Top-Level Takeaways

-

Supply constraints have put the brakes on a lot of auto loans but a focus on refinancing has helped build the direct business.

-

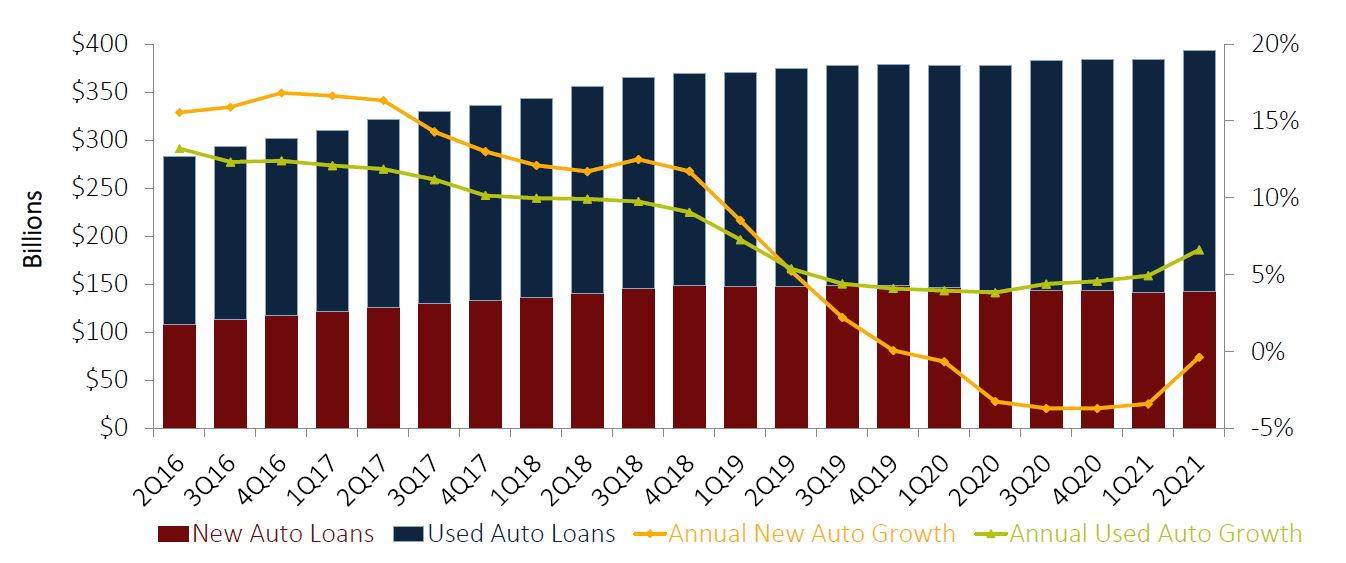

Data from Callahan & Associates show lending for new and used autos has bounced off pandemic lows.

The pandemic-driven auto shortage stood out in stark relief to Betsy Sommers when she drove by a large auction lot in northern Connecticut a couple months ago. It was nearly empty.

This place is just huge, acres and acres, and its lots are usually filled with used autos, says the senior vice president of Seasons Federal Credit Union ($168.2M, Middletown, CT). It was shocking to see how few cars there were.

The same is true for new vehicles, too. Sommers says she and her son, a student at the University of Arizona, visited a few Honda and Toyota dealerships in Tucson aiming to buy a new car and found almost no new or used cars available.

A semiconductor chip shortage has led to production slowdowns that have led to August sales dropping 13.7% nationwide from August 2020 and 25.3% from August 2019, according to J.D. Power/LMC Automotive estimates cited by Forbes.

We’ve had a significant number of loan applications withdrawn because of lack of inventory, Sommers says.

She expects a snapback when production returns to normal, but in the meantime, her Nutmeg State cooperative and others in the movement are faring reasonably well. According to second quarter data from Callahan & Associates, lending for both new and used autos has bounced off pandemic lows.

NEW AND USED AUTO PORTFOLIO GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.21

Callahan data shows indirect and direct lending alike have bounced off pandemic lows.

Twelve-month auto loan growth for credit unions with more than $100 million in assets was 4.43% year-over-year. Indirect lending was up 5.18% and direct lending was up 3.09% from the second quarter of 2020.

Those aggregate numbers show the trends to watch, but institutions have a way of forging their own paths. Here, Sommers and the CEO of Pennsylvania cooperative BHCU($212.1M, Ridley Park, PA) share what’s working for their cooperatives.

Seasons FCU Buys Loans And Revamps The MSR Model

Second quarter figures from Seasons show auto lending down 1.12% overall from the year before, driven by a 28.92% drop in indirect lending. The credit union still has a big stake in auto lending, which comprise $56.61 million of its $168.2 million intotal assets. And its direct lending portfolio of $19,097,145 as of June 30, 2021, was up 35.9% from $14,048,722 as of June 30, 2020.

“Direct lending has always been our bread and butter,” Sommers says.

A lot of Seasons recent activity is the result of low interest rate refinancing. According to the Seasons SVP, 52% of the direct auto loans the credit union originated between Feb. 1 and July 31 were refis. The credit is offering up to a full percentage point off its existing auto loan rate, using a rate floor based on the borrower’s credit score.

“We did two campaigns with two different credit bureaus to filter for individuals in our FOM who might be ripe for refis, and we’re talking to members about how we can save them money,” Sommers says. “We’re really going back to basics.”

That back-to-basics, high-touch approach extends to a restructuring that took place when Seasons re-opened its four branches in May 2020. The credit union had been using a universal teller model but went back to having a member service representative off each lobby, handling non-teller tasks like opening accounts, issuing debit cards, and originating loans.

Additionally, the cooperative hired a full-time indirect lending specialist to network with dealers and restore a business the credit union had been putting less emphasis on since it began experiencing liquidity issues in 2018.

Sommers says she also began buying auto loan participations for the first time in March 2020. As of the end of July 2021, Seasons held nearly $7.3 million in such loans bought from other credit unions, brokers, and an online loan participation portal.

“We’ve learned a lot of lessons about what’s profitable for our credit union from a long-term perspective,” she says. “I could talk all day about that.”

BHCU Abandons Indirect And Avoids Buying Loans

At BHCU, year-over-year auto loan production fell by 2.40% in the second quarter of 2021. Indirect lending was down 98.54%, but direct was up 113.86%. The $212.1 million cooperative had a total auto portfolio of $7.38 million at that point.

“Very attractive rates have helped maintain demand for both purchase business and refinance activity for existing members,” says Gary Golden, CEO of BHCU. “However, the lack of inventory for new vehicles is now slowing down purchase activity. Clearly, 2Q21 was a bit of an anomaly and probably not the right benchmark.”

Golden says his Delaware County cooperative has de-emphasized indirect lending and instead now favors direct.

“We determined we could not compete in the indirect space without significant scale and resources and essentially exited the efforts behind it,” the CEO says. “At this point, indirect is a defensive product kept primarily for the convenience of our members shopping at CUDL enabled dealerships.”

According to Golden, BHCU has undertaken some minor promotions to recapture business from members with auto loans elsewhere, but generally the credit union is competing on rates and terms.

“We like auto loan paper and given the deposit rate environment can afford to be quite aggressive in pricing for this asset class,” he says. “We have zero delinquency, and auto loans tend to carry minimal extension/interest rate risk given their relatively short durations. It’s an easy spot to provide a value proposition for the membership.”

Golden also says direct lending is a natural sweet spot for cooperatives like his.

” If you’re not a large enough credit union or otherwise not in an area where you can compete for quality indirect loans, focus on what you do best,” he says. “That’s probably direct to member. Take advantage of the current rate environment knowing auto loans tend to become repeat business, so you don’t have to make a killing on every deal now. Higher volume with thinner margins in this business isn’t actually a bad thing.”

The CEO also recommends avoiding buying into large pools of auto loans spread out across the country to grow the balance sheet.

“The risk is rarely worth it,” he says. “Grow organically and seek the recapture business capitalizing on the brand awareness you have with your members.”