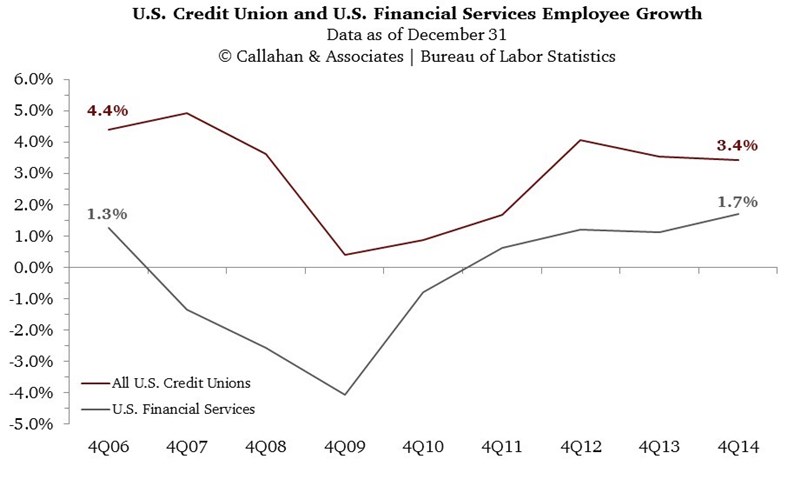

Since 2006, as the United States was slipping into the recession, credit unions have fared significantly better from an employment perspective than their broader financial services peers. In 2009, the low point of the recession, credit union employment growth remained positive it increased 0.4% as employment in the U.S. financial services sector declined 4.1%.

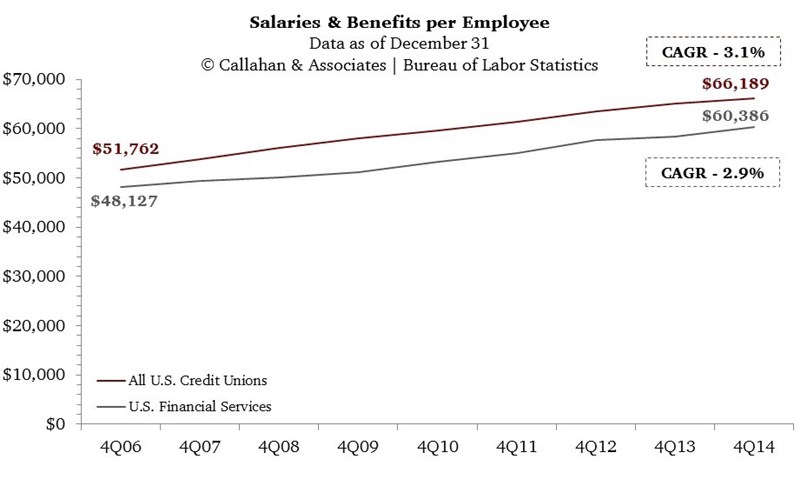

From a compensation perspective, credit union employees currently, and have historically, fared better than their broader financial services peers. Since 2006, the average salary and benefits per credit union employee has increased from $51,762 to $66,189, representing a compound annual growth rate of 3.1%. By comparison, the average salary for U.S. financial services sector employees grew at a 2.9% rate over the same period.

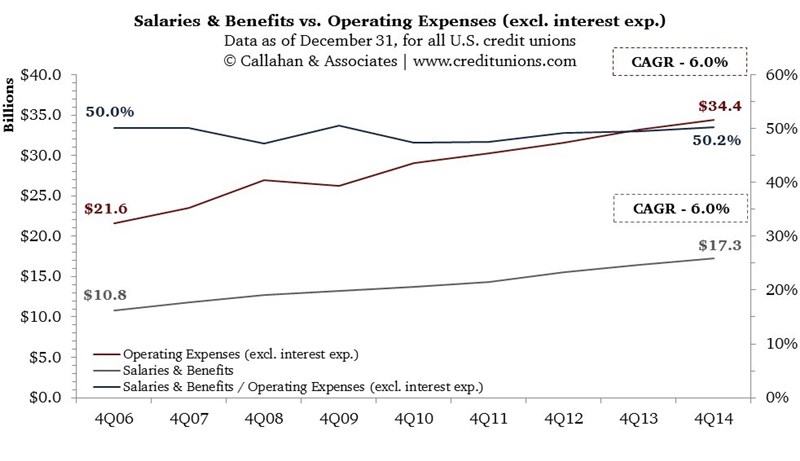

In aggregate, salaries and benefits and operating expenses have increased at near identical rates since 2006. Of note, as a percentage of non-interest operating expenses, salaries and benefits have remained very stable, remaining in the 47%-50% band over the time period.

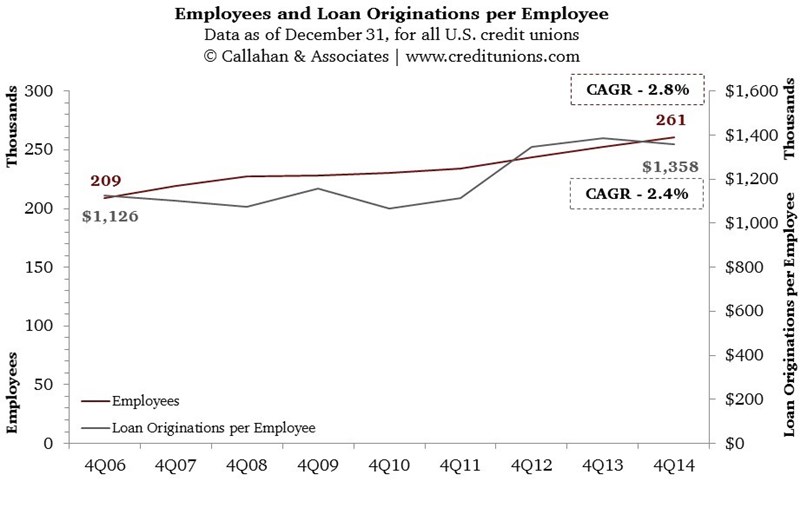

Over the past nine years, credit union employment has grown from 209,000 to 261,000. Over the same period, the average loan origination per employee has grown from $1.1 million to $1.3 million. In the past year, however, employment has continued to grow while loan originations per employee have declined since hitting a high point of nearly $1.4 million per employee in year-end 2013.