Financial publications love to tell credit unions that data analytics is important for personalizing and improving the member experience.

The problem is, that’s where they often stop.

They don’t explain how credit unions are supposed to track and collect data. They also fail to show credit union leaders how to draw out insights or turn member data into actions — especially when it comes to how and when members interact with advisory staff or visit branches.

Being told your final destination — but not being given a map or a compass to get there — doesn’t sit right with us. So, we created an in-depth, tactical Banking Analytics Guide to walk institutions through the three phases of data maturity:

- Gathering the right data.

- Setting up metrics tracking.

- Using historical data to forecast traffic trends, member needs, and more.

This piece is a preview of our guide. You’ll get a handful of top tips from each phase, helping to demystify data analytics and setting you on a course for stronger member insights.

Want the detailed version of the Banking Analytics Guide pronto? Read the whole guide for free here.

Phase 1: Build Your Data Collection Foundation

Strong foundations make for sturdy strategies. In the first phase of analytics maturity, you’ll identify the data you want to collect, categorize it, and then store it.

Here are some tips to get you started.

- Start with simple tools. Data analytics doesn’t always require complex technology. You can start with the tools you’re (probably) using today to find useful data points: an appointment scheduling platform, member survey tools, your Customer Relationship Management software, contact center data or systems, your website backend, and your mobile apps. To build a data catalog (more on that later), the only other thing you’ll need is Excel or Google Sheets.

- Categorize and tag your data. Investigate data from three angles: your client’s take (ex: how members behaved or felt), your staff member’s take (ex: how staff behaved or felt), and what happened in your application (ex: feature usage data). Collect both qualitative data points (ex: CSAT) and quantitative ones (ex: open-ended feedback) versions of each. When saving metrics, tag them with a label to explain what it is: an interaction, product/service, or outcome. Finally, gather data from your systems (appointment tool, queue management software, or CRM) and survey tools.

- Organize everything in a simple data catalog. A data catalog is simply a spreadsheet where you list out all the types of data you want to track, the category, type, tags, and where the data comes from. For starters, record things like walk-in traffic, appointment volume, popular reasons for visits, wait times, outcomes (like conversion rate), and no-show rates.

That’s it! You’ve reached the first phase of data maturity and have a reliable member data foundation for your credit union. In the next phase, you’ll learn how to build an analytics dashboard and set goals when around member engagements.

Phase 2: Set Up Banking Analytics To Measure Continuously

Early analytics functions aren’t perfect. They often rely on manual processes, aren’t up-to-date, and suffer from having too much data and too few insights.

That’s okay as a starting point. Let’s talk about how to fix some of these limitations.

- Build or buy an analytics dashboard. A simple spreadsheet can operate as a dashboard. However, manual data entry and custom formulae could hold you back. In the long term, your credit union will benefit from a dedicated analytics dashboard, either built by your in-house development team or purchased ready-made from a third-party vendor. These dashboards continuously ingest data from CRMs, business intelligence tools, and more. They then analyze the information and deliver a complete picture of your member journey.

- Set member experience goals and assign metrics. Make a list of all your CX goals. Some ideas could be increasing membership, boosting satisfaction scores, or optimizing staffing levels to handle walk-ins. Then, select one or two to focus on. Of course, you’ll need a way to measure that goal, so you’ll need to choose a corresponding metric to track in your dashboard. For our previous goals, this could include new member sign-ups monthly, NPS and/or CSAT scores, and employee utilization rates (which some appointment scheduling tools, like Coconut Software, can track).

- Use experiments to improve your service. With your goals set and metrics assigned, now the fun can begin. We recommend using the scientific method to run experiments. Here’s a quick example: Ask a question (Will self-service appointment booking make members happier?), take a baseline measurement (Our two-week average CSAT score is 75%), record a hypothesis (Allowing members to book appointments will improve their experience), make a change (We’ve implemented a self-service booking tool), review the data (Compare CSAT), and record the results (Our two-week average CSAT improved from 75% to 82%).

During phase two, expect to build a continuous improvement flywheel of measurement, hypothesizing, executing, and learning. Cycle by cycle, you’ll remove points of friction, address underlying issues, and elevate your entire member experience. And once your flywheel is spinning, you can begin to look into the future.

Phase 3: Start Making Forecasts

In the first and second phases, data analytics looks backward. In phase three, you can begin looking forward, using data to anticipate the future. Forecasts can help improve your planning and decision-making beyond mere guesswork.

Here’s how to get started with basic forecasting.

- Narrow your focus. Accurate forecasting needs reliable past data. Consider what information you already have to work with, like seasonable appointment volume, in-branch traffic trends, or product popularity. That data will lead you to helpful questions about the future. For example, will you need to pull in floating staff during a busy period? Can you improve staff utilization rates? Should you discontinue a service plan? Shift the strategy around your branch network?

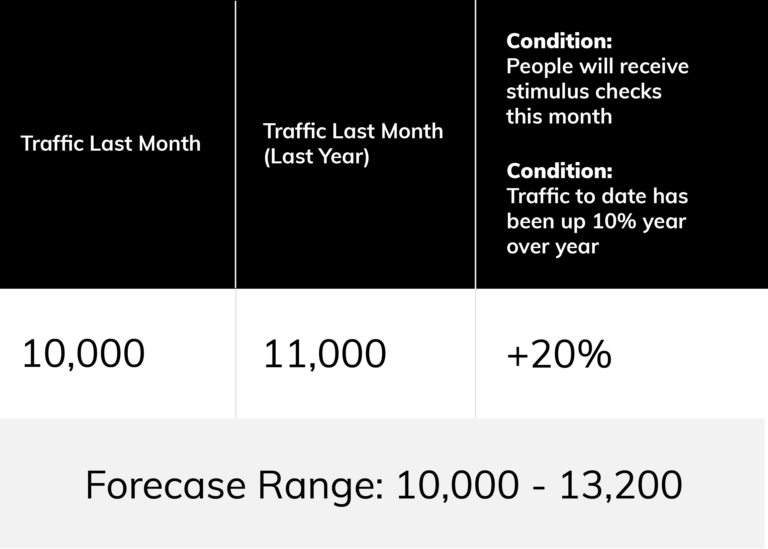

- Gather historical data (and conditions). Forecasting relies on reliable historical data, but there’s another factor, too: conditions. Specifically, conditions that might influence your data. For example, calls and branch visits will be higher during your busy season. Conversely, they might dip over Thanksgiving. To build a forecast, gather your data and a list of conditions. Control for conditions by increasing or decreasing your forecast based on an estimated percentage. (There’s always a degree of guesswork here, don’t worry.)Here’s a quick example of a branch traffic forecast:

- Verify your forecast accuracy. Forecasting is a skill that improves over time. Each prediction you make should make subsequent forecasts stronger. Record your hypotheses and results, logging surprises and unusual results so you can make stronger predictions as you go.

This is just a taste of what forecasting and predictive analytics can do. If you have a data science team, they’ll push far beyond standard forecasting, introducing advanced models and algorithms.

Better Data, Stronger Member Experience

You already know data analytics is key to better understanding the member experience. Now, you should have a clear idea of how you can actually start implementing an analytics strategy at your credit union. (Hopefully, it’s not as daunting as it once seemed!)

For a deeper dive into credit union analytics, we’ve put together a full Banking Analytics Guide, which includes the top member interaction data points to track, templates and calculation examples to use, and more tools and advice to help take the guesswork out of transforming your members’ experience.