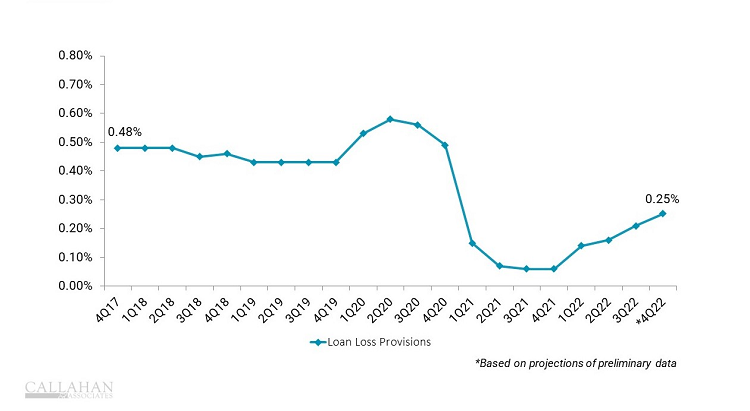

ANNUALIZED PROVISION FOR LOAN LOSSES/AVERAGE ASSETS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.22

© Callahan & Associates | CreditUnions.com

- Based on preliminary data, the dollar amount set aside as provision for loan and lease losses at U.S. credit unions increased 341.8% year-over-year in the fourth quarter of 2022. As a percentage of average assets, provisions jumped from 0.06% one year ago to 0.25% at year’s end. Despite the recent surge, this remains well below the historical average for the industry.

- Loan delinquency rates increased 8 basis points quarter-over-quarter to 0.61%. Record-low delinquencies reduced the need for substantial provisions the past two years, but that will change if delinquency rises. It is unclear whether the spike in delinquency was seasonal or if it will pick up steam in 2023.

- Relatedly, regulatory changes required by new CECL reporting standards may have some impact on how much credit unions set aside for loss coverage.

- Despite the rise in delinquency, credit unions remain well-covered with $1.25 set aside for every $1 of delinquent loans.

What’s Happening In Your Market?

Let data inspire your next lending strategy with comparative performance analytics from your market or against peers of your size. Callahan’s Peer software offers endless opportunities to pull custom research to make strategic, member-driven decisions for your institution.

LEARN MORE

LEARN MORE