Top-Level Takeaways

- UNFCU and All In FCU have eliminated friction in their processes using journey mapping to improve the member experience.

- Member feedback is critical, as is putting the learnings into action. Else, it’s naught but pretty charts on the wall.

Journey mapping has become a go-to way for a growing coterie of credit unions working to reduce process friction and improve the member experience by examining how that service is delivered every step of the way.

United Nations Federal Credit Union ($5.6B, Long Island City, NY) and All In Federal Credit Union ($1.4B, Daleville, AL) are examples of financial cooperatives who have taken that trip, going beyond the flip charts to make the journey an iterative process that learns as it goes.

Each took its own path: UNFCU initially used a consultant to help facilitate the work whereas All In has a manager who leads each journey while making it part of the training regimen. But they share this: At the end of the process, journey mapping improved the member experience.

For example, loan applicants no longer have to sign multiple, redundant documents in a process that now is the same regardless of where they apply.

“We had people signing documents in branches that they didn’t need to online,” says Laurie Flanders, sales manager and accountability trainer. “Why?”

We’ve evolved from a transactional experience, from a get-them-in, get-them-out mentality to a needs-based relationship that builds a conversation. It’s changed everything we do. It’s helped us make sure we keep the members in mind first.

The Journey Begins

Journey mapping can be defined as presenting processes, member needs, and perceptions across all interactions between cooperative and consumer.

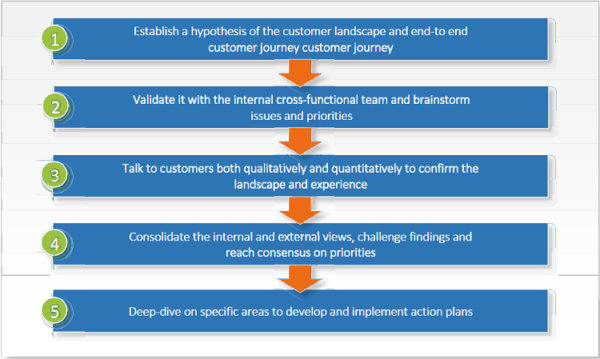

There are typically two parts to the process: the internal workshop and customer/member research, says to Cindy Grimm, chief customer experience officer with CX Solutions, a member experience consultancy.

“The internal workshop brings together people from different areas to look across the full journey,” Grimm says. “Participants are asked to put their customer hat on and think like their customer. The purpose is not to map internal processes. That’s a separate task after we understand things from the customer’s perspective.”

Step two is the external research that uses surveys, focus groups, and other feedback techniques to understand which parts of the journey have the most impact on loyalty and word of mouth, and to prioritize improvement opportunities.

“Don’t look at just internal processes,” Grimm stresses. “Member feedback is critical to going beyond just a pretty picture on the wall that results in no clear action items that improve the experience.”

From Flip Chart To Front Line

All In and UNFCU each began their journey mapping journeys in 2017, when the big New York credit union brought in CX Solutions and the south Alabama cooperative hired Laurie Flanders as sales manager and accountability trainer.

Building on the techniques she developed in her previous stop at Pen Air FCU — where she says journey mapping led to upgrading more than 100 processes — Flanders began by forming groups based on the two pizza rule made famous by Amazon founder Jeff Bezos. That rule directs groups be small enough to be fed with two pizzas.

After that, Flanders suggests a four-step process:

- Select the best team to have around the table.

- Take an item and map the journey of the member in each channel the member could use to accomplish the task.

- Look at the current reality and ask a few questions: Is this the best experience the credit union has to offer? Is it duplicating efforts? What part of this experience is in the credit union’s control? Where can the credit union make efficiency upgrades?

- Finally, rearrange the pieces of the process to better serve the member and decide what tasks need to be completed to support this realignment.

Less Friction, More Connection

Along with identifying broken system processes that were negatively impacting the overall experience of the member, Flanders and her colleagues found they were forging a renewed connection with their member-owners based on depth, not necessarily speed.

“Our experience had been based on moving people, a get-them in, get-them-out mentality,” she says. “This left us with a large deficit when it came to building a deep, lifelong relationship with our members, and ultimately resulted in many of our members maintaining primary relationships with other institutions. Now, we’ve evolved from a transactional experience to a needs-based relationship that builds a conversation. It’s changed everything we do. It’s helped us make sure we keep the members in mind first.”

Values Go First

Journey Mapping With UNFCU

Rossana Creo, vice president of strategic planning at UNFCU, shares five tips for effective journey mapping.

-

Establish a database of all member touchpoints as a starting point.

-

Do your due diligence and research to determine if this tool is right for your credit union.

-

Leverage diverse, cross-functional teams to get the most employee feedback. Do the same for the voice of the member components. Your findings should represent the entire membership.

-

Share the results and outcomes across the organization.

-

Repeat the process to focus on continual improvements to the member journey.

Flanders stresses beginning the process by ensuring the work is seen through the lenses of mission, vision, and values. UNFCU also had mission and values in mind as it embarked on its journey-mapping adventure.

“Our mission is serving the people who serve the world,” says Rossana Creo, vice president of strategic planning. “Journey mapping as a tool aligns with our mission by providing us another means of identifying what matters most to members.”

Just ask Phillippe in Italy and Nadia in Sudan, two of the personas with specific demographic and product characteristics typical of UNFCU members stationed in those countries.

The journey mappers kept the needs of those personas in mind as they together examined processes in sub-journeysinto such areas as loans, credit cards, and payments.

“We broke journey mapping down into sub-journeys,” Creo says. “This helped us identify our highest priorities and areas where we can make improvements. We continuously review our member touchpoints, processes, and systems to improve the experience we deliver.”

The process continues at All In, too, where journey mapping techniques are part of regular training for existing employees and new hires.

ROI And Some Do’s and Don’ts

Grimm at CX Solutions says her company works with clients to make changes that have the greatest impact on customer loyalty, and that there are ways to predict and gauge success.

“We use economic modeling to project the business impact of specific changes so that priorities can be set based on the ROI of each potential improvement opportunity,” she says.

Results also can often be tracked through ongoing metrics that the credit union is already tracking, Grimm says.

“For example, if the goal was to improve completion of tasks via the digital, with fewer calls to the call center, you can see that through operational data and don’t need a survey” he says.

Don’t reinvent the wheel. Get rolling on important initiatives using documents, policies, and templates borrowed from fellow credit unions. Pull them off the shelf and tailor them to your needs. See what we have for you in the Callahan Policy Exchange. Don’t have access? Learn more.