HOME BUYERS AND SELLERS BY AGE

FOR U.S. HOME BUYERS| DATA AS OF NOV. 2022

© Callahan & Associates | CreditUnions.com

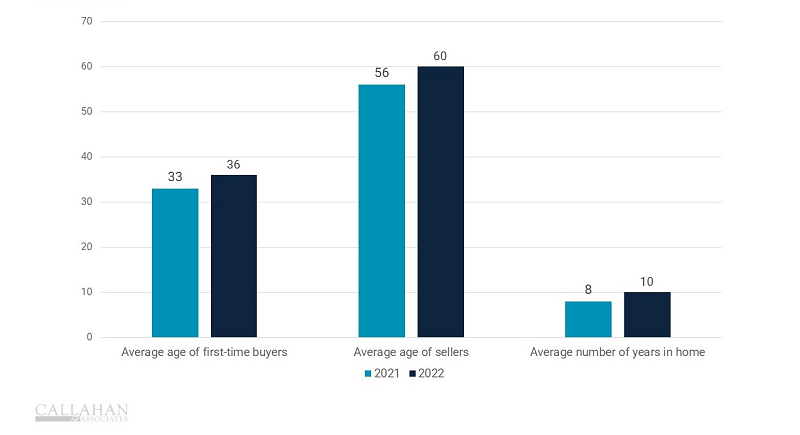

- Limited inventory, high prices, and rising interest rates are changing how and when Americans buy homes and take out mortgages. The 2022 Profile of Homebuyers and Sellers from the National Association of Realtors found the average age of first-time homebuyers rose from 33 to 36 last year, hitting an all-time high.

- Additionally, first-time homebuyers comprised barely one-quarter (26%) of all buyers, the lowest figure on record. That same percentage of first-time buyers reported the down payment as the most difficult part of the purchasing process, indicating there is still a substantial market for the down-payment assistance programs many credit unions offer.

- Sellers’ ages are also rising, from an average of 56 in 2021 to a new high of 60.

- Most Americans are spending an average of 10 years in their homes. That’s up from eight years reported in the 2021 version of the same study but in line with pre-pandemic norms.

- For more highlights from the report, click here.

Gauge Your Mortgage Performance

Take a data-driven look at leaders and competitors in your financial market with Peer. Backed by data from HMDA, the 5300 Call Report, and the U.S. Census Bureau, Peer offers endless opportunities to pull custom research to make strategic, member-driven decisions for your institution.

Claim Your Mortgage Scorecard

Claim Your Mortgage Scorecard