FINANCIAL EDUCATION IMPACTS DELINQUENCY RATES

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.22

© Callahan & Associates | CreditUnions.com

- As financial institutions with community reach and a mission to empower their members, a growing number of credit unions offer some form of financial literacy education, whether that’s financial counseling, seminars, literacy workshops, first-time homebuyer education, or online programs. At its core, financial literacy is knowing how to manage one’s money. This includes not only basic saving and spending, but paying bills, creating a budget, managing debt, and saving for retirement.

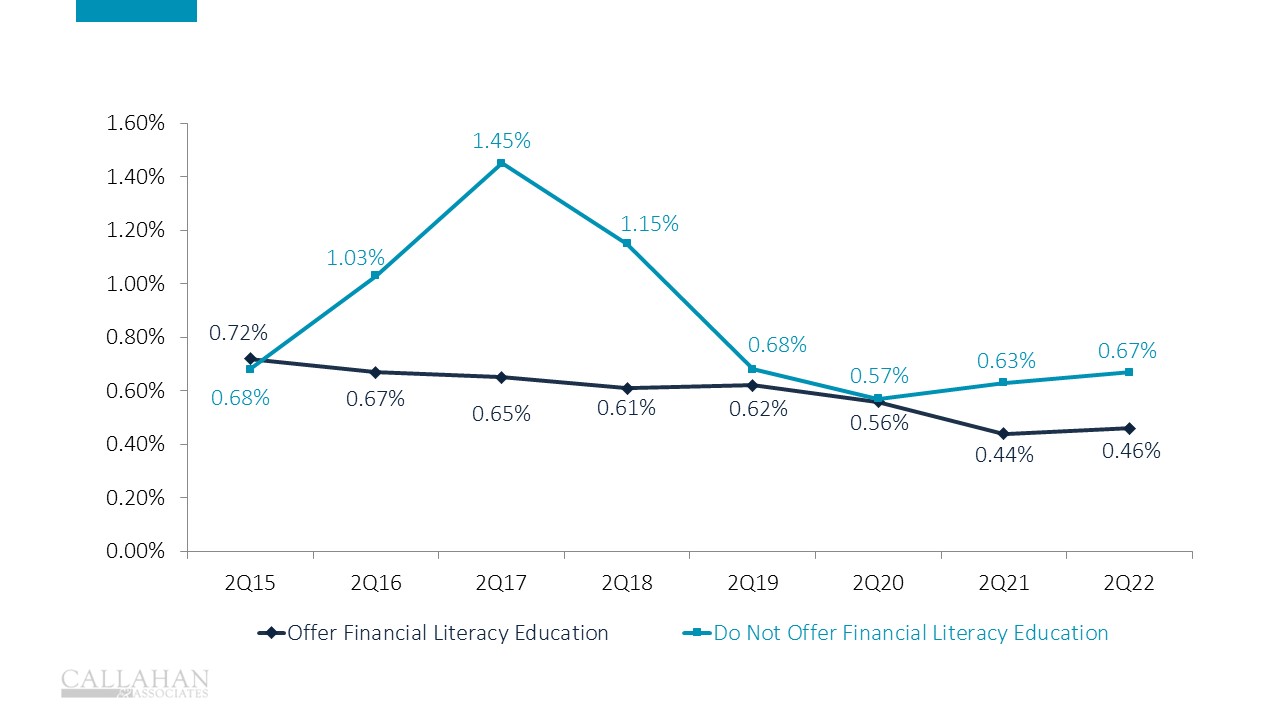

- The above graph compares delinquency rates for credit unions of $100 million in assets or more that provide at least one financial literacy offering with those who don’t provide any.

- Credit unions offering one or more financial education options reported a lower total loan delinquency rate than their peers in recent years, according to data from the National Credit Union Administration. Most recently, the two groups differ by 21 basis points.

- These credit unions consistently report lower credit card delinquency. As of June 30, credit unions with financial education offerings reported a credit card delinquency ratio of 1.05%, 40 basis points below credit unions without.

- Since the pandemic, credit unions offering financial education are reporting a downward trend in the average total delinquency ratio, while their counterparts’ delinquency ratio is trending slightly upward.