DIVIDENDS PER MEMBERS VS. 3-MONTH TREASURIES

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.23

© Callahan & Associates | CreditUnions.com

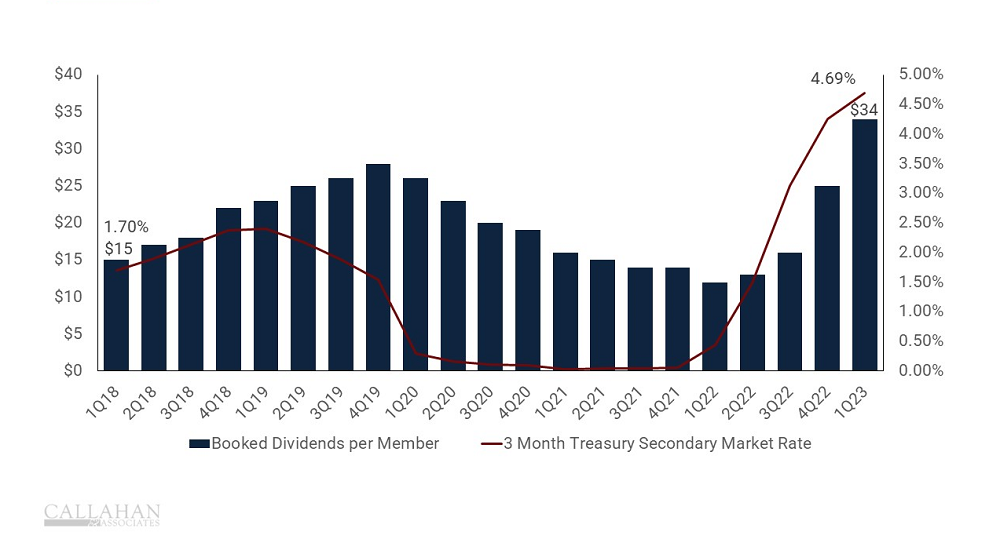

- In March 2022, the Federal Reserve began increasing its benchmark federal funds rate to fight inflation. The higher interest rates rippled through the economy, ultimately raising yields on bonds offered by the Treasury Department. Credit unions were forced to increase their own dividend rate to keep up and attract deposits from members, raising the dividend per member each quarter in the process.

- The Treasury yield and dividend rate at credit unions tend to move together, albeit with a lag. In the first quarter of 2023, credit union dividend rates caught up with the growth in the Treasury rate. With higher interest rates on Treasury securities, credit union members now had options on where to put their medium and longer-term savings. They could put their savings into their credit union, or they could purchase bonds that would give them an almost risk-free return of more than 4.0%.

- Credit unions began to offer higher rates on termed deposits, such as certificates and IRA/Keough Accounts, to attract funds in this higher interest environment. This increased the quarterly booked dividend per member by 174.0% to $34. Following the increase in deposit rates, the portion of share certificates in a credit union share portfolio ballooned, from 13.0% of shares in the first quarter of 2022 to 19.1% one year later, driving the increase in dividends per member.

How Do You Perform Against Peers?

Callahan’s Peer software offers endless opportunities to pull custom research and comparative performance benchmarking to make strategic, member-driven decisions for your institution. Let us show you how it works with a free custom scorecard with metrics and peer groups of your choosing.

Claim Your Custom Scorecard

Claim Your Custom Scorecard