PREFERRED PAYMENT METHOD BY HOUSEHOLD INCOME

FOR U.S. CONSUMERS | DATA AS OF OCTOBER 2021

© Callahan & Associates | CreditUnions.com

- A 2022 study from the Federal Reserve — the “Diary of Consumer Payment Choice” — offers clues into consumer payments trends headed into 2023. Most notably, cash usage continues to shift. Cash accounted for 20% of all payments in 2021 — the most recent data available — up one point from 2020 but down from 26% in 2019.

- Despite that year-to-year stability, cash payments are down 11 percentage points compared to 2016, when they comprised 31% of all payments. Debit card usage and ACH payments have remained relatively stable during the same period, whereas credit card use as a percentage of all payments continues to climb, rising from 18% in 2016 to 28% in 2021.

- The percentage of consumers using cash for person-to-person payments has also fallen dramatically, from 61% in 2019 to just 49% in 2021. Perhaps not surprisingly, mobile app usage for P2P exchanges nearly doubled in just one year, rising from 15% in 2020 to 29% in 2021.

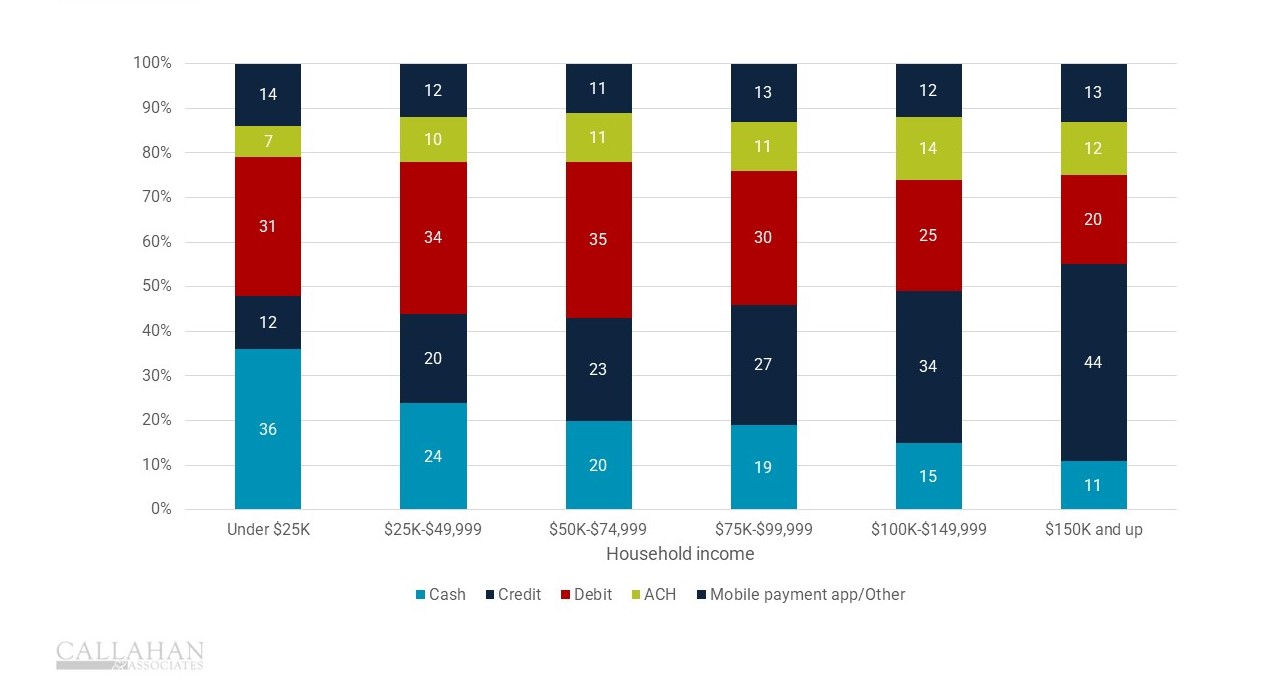

- Cash usage continues to be highest among those age 55 and older, a figure that hasn’t changed significantly since 2016, whereas cash payments among younger consumers has generally been on the decline. Cash payments were also more common among consumers in low-income households.