Top-Level Takeaways

-

UNIFY Financial and Desert Financial are two of the first nearly two dozen cooperatives in the process of rolling out blockchain-based authentication.

-

The contactless, phone-based method provides members their own digital identity to use across any channel or organization that’s part of the trusted registry network.

A viral pandemic has proven to be the right moment for some forward-leaning credit unions to begin the long-planned rollout of new contactless technology for authenticating members.

Gordon Howe, President and CEO, UNIFY Financial FCU

UNIFY Financial Federal Credit Union ($3.2B, Torrance, CA) and Desert Financial Federal Credit Union($5.7B, Phoenix, AZ) are two of the first member-owned cooperatives to begin offering members digital credentials using distributed ledger technology, the blockchain tools that have been in development globally for the past several years.

UNIFY and Desert Financial are co-owners of CU Ledger, a credit union service organization, and among the two dozen or so credit unions that are in various stages of deploying MemberPass. That’s the CUSO’s branded distributed ledger systemfor which approximately 500 digital credentials have been issued so far, all originated on members’ smartphones.

The system bypasses the normal know-your-customer regimen of online and telephone challenge questions by allowing the same credentials to be used across all channels where it’s been enabled.

It’s going to be nice coming out of this pandemic crisis having a truly contactless way to authenticate, says Gordon Howe, president and CEO of UNIFY.

How It Works

Those digital credentials are like a passport. They belong to the member and are used to verify identity to the issuer and any other organization that belongs to the same network, called the trust registry.

Members enroll with MemberPass over the phone or in person and then contact their credit union, at which point a member service rep takes them through a quick verification process that involves communication between the credit union’s systems andthe member phone.

UNIFY has the public blockchain key and the member has the private key, Howe says. That’s how they link up.

That linkup, says Desert Financial executive vice president Ron Amstutz, has reduced contact center verification to 12 to 15 seconds. Notable, because that same verification without MemberPass can take from 90 seconds for routine transactions to threeminutes for some high-risk money moves.

Nothing Personal Here

No personal information is stored on the distributed ledger and the members’ digital membership pass remains under the members’ control. The credit union, meanwhile, retains the right to verify, reject, or revoke the credentials at any time.

Ron Amstutz, Executive Vice President, Desert Financial FCU

The difference between this new kind of authentication and traditional methods: the identity belongs to the holder, so they don’t have to repeat the process of creating new authentications with every other third party.

The MemberPass credentials are stored in a digital wallet app called Connect.me, although they can also be integrated into a credit union’s mobile app if that connection is available.

That’s not the case yet at UNIFY, which currently is using MemberPass in its contact center and one of its branches, nor at Desert Financial, which is using it at the contact center. But both are pursuing integration with their digital banking providersand expanding its use in branches.

Although MemberPass currently is limited in scope, the plan is to create a vast network of entities of all kinds a huge trust registry of sortsthat will accept the authentication just as they do traditional methods now. Right now, thetrust registry includes a few credit unions, but work with other organizations, such as CU Direct, is underway that would connect credit unions, car dealers, and indirect lending deals through that CUSO.

The Time Is Right

The pandemic has made the timing for any kind of new and improved contactless authentication seem better than ever, as people want to maintain their distance and fraud continues to rise.

The need to build member trust in their credit union has never been more critical, says Amstutz at Desert Financial. He says the new system allows Desert Financial to protect both the credit union and the member as traffic spikes in itsdrive-thrus and call centers.

Call centers have been particularly targeted by fraudsters and the reaction from members who have used MemberPass so far has been generally positive. After all, it helps them avoid the knowledge-based questions and other friction that comes with authenticatingon the phone, Amstutz says.

The Alphas Of Betas

UNIFY is now moving enrollment into more branches as well as on the phone, while Desert Financial, which began its beta testing last December with employee-members and high-value transactions in the call center, has been enrolling members on the phoneas it prepares the familiarization techniques it will use for members in branches.

Executives of both cooperatives relish the role of going first in finally bringing blockchain off the drawing board and into live channels, proving that distributed ledgers work to the benefit of members and credit unions alike.

We made it a priority that we’re going to be the alpha with this, Howe says. No more demos. No more test environments. Show me how this works live! We want to be a leader out there.

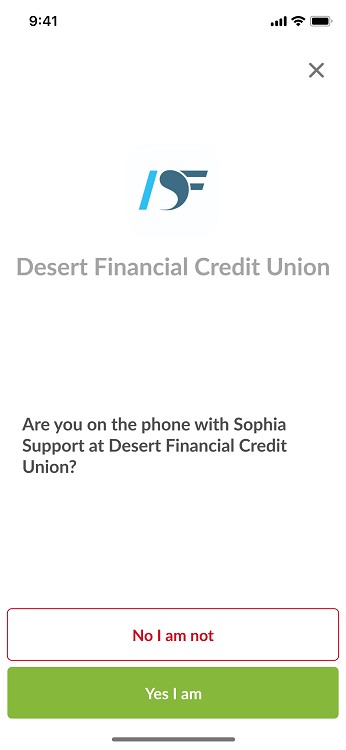

Desert Financial members see a simple, straightforward screen when they use their smartphones to authenticate themselves using the new distributed ledger service from their credit union.

He credits his own internal champions of the project including his chief administrative and information officers with helping the credit union get to this point. Howe also compliments CUFX for the integration accomplished between the creditunion’s core processor Symitar and the distributed ledger tools. (CUFX is the credit union- and vendor-funded middleware provider created a decade ago to develop and distribute software standards across the credit union movement.)

Desert Financial, meanwhile, also is using its CU Ledger API to integrate enrollment status and changes directly into its core processing system, and both credit unions are exploring connections with their online and mobile banking providers.

The Phoenix cooperative is also no stranger to being an alpha beta itself.

We were one of the first to launch voice banking through Alexa and the first to offer financial actions on Google, Amstutz says. We were also the largest credit union to convert to Corelation as our core processor in 2015. Now, we’reexcited to be one of the first credit unions to launch this new method of authentication for our members.