AVERAGE MEMBER RELATIONSHIP VS. MEMBERS PER FTE

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.22

© Callahan & Associates | CreditUnions.com

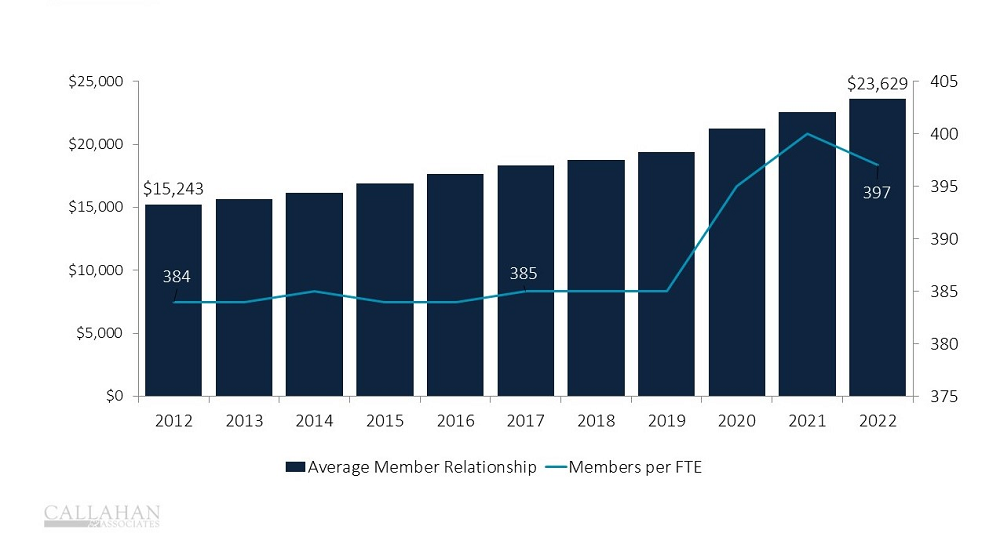

- The average member relationship has grown steadily since 2012, averaging 4.5% compounded annual growth during that period and 6.8% since the onset of the COVID-19 pandemic in 2020. This increase was due in large part to the economic relief payments sent by the government, which eventually made their way to local credit unions.

- In the past decade, members have taken advantage of low interest rates to take out loans for homes, HELOCs, and cars, deepening their relationship with their credit union in the process.

- To accommodate the needs of a growing membership, credit unions hired at roughly the same rate they added members between 2012 and 2019; however, hiring slowed with the onset of the pandemic, and member growth has outpaced employee growth since 2020. Notably during the COVID-19 pandemic, credit union employment grew only 0.6% whereas membership grew 3.2%.

- With continued membership growth and an ever-deepening member relationship, credit unions should ask whether their suite of products and employee base are giving members the attention and service they need. Whether it be faces at the branches, digital transformation, or member experience strategists, credit unions who put the member experience first can deepen member engagement.

How Do Your Member Relationships Compare?

Use industry data to determine how your credit union performs against others, uncover new areas of opportunity, and support your strategic initiatives. Callahan’s credit union advisors are ready to show you how — are you ready to see how you stack up?

Schedule Your Peer Demo