Historically low rates following multiple year-end cuts by the Federal Reserve contributed to strong mortgage lending in the first quarter of 2020. According to the Mortgage Bankers Association (MBA), first quarter refinance production accounted for 54%, or $306 billion, of the $563 billion in total mortgage originations nationwide as consumers locked in lower rates on existing mortgages. Along with the fourth quarter of 2019, when refinances accounted for 55%, this is the first period where refinances have outpaced purchases since the first quarter of 2015. Credit unions often benefit during such periods, and the MBA predicts the dynamic will continue through the second quarter.

Key Points

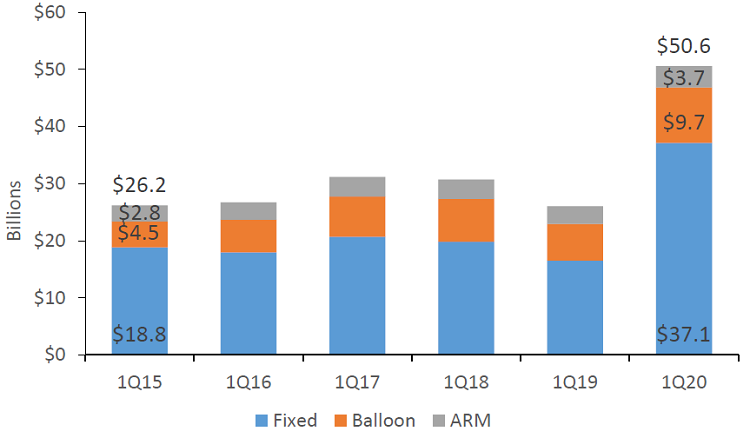

- Credit unions originated $50.6 billion in first mortgages in the first three months of the year, up 94.3% from the first quarter of 2019.

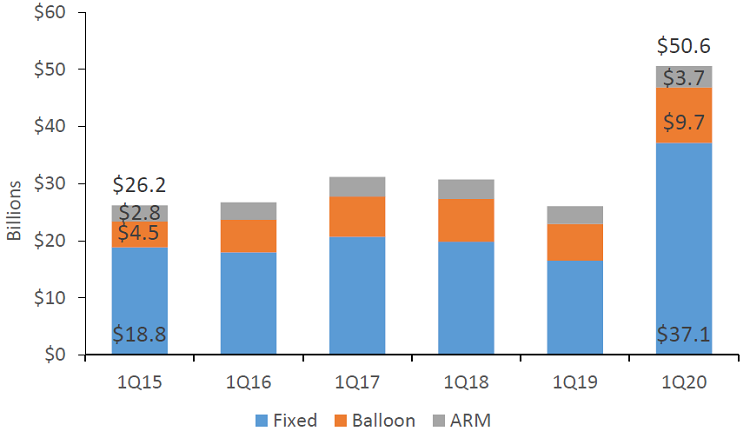

- Fixed-rate mortgages accounted for 73.4% of total mortgages originated in the first quarter of 2020. Balloon/hybrid loans made up 19.2%, and adjustable-rate mortgages made up the remaining 7.4%.

- Credit union mortgage market share increased 1.0 percentage point year-over-year to 9.0%, the highest rate on record.

- Outstanding first mortgage balances increased 10.9% annually to $483.3 billion in the first quarter. This loan segment has contributed 70.2% of total credit union loan growth over the past 12 months.

- First mortgage delinquency increased 7 basis points in the past year to 0.46%.

1ST MORTGAGE ORIGINATIONS & MARKET SHARE

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

Through the first three months of 2020, mortgage originations at credit unions reached $50.6 billion, nearly double first quarter 2019 levels.

MORTGAGE ORIGINATIONS BY TYPE

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

Fixed-rate mortgages accounted for 73.4% of total originations at credit unions nationwide. The trend is common in low-rate environments as members lock in lower costs for the life of their loans.

AVERAGE 1ST MORTGAGE DELINQUENCY

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

First mortgage delinquency increased 7 basis points year-over-year but remains at a low rate historically.

The Bottom Line

The Fed kept interest rates low in the hopes of spurring borrowing, and credit unions consequently managed a growing, robust mortgage pipeline in the first quarter. The MBA projects sustained mortgage production growth in the second quarter. However, although originations are strong and industry market share is rising, the low rates put downward pressure on income spreads. Additionally, credit unions should continue to monitor asset quality, which was up 7 basis points over the past year.

Without official data from the NCUA, Callahan is reporting first quarter data trends from institutions that represent 99.7% of the industry’s assets.

This article appeared originally in Credit Union Strategy & Performance. Read More Today.