Credit unions are ready for the next uptick in interest rates the Fed has hinted it will introduce as early as its next meeting in mid-June.

The Federal Reserve’s Board of Governors has increased interest rates, which hit rock bottom during the Great Recession, only three times since December 2015. The Fed’s intent has been to encourage borrowing and stimulate the economy, but its actions have also leveled the yield curve into a flat plane.

Now, only a sliver of investments held by American credit unions are in long-term securities. Cash and maturities of three years or less comprise most of the portfolio.

Long-term securities lose value quickly as interest rates rise, but that’s not been the primary driver of staying short in credit union land through quarter after quarter of predicted rate hikes.

Jay Johnson, Partner, Callahan & Associates

Credit unions are staying relatively short and relatively liquid because of all the lending activity, says Jay Johnson, a partner at Callahan and president and treasurer for TRUST Mutual Funds. Most of the growth in the credit union portfolio has been on the cash side. Lending has been so good that credit unions want to keep their investment durations short.

Indeed, the movement turned in its 11th consecutive quarter of double-digit loan growth in the first three months of 2017, expanding at a year-over-year rate of 10.9% and approaching $900 billion in total balances. First mortgage originations jumped 15.9% from one year ago and market share hit a new record of 8.6%.

Johnson and Alix Patterson, a co-partner at Callahan & Associates, dove into several dimensions of the credit union investment portfolio during the consulting company’s May 25 Trendwatch webinar.

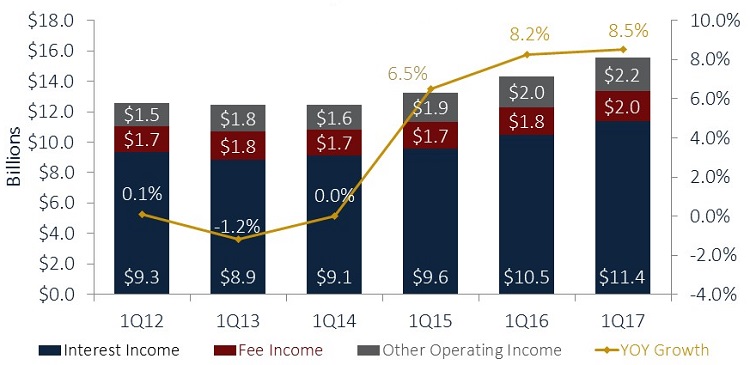

YTD TOTAL REVENUE AND YEAR-OVER-YEAR GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.17

Interest income is the fastest growing revenue driver, although all revenue components are higher than in first quarter 2016.

Source: Callahan & Associates.

Of note, America’s credit unions leveraged their collective investment portfolio of more than $370 billion and nearly $900 billion in lending to generate $15.4 billion in total revenue in the first quarter of 2017. That’s 8.5% more than in the same quarter of 2016 and includes increases in all three categories of income: interest, fee, and other operating.

Although all three categories of income showed nice growth, interest income which includes lending plus investments was the fastest-growing revenue driver.

Loan yields have declined as investment yields have risen; cost of funds remained steady.

Rate hikes so far have not yet changed credit unions’ cost of funds, which have stayed relatively flat since 2012.

Meanwhile, loan yields have declined against rising investment yields. Note the rise of 37 basis points from a low of 1.07% in the third quarter of 2013 to 1.44% in the first quarter of this year.

That’s a pretty significant bump, says Johnson, who’s also president of Callahan Financial Services, a Callahan subsidiary dedicated to expanding credit unions’ investment alternatives.No one can say with certainty, but it does look like the Fed is going to move up rates. And as it does that, credit unions can get more pickup on the yields in their investment portfolios.

According to Johnson, the movement’s CFOs and ALM managers have been handling the interest rate environment well. They’ve not been trying to anticipate rates and have instead remained relatively liquid to accommodate the lending and savings needs of their members.

The most important thing credit unions can do now is maintain their conservative stance on investments, Johnson says. We’ve already seen the benefits of that investment strategy, and the overall balance sheet looks well positioned for the dynamics we have now.