The most disruptive technological change of the 21st century will be the widespread adoption of self-driving cars. And it’s not a matter of if, it’s when.

Each day brings with it yet another news story, another update in the progress toward fully automated automobiles. The adoption of this technology will carry both benefits and drawbacks, but what are they, really?

The Benefits

In 2015, there were 38,300 motor vehicle-related deaths in the United States and 4.4 million serious injuries. The death total represents an 8% year-over-year increase, the largest percent increase in 50 years, according to the National Safety Council.

Vehicle traffic deaths rank second to poisoning as the leading causes of accidental death in this country, and the adoption of fully automated automobiles offers an attractivepromise: Remove flawed human decision-making from driving and allow inter-vehicle communication to make roads safe.

Automation also brings with it the promise of increased speed and convenience. In a fully autonomous world, there’s no need for stoplights or stop signs. Remove erratic human behavior, which rules to regulate the flow of traffic are meant to address,and there’s potential for unfettered travel at higher average speeds.

Finally, transportation costs will dramatically decline. A large percentage of fares for cabs and ridesharing services go to pay the driver. Eliminate this cost and that $20 ride falls by 50% or more.

What other forces are changing the credit union marketplace? Callahan’s Strategy Lab helps credit union leadership teams take a step back and focus on issues of strategic importance for their organization. Learn more today.

The Drawbacks

For consumers, the adoption of fully autonomous automobiles undoubtedly creates advantageous market forces: fewer deaths, lower commute times, and reduced transportation costs.

But there will be consequences that are easy to underestimate.

For example, how soon will automated vehicles hit the public road? In Pittsburgh, Uber has already launched a self-driving fleet of vehicles,and Moody’s predicts the commercial release of automated vehicles by 2020. The financial services company furtherpredicts that automation will become a standard option in vehicles by 2030, will be standard in all new cars by 2035, will represent the majority of vehicles on the road by 2045, and will be universal by 2055.

Yes, 2055 is four decades away, but people will have to deal with the implications of automated vehicles within the next decade. Change might occur so rapidly that those who work in related industries won’t have time to adjust careers and enternew fields. Plus, there’s no guarantee other industries will have the room to absorb millions of workers.

In the short term, taxi businesses and ride-sharing services like Uber and Lyft are the most ripe for disruption. But they’re not the only ones whose futures are at stake.

Consider the American trucking industry. At face value, it would be safer and cheaper for companies to adopt automated trucks that can drive all night at a quicker pace. If that happened, the 191,000 jobs the American mining industry has lostsince late 2014 would represent approximately 5% of the 3.5 million American truck drivers whose jobs would be made obsolete by automation.

And the disruption doesn’t stop there.

Insurance, Home Prices, Credit Unions, And More

In the age of autonomous vehicles, what happens to auto insurance? In June 2015, KPMG published a study that estimated theinsurance industry would shrink by as much as 60% within 25 years, a loss of some $75 billion. And local governments, which recover hundreds of millions of dollars in traffic fines and vehicle registration costs, will need new revenue models or taxation venues.

Automated vehicles might even cause home values to drop. One of the largest drivers of home price is location people pay for convenience. But in a world where an eight-mile ride takes eight minutes, is it any less convenient to live 20 miles away?Of course other factors also drive home value, but today’s borrowers might not be willing to gamble that in 10 years their home price will hold steady or increase.

Credit unions face unprecedented changes, and responses to competitive pressures that might have worked in the past might not lead to success in the future. Contact Callahan & Associates to learn more about team learning experiences developed to help credit unions succeed in a changing world.

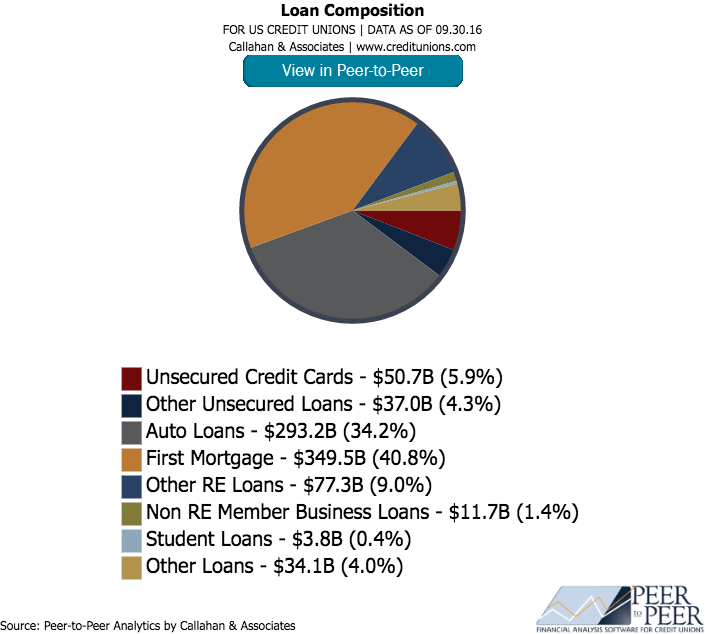

Automated cars affect credit unions, too. Maybe not in the short-term, but certainly within the next few decades, the rise of automated vehicles will require credit unions to find a way to replace their auto loans. As of third quarter 2016, they madeup more than 34% of the credit union balance sheet, according to data from Callahan & Associates.

Nationally, auto loans make up 34.2% of the credit union loan portfolio, representing $293.2 billion.

The strategic question for credit unions is: If you believe automation is a matter of when and not if, where do you focus your resources?

Student loans? Business loans? Lifestyle financing?

The good news is this change is not a short-term problem. But the bad news is, it is a problem.

You Might Also Enjoy

-

The Secret Behind Member Behavior

-

Turn Financial Wellness Talk Into Action In 2017

-

Community Reinvestment In The New Year

-

Fail, To Succeed

The Rise Of The Machines

The most disruptive technological change of the 21st century will be the widespread adoption of self-driving cars. And it’s not a matter of if, it’s when.

Each day brings with it yet another news story, another update in the progress toward fully automated automobiles. The adoption of this technology will carry both benefits and drawbacks, but what are they, really?

The Benefits

In 2015, there were 38,300 motor vehicle-related deaths in the United States and 4.4 million serious injuries. The death total represents an 8% year-over-year increase, the largest percent increase in 50 years, according to the National Safety Council.

Vehicle traffic deaths rank second to poisoning as the leading causes of accidental death in this country, and the adoption of fully automated automobiles offers an attractivepromise: Remove flawed human decision-making from driving and allow inter-vehicle communication to make roads safe.

Automation also brings with it the promise of increased speed and convenience. In a fully autonomous world, there’s no need for stoplights or stop signs. Remove erratic human behavior, which rules to regulate the flow of traffic are meant to address,and there’s potential for unfettered travel at higher average speeds.

Finally, transportation costs will dramatically decline. A large percentage of fares for cabs and ridesharing services go to pay the driver. Eliminate this cost and that $20 ride falls by 50% or more.

What other forces are changing the credit union marketplace? Callahan’s Strategy Lab helps credit union leadership teams take a step back and focus on issues of strategic importance for their organization. Learn more today.

The Drawbacks

For consumers, the adoption of fully autonomous automobiles undoubtedly creates advantageous market forces: fewer deaths, lower commute times, and reduced transportation costs.

But there will be consequences that are easy to underestimate.

For example, how soon will automated vehicles hit the public road? In Pittsburgh, Uber has already launched a self-driving fleet of vehicles,and Moody’s predicts the commercial release of automated vehicles by 2020. The financial services company furtherpredicts that automation will become a standard option in vehicles by 2030, will be standard in all new cars by 2035, will represent the majority of vehicles on the road by 2045, and will be universal by 2055.

Yes, 2055 is four decades away, but people will have to deal with the implications of automated vehicles within the next decade. Change might occur so rapidly that those who work in related industries won’t have time to adjust careers and enternew fields. Plus, there’s no guarantee other industries will have the room to absorb millions of workers.

In the short term, taxi businesses and ride-sharing services like Uber and Lyft are the most ripe for disruption. But they’re not the only ones whose futures are at stake.

Consider the American trucking industry. At face value, it would be safer and cheaper for companies to adopt automated trucks that can drive all night at a quicker pace. If that happened, the 191,000 jobs the American mining industry has lostsince late 2014 would represent approximately 5% of the 3.5 million American truck drivers whose jobs would be made obsolete by automation.

And the disruption doesn’t stop there.

Insurance, Home Prices, Credit Unions, And More

In the age of autonomous vehicles, what happens to auto insurance? In June 2015, KPMG published a study that estimated theinsurance industry would shrink by as much as 60% within 25 years, a loss of some $75 billion. And local governments, which recover hundreds of millions of dollars in traffic fines and vehicle registration costs, will need new revenue models or taxation venues.

Automated vehicles might even cause home values to drop. One of the largest drivers of home price is location people pay for convenience. But in a world where an eight-mile ride takes eight minutes, is it any less convenient to live 20 miles away?Of course other factors also drive home value, but today’s borrowers might not be willing to gamble that in 10 years their home price will hold steady or increase.

Credit unions face unprecedented changes, and responses to competitive pressures that might have worked in the past might not lead to success in the future. Contact Callahan & Associates to learn more about team learning experiences developed to help credit unions succeed in a changing world.

Automated cars affect credit unions, too. Maybe not in the short-term, but certainly within the next few decades, the rise of automated vehicles will require credit unions to find a way to replace their auto loans. As of third quarter 2016, they madeup more than 34% of the credit union balance sheet, according to data from Callahan & Associates.

Nationally, auto loans make up 34.2% of the credit union loan portfolio, representing $293.2 billion.

The strategic question for credit unions is: If you believe automation is a matter of when and not if, where do you focus your resources?

Student loans? Business loans? Lifestyle financing?

The good news is this change is not a short-term problem. But the bad news is, it is a problem.

You Might Also Enjoy

The Secret Behind Member Behavior

Turn Financial Wellness Talk Into Action In 2017

Community Reinvestment In The New Year

Fail, To Succeed

Daily Dose Of Industry Insights

Stay informed, inspired, and connected with the latest trends and best practices in the credit union industry by subscribing to the free CreditUnions.com newsletter.

Share this Post

Latest Articles

Meet The Finalists For The 2026 Innovation Series: Data And Decision Intelligence

A New Product Playbook Is Driving Change At Premier Credit Union

Meet The Finalists For The 2026 Innovation Series: AI-Powered Member Experience

Keep Reading

Related Posts

Meet The Finalists For The 2026 Innovation Series: Data And Decision Intelligence

A New Product Playbook Is Driving Change At Premier Credit Union

Meet The Finalists For The 2026 Innovation Series: AI-Powered Member Experience

Meet The Finalists For The 2026 Innovation Series: Data And Decision Intelligence

Callahan & AssociatesMeet The Finalists For The 2026 Innovation Series: AI-Powered Member Experience

Callahan & AssociatesWhen Members Don’t Turn To FIs, They Turn To Friends And Family

Andrew LepczykView all posts in:

More on: