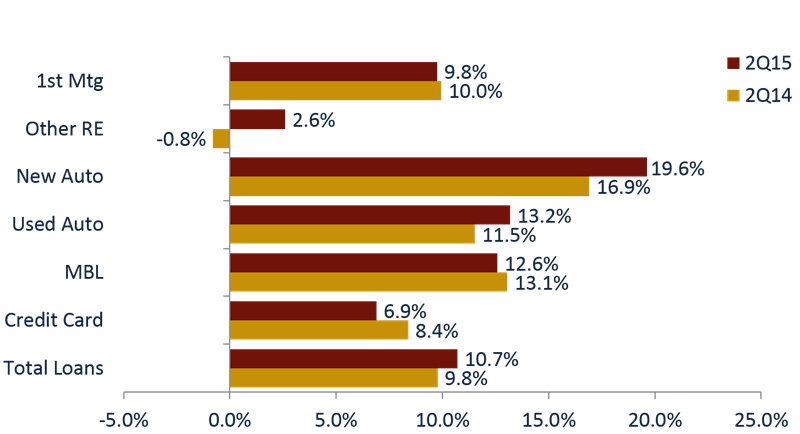

According to FirstLook data from Callahan & Associates, the aggregate credit union loan portfolio expanded 10.7% between June 30, 2014, and June 30, 2015. Real estate and consumer lending split the growth, with the two portfolios growing 8.3% and 14.1%, respectively.

From a dollar contribution perspective, consumer lending balances slightly outpaced real estate lending. The consumer loan portfolio grew $36.4 billion whereas the real estate portfolio increased $29.5 billion over the same period. Low interest rates coupled with growing consumer confidence and low employment rates have led to increased consumer borrowing.

12-MO. GROWTH IN LOANS OUTSTANDING

For all U.S. credit unions | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

Auto lending, historically a strong point for credit unions, posted the largest year-over-year percentage growth of any lending category. Both the new and used auto loan portfolios grew at double-digit rates at credit unions nationally. Collectively, the auto portfolio expanded 15.5% between June 2014 and June 2015.

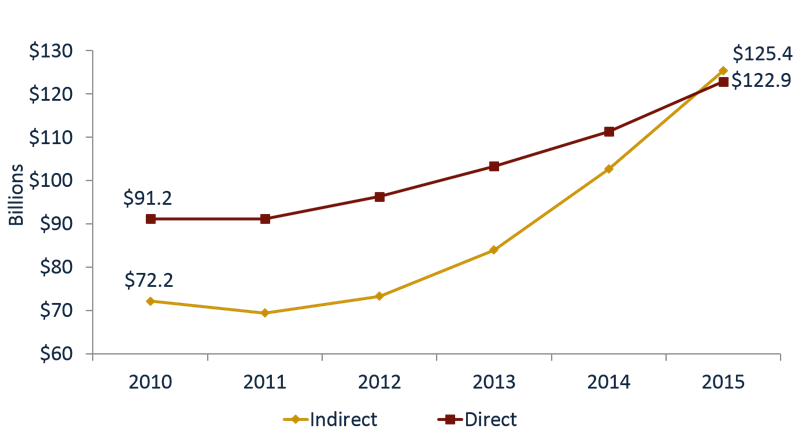

Direct lending, the traditional avenue credit unions have used to make auto loans, has been decelerating since 2012; however, the share of loans made to members at a dealership indirect lending has been growing. As of June 30, indirect auto lending volumes surpassed direct lending for the first time in history for credit unions. Over the past 12 months, indirect lending increased 22.2% whereas direct lending grew 10.3%.

Read about direct lending success in Strategies To Make A Direct Impact On Auto Loan Growth.

INDIRECT VS. DIRECT AUTO LOANS

For all U.S. credit unions | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

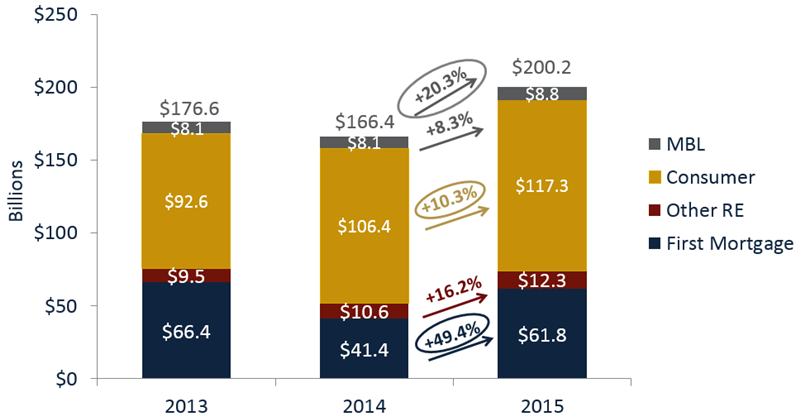

Loan originations at credit unions also topped historical performance peaks. As of June 30, every major loan category posted significant year-over-year growth. Total originations which includes first mortgages, consumer, other real estate, and member business loans (MBL) totaled more than $200 billion for the six months of 2015. That’s the largest amount ever recorded for credit unions in the first six months of a year.

Although all categories posted impressive growth, first mortgage originations, which includes both purchase mortgages and refinancings, recorded the largest percentage and dollar change versus one year ago, rising $20.4 billion (49.4%) compared to the first six months of 2014. Additionally, other real estate loans, which include home equity lines of credit, also posted notable gains over the six-month period, rising 16.2% to $12.3 billion.

YTD LOAN ORIGINATIONS

For all U.S. credit unions | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates