ultimately my goal is to drive value for the credit union and our 135,000+ members.

How has the COVID-19 pandemic affected what you do at Together?

PA: Despite the unexpected challenges the pandemic posed, our resulting assistance and mitigating strategies, enhanced remote capabilities, and operational efficiencies have strengthened the way we think about and do our business. We’ve always rallied behind our mission the pandemic reinforced our capabilities for collective action and that business-as-usual can thrive as unusual.

My goal also is to create a cohort of credit union peers as well as others in the same roles in service industries. There’s nothing better than networking!

How does your role help improve member service?

PA: Our entire strategic plan, initiatives, and priorities center on delivering superior member experiences. My role helps apply this lens every day, in all strategic considerations.

How do you track success in your job?

PA: Currently, wet track success with both quantitative and qualitative measures. Our strategic priorities scorecard is updated monthly and contains KPIs for our three strategic pillars. We’re also tracking the effect of various impact initiatives such as people-hours saved and more.

Qualitatively, I measure success via acceptance of this new role via my ability to contribute and provide value based on feedback, requests for assistance, and impact of input. It’s a new position, so the measurements are definitely a work in progress.

How do you stay current with topics that fall under your role?

PA: As this role is new to me and to the credit union, I am reading most everything I run across and attending more webinars than one could think possible trends, foresight, consumer behavior, market disruptions, and certainly strategy best practices.

We are active members of several collaborative credit union efforts focused on RD and strategy, including CUFSLP, MDC, and Filene, all of which provide exceptional resources that complement and expand our internal capabilities.

My goal also is to create a cohort of credit union peers as well as others in the same roles in service industries. There’s nothing better than networking! If you’re in for talking strategy and execution, catch me anytime at panderson@togethercu.org.

This interview has been edited and condensed.