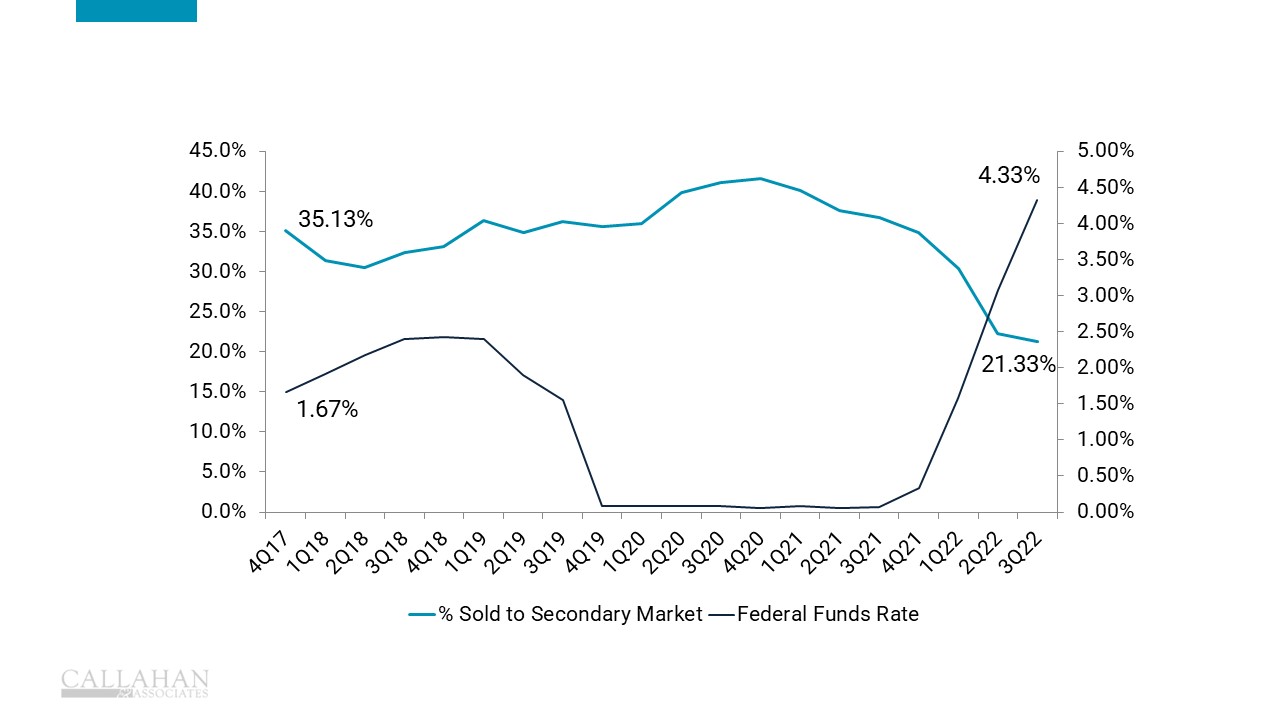

PERCENTAGE OF MORTGAGES SOLD ON THE SECONDARY MARKET VS. FEDERAL FUNDS RATE

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.22

© Callahan & Associates | CreditUnions.com

- With interest rates on the rise, credit unions have dramatically scaled back the percentage of mortgage loans sold on the secondary market to levels not seen since the early 2000s.

- Credit unions increased sold mortgage loan (as a percent of total loans originated) from 2019 through 2021, when the federal funds rate was at historic lows. Low rates present high interest rate risk and limited opportunity for interest income. Given the environment, selling mortgages for an upfront fee was attractive to credit union managers.

- Selling more mortgages to the secondary also provided the added benefit of liquidity. Selling loans freed up funds for credit unions to originate more loans in a record-hot real estate market, and more liquidity also allowed lenders to originate loans at potentially higher future rates.

- The environment started to shift in late 2021 when the Federal Reserve began raising benchmark interest rates to help curb inflation and credit unions started selling fewer loans. A higher yield makes it more attractive to keep new loans on the balance sheet, as they are less susceptible to interest rate risk. Although the federal funds rate typically influences the percentage of loans sold on the secondary market, this is the largest shift in more than five years.

- Through Sept. 30, 2022, year-to-date interest income for the credit union industry was up 15.3% year-over-year as higher rates and held loans expanded margins. The net interest margin increased 21 basis points in the second and third quarters to the highest point since the fourth quarter of 2020. Although other operating income declined amid slowing mortgage sales, growing interest revenue created a net positive for credit union earnings.

- Selling fewer loans to the secondary market might reduce the liquidity available for credit unions to make loans. Many credit unions still have plenty of shares to lend; however, others might need to tighten lending if loan demand drains excess liquidity.