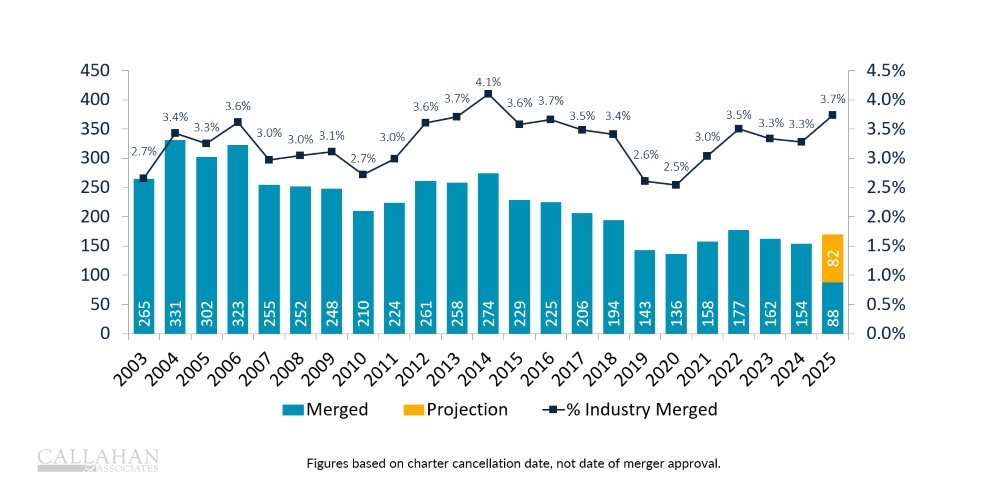

Credit union merger activity is on track to grow in 2025, suggesting that mergers and acquisitions are here to stay.

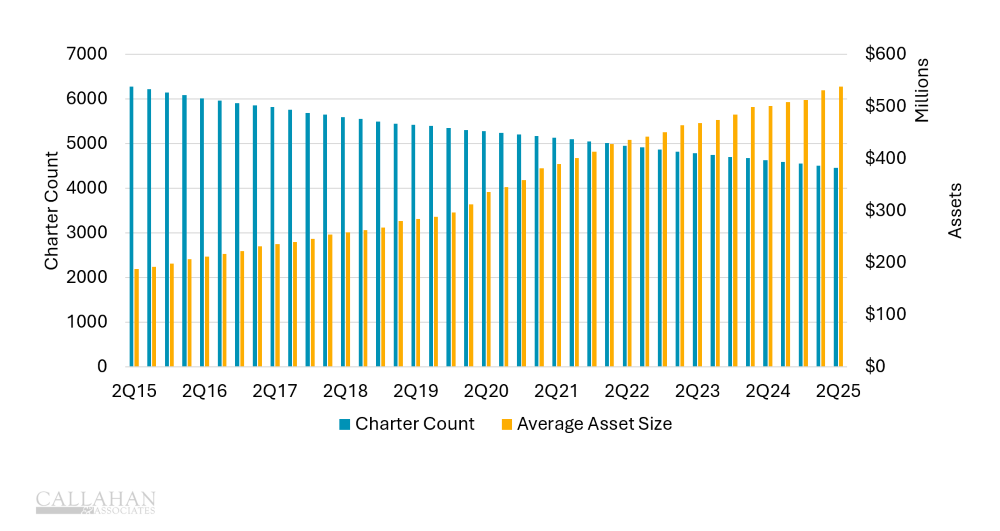

Amid industry consolidation, the average credit union size has jumped 186% in the past 10 years, growing from $188.2 million to $538.2 million as credit unions chase the efficiencies that come with scale.

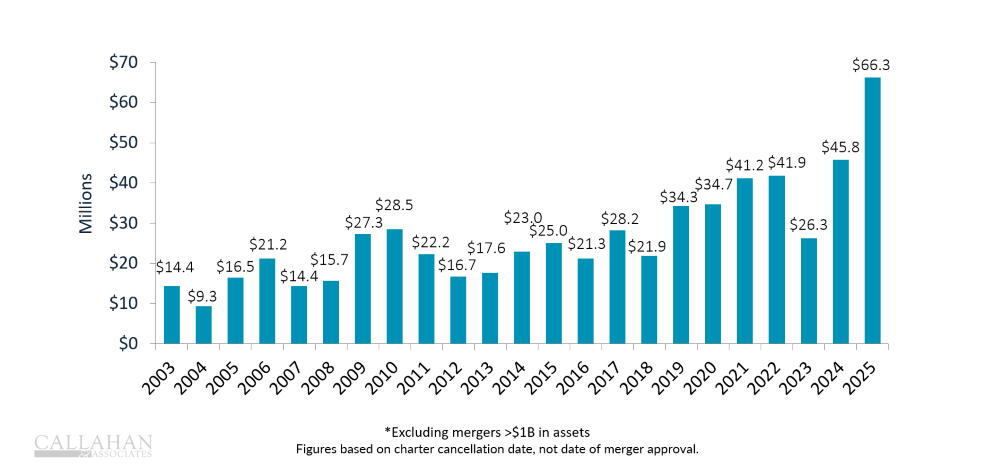

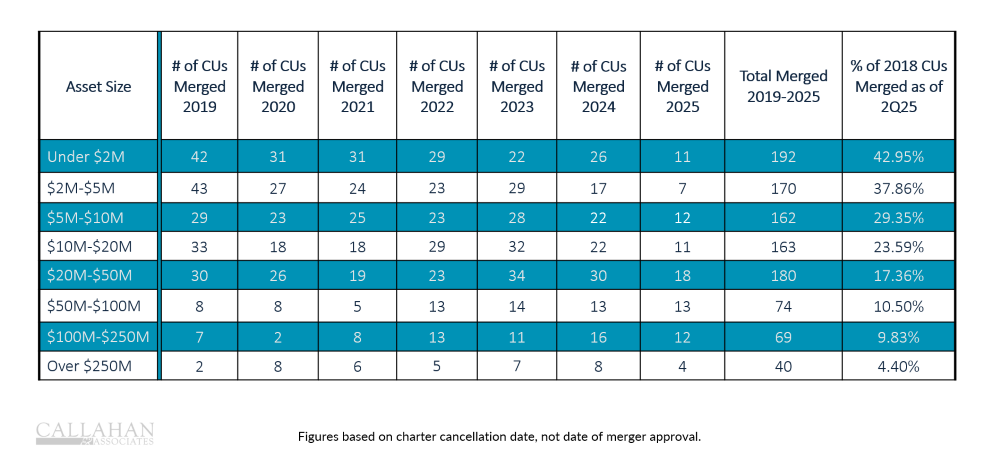

Mergers are growing in scale, too. As of June 30, 2025, the average asset size for a merged credit union was $66.3 million. By comparison, 65% of all credit union mergers since 2019 included institutions with less than $20 million in assets. Even larger mergers are on the horizon, with plans in motion from:

- Wings Financial Credit Union ($9.5B, Apple Valley, MN) and Ent Credit Union ($10.3B, Colorado Springs, CO).

- Digital Federal Credit Union ($12.7B, Marlborough, MA) and First Tech Federal Credit Union ($17.1B, San Jose, CA).

- CommunityAmerica Credit Union ($5.4B, Lenexa, KS) and Unify Financial Federal Credit Union ($3.5B, Allen, TX).

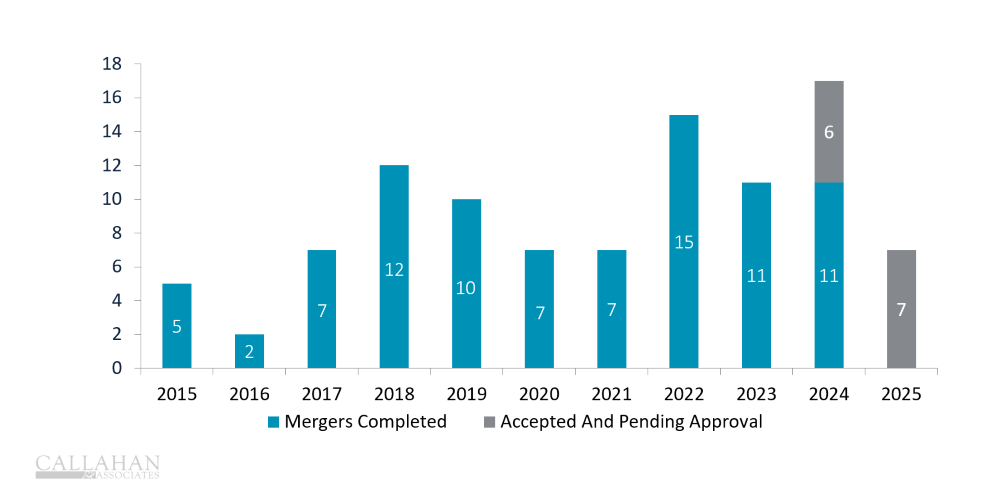

On the bank front, seven credit unions in 2025 have reached an agreement to acquire a bank, down from 17 in 2024. Although the boards have approved these mergers, the agreements still need to clear regulatory approval.

MERGER NUMBERS AND RATE

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

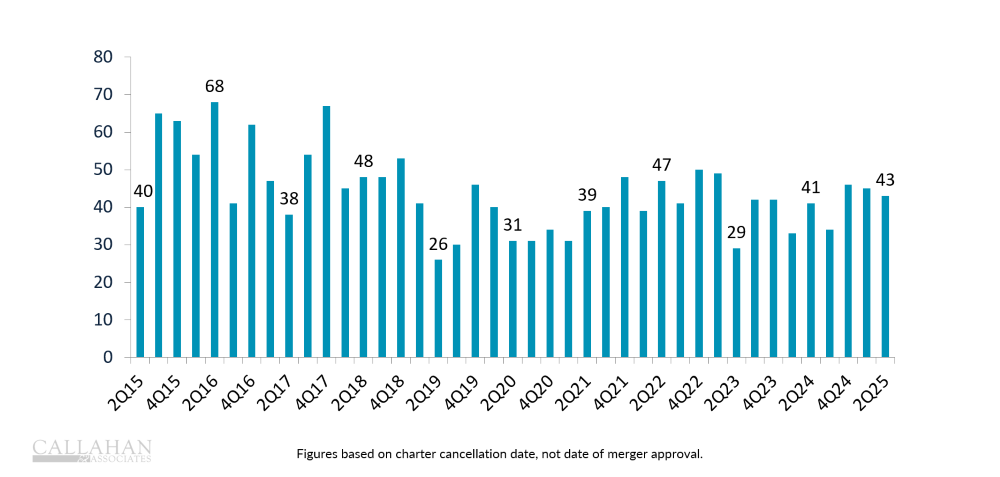

MERGERS COMPLETED BY QUARTER

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

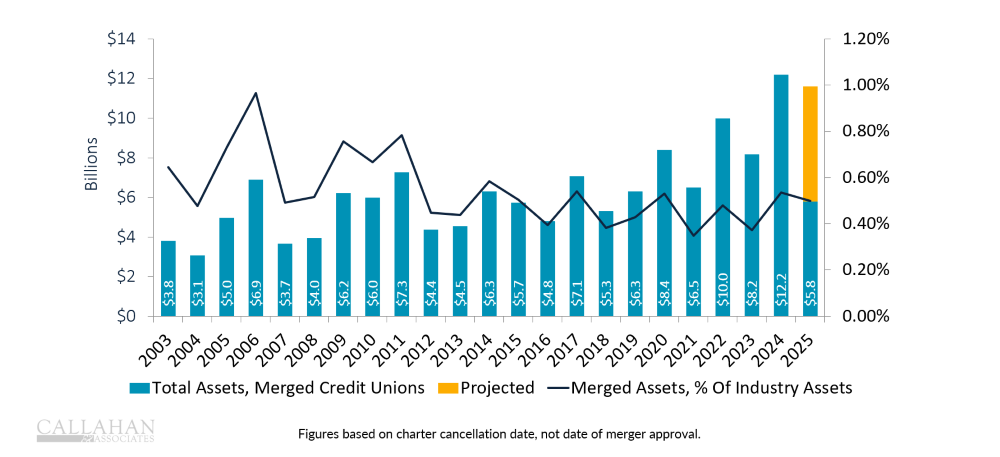

ASSETS OF MERGED CREDIT UNIONS

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

AVERAGE ASSET SIZE OF MERGED CREDIT UNIONS

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

CREDIT UNION MERGERS

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

CREDIT UNION BANK ACQUISITION BY YEAR

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

AVERAGE ASSET SIZE AND CHARTER COUNT

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

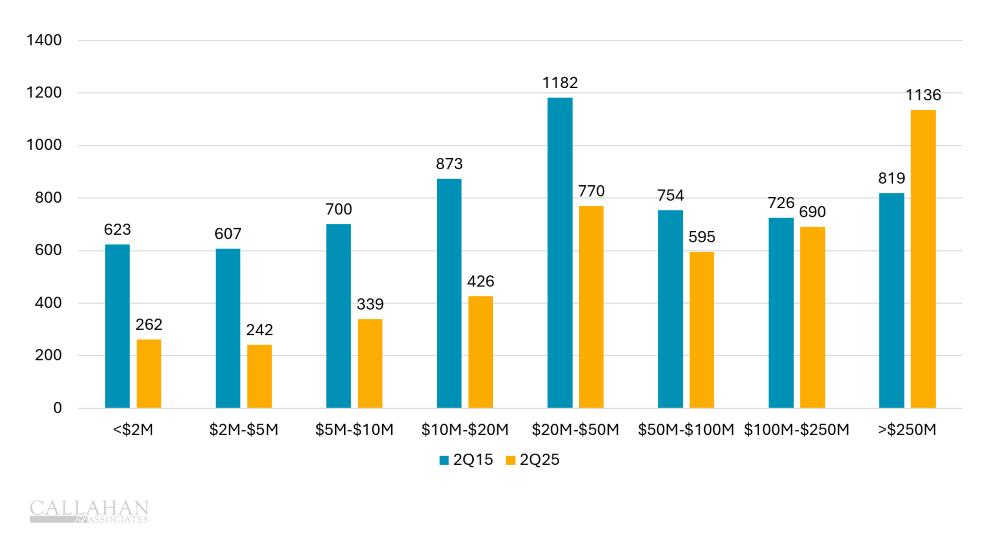

CHARTER COUNT BY ASSET SIZE

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

Mergers Made Smarter. Callahan’s Peer Suite has built-in merger functionality that allows credit unions to combine the 5300 Call Report data of two reporting credit unions to scenario plan a merger and gauge the financial impact using pre-built charts for lending, deposits, income, expenses, capital, staffing, members, infrastructure, electronic offerings, member metrics, and more. Learn more today.