The U.S. job market fared better than expected in the first quarter, showing remarkable resilience even as recessionary fears propagated. According to the Bureau of Labor Statistics, the U.S. unemployment rate averaged 3.5% during the first three months of the year, reaching a 54-year low of 3.4% in January.

There were approximately 1.6 vacancies per available worker, totaling 9.6 million job openings. According to ZipRecruiter, layoffs have been concentrated to a few industries — namely finance, construction, technology, and real estate — and those who have been released have quickly found a similar role. Although rate hikes and well-publicized bank failures ensure concerns about overall market stability persist, job numbers remain a beacon of optimism.

Credit Union Key Points

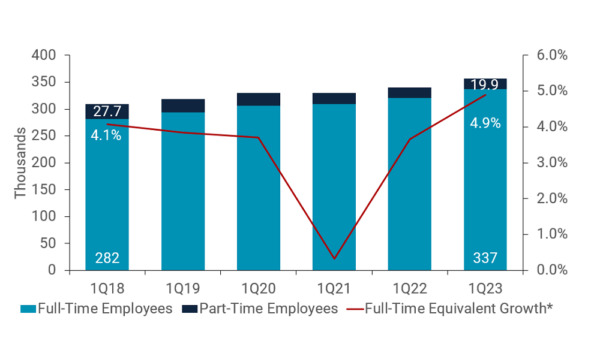

- Full-time equivalent employees (FTEs) at credit unions increased 4.9% year-over-year to 347,403. Despite some negative economic indicators, the rise in staff count demonstrates credit unions are actively hiring to cater to their expanding member base.

- Loan originations per FTE decreased 32.9% year-over-year to an annualized pace of nearly $1.6 million. This decline can be attributed to a reduction in overall loan origination activity caused by higher interest rates and elevated asset prices.

- Total annual compensation expense per FTE reached $97,180 up 6.5% from one year ago. For the first time in a few years, this is higher than the pace of inflation, which helps improve the standard of living for industry employees.

Performance At-A-Glance

FULL-TIME AND PART-TIME EMPLOYEES

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.22

© Callahan & Associates | CreditUnions.com

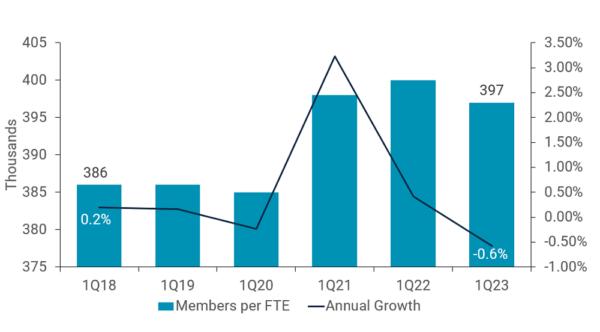

MEMBERS PER FTE

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.22

© Callahan & Associates | CreditUnions.com

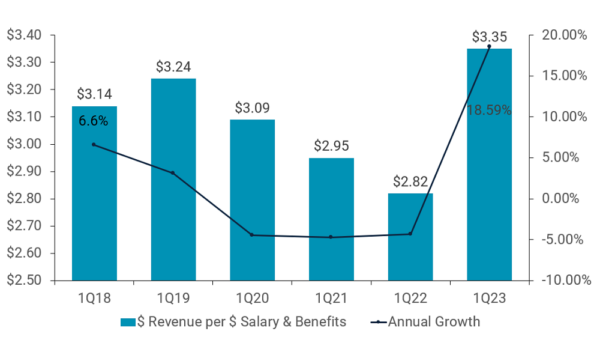

REVENUE PER FTE

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.22

© Callahan & Associates | CreditUnions.com

How Do You Compare?

Claim Your Custom Scorecard Today

The Bottom Line

Driven by the growing needs of their expanding member base, credit unions are actively hiring staff to support these deepening relationships. However, rising operating costs complicate the landscape for credit unions and other industries alike.

With liquidity concerns a growing issue, credit unions have the opportunity to pivot employee resources toward conversations around savings plans — the traditional foundation of a credit union-member relationship. Hiring, leveraging technology, and fostering a supportive work environment all ensure credit unions have the resources in place to face future challenges head-on and improve their communities in the process.

This blog originally appeared in Credit Union Strategy & Performance. Contact Callahan & Associates to learn how you can gain access today.