America divided. Red versus blue. Wall Street versus Main Street. Us versus them.

Such mantras have dominated social discourse in recent years, leading many to wonder if the country will ever find a common ground. But things changed in March as Americans settled into the sobering reality of social distancing, government-imposed lockdowns,and massive job losses in the wake of the novel coronavirus COVID-19 outbreak.

Almost overnight, all-too-human virtues such as empathy, altruism, and generosity started trending again. Because of the highly contagious nature of COVID-19, individuals are compelled to think about how their actions might impact the health of people they don’t even know. With the exception of a little toilet paper hoarding, Americans have pulled closer together as a community even as they remain six feet apart.

“As credit unions, we can’t forget who we are during this time,” says Chad Helminak, director of development education and cooperative culture at the National Credit Union Foundation (NCUF). “Empathy comes natural to credit unions. We’ve been practicing it since Day One, and look how far we’ve come. Credit unions are a great place to change the world one person at a time.”

Helminak leads the NCUF workshop Exploring Empathy for credit unions across the country, focusing on the premise you never truly know someone until you walk a mile in their shoes. At a time when workplaces have been severely disrupted, credit unions are already stepping up to the challenge by staffing drive-thru windows and pushing out loan payment due dates to support members affected by COVID-19.

Empathy is needed in times like these, Helminak says, and just like a muscle in the body, it needs constant practice.

“It could be small changes such as waiving an NSF fee for a member who has overdrafted an account,” Helminak says. “That member might have been living paycheck to paycheck and just lost their job. Waiving that fee might help save them.”

Learning From Life Simulations

Typically, the NCUF’s Exploring Empathy session begins with a life simulation wherein participants don badges with the names of different people whose lives are in turmoil. In roles that include a homeless person, a child, a disabled grandparent, and a single parent facing eviction, participants face financial hardships such as job losses and mounting medical bills.

“There are things beyond the balance sheet and account balances that are impacting our members’ lives,” Helminak says. “Bad things happen to good people. The question is: What can we do about it? How can we practice empathy in a greater way, and how can it help our business? Empathy is not about charity. It’s about innovation and developing solutions that meet the needs of our members.”

Each persona includes demographic information including employment background and income. Participants must live their persona’s life during a four-week period compressed into four 15-minute segments. Around the room, volunteers play landlords, police, job recruiters, and other roles. Participants have 15 minutes to wait in line and accomplish a week’s worth of important errands. They draw life happens cards to simulate disruptive events, such as an unexpected trip to the hospital. Often, time runs out before they can complete their errands.

Rethinking Charitable Giving

During a recent NCUF workshop, more than 60 members of the Interra Credit Union ($1.2B, Goshen, IN) leadership team participated in a life simulation. Interra enlisted the local sheriff to play the role of policeman while the head of the local housing agency collected rent. Both provided real-life perspectives on the simulations. The credit union’s board chair played a thief and a drug dealer who stole from participants and encouraged nefarious behavior.

“When we ask at the end how many people committed a crime, you’d be surprised by how many hands go up,” Helminak says. “People in desperate situations take desperate measures.”

Interra CEO Amy Sink says the NCUF’s program helped open minds to a new mission for the Interra Cares Foundation. Formed in 2018 and supported by annual fundraising campaigns, the credit union’s foundation has to date provided charitable donations to community support groups, but Sink says she and her board believe it can do much more.

Things began to come into focus last year when Sink and other credit union leaders completed the Sustainable Business Strategy course from Callahan & Associates in collaboration with Harvard Business School Online. The course challenges participants to think differently about solving problems, and after taking it, Interra’s leaders decided to raise the priority of the foundation’s mission. The credit union has since tasked executive vice president and chief strategy officer, David W. Birky, with pulling together resources across the credit union and partnering with relief agencies and the private sector to more directly impact people in need.

Two areas have emerged as especially important: transportation and housing.

“We need to think bigger,” Sink says. “How do I get a car into somebody’s hands when they’re unlikely to walk through our door? If we can get them a reliable car or even a bus pass, we can make sure they can get to and from work, so they have an income and eventually build up savings.”

Turning Ideas Into Action

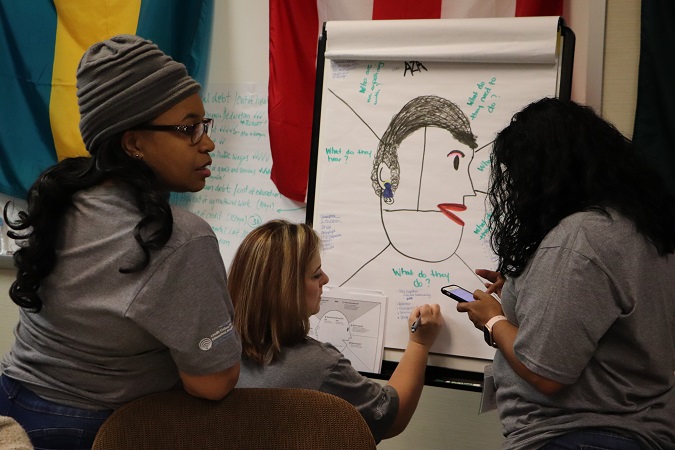

A follow-up session to the empathic leadership workshop requires participants to jot down thoughts on what members facing various challenges might be thinking, feeling, saying, and doing. With that understanding, they think about how the credit union can improve the way it serves these individuals.

Interra’s management team presented concepts uncovered during their empathy mapping to employees who, Sink notes, also might benefit from a little empathy training.

“When you have a 20-something-year-old teller or member-advisor trying to help with these kinds of problems, sometimes it can go very badly,” Sink says. “It’s a simple fact that one-in-four people in the community is struggling. That means one-in-four employees might be struggling, too. If we can’t take care of our employees, how can we look outside and help people?”

Now, with so many communities locked down under the COVID-19 threat, unemployment claims just hit an unprecedented 3.2 million in one week, and economic recession fears are rising. Empathic leaders must address these issues head on, Sink says.

“When there’s a big problem like coronavirus, all the great minds come together to solve it,” Sink says. “I think we can do the same thing with these social problems. I don’t have a lot of confidence in the federal government, but I know we can make a difference if we put our money into the hands of people who can really help.”