CREDIT UNION VS. NATIONWIDE EMPLOYEE GROWTH

FOR U.S. CREDIT UNIONS & NONFARM EMPLOYEES | DATA AS OF 12.31.22

© Callahan & Associates | CreditUnions.com

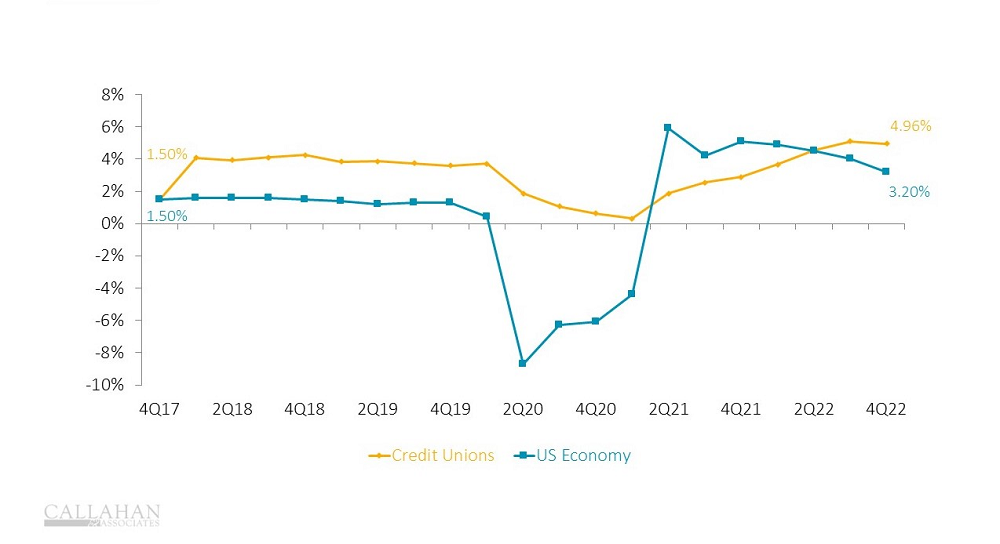

- During the COVID-19 pandemic, hiring slumped across the nation as companies laid off and furloughed employees. Hiring within the credit union industry also dipped, but overall staffing never declined year-over-year.

- In the rebound period of early 2021, American employers hired at a faster pace than the credit union industry for the first time in five years. In the past few quarters, however, credit unions have surpassed the broader economy in job growth as they invest in infrastructure to support a growing membership.

- Today, higher interest rates are creating headwinds for growth in the U.S. economy, and reduced growth combined with higher funding costs often equate to hiring slowdowns or job cuts, such as those that have occurred in the tech industry. Membership at credit unions, however, is growing, which is favorable for hiring.

- The average credit union employee makes $91,519 in salary and benefits, brings in $55,326 in net income, and is responsible for 397 members. Credit unions must consider whether their current employee base can be more efficient in serving members or if the organization needs to bring on more employees in a macroeconomic environment that likely will offer more members but fewer share inflows and loans originated.

How Does Your Staffing Compare?

Use industry data to determine how your credit union performs against others, uncover new areas of opportunity, and support your strategic initiatives. Callahan’s credit union advisors are ready to show you how — are you ready to see how you stack up?

SCHEDULE YOUR PEER DEMO