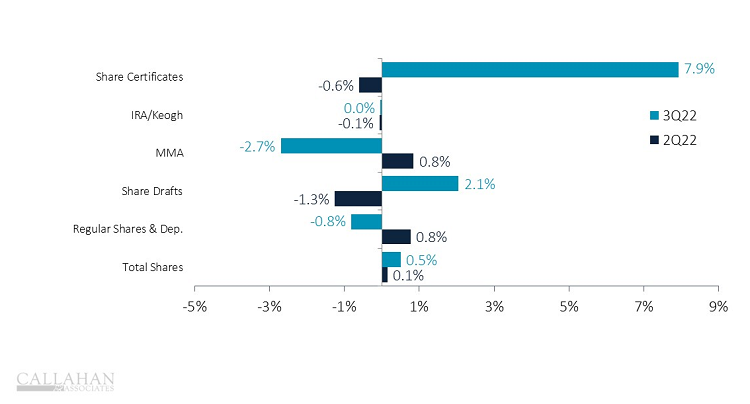

3-MONTH GROWTH IN SHARE SEGMENTS

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.22

© Callahan & Associates | CreditUnions.com

-

- Credit union share balances grew just 0.5% during the third quarter of 2022. This is the second-slowest quarterly growth rate for the industry since 2018 and well below the nearly double-digit rates reported during the peak of the pandemic.

-

- Slowing share growth is making it more difficult to fund record loan demand, and the industry’s loan-to-share ratio increased 4.6 percentage points from June 30, 2022, to 78.3% as of Sept. 30.

-

- To attract more deposits, credit unions are running share certificate promotions, a proven way to bring in new liquidity. Share certificates — which offer members a higher interest rate but cannot be withdrawn for a designated period of time — are costly for credit unions but present the opportunity to lend the funds at even higher rates. Members, also, benefit from the higher yield offerings and continued access to financing.

-

- Share certificates increased 7.9% in the third quarter of 2022. This ended a streak of nine consecutive quarters of declining balances. When rates were near zero, members did not see the advantage of share certificates over more liquid options. Now that rates are higher, they are more attractive.

- Inflation — which was 8.3% annually through September — is the primary catalyst for interest rate increases and helps explain the overall decline in non-certificate share types since June. When prices increase and wages fail to keep up, members must spend a greater portion of their income, dipping into their savings when necessary, on the same basket of goods.