Branches have long been a cornerstone of how credit unions connect with members and build trust within their communities. But the way people use these spaces is changing.

That shift isn’t happening in isolation. Industry research underscores how consumer expectations and behaviors are reshaping the role of physical locations and why branches still matter. The challenge — and opportunity — lies in rethinking what a branch can be. Data shows consumers still seek human touchpoints, even as digital dominates routine tasks.

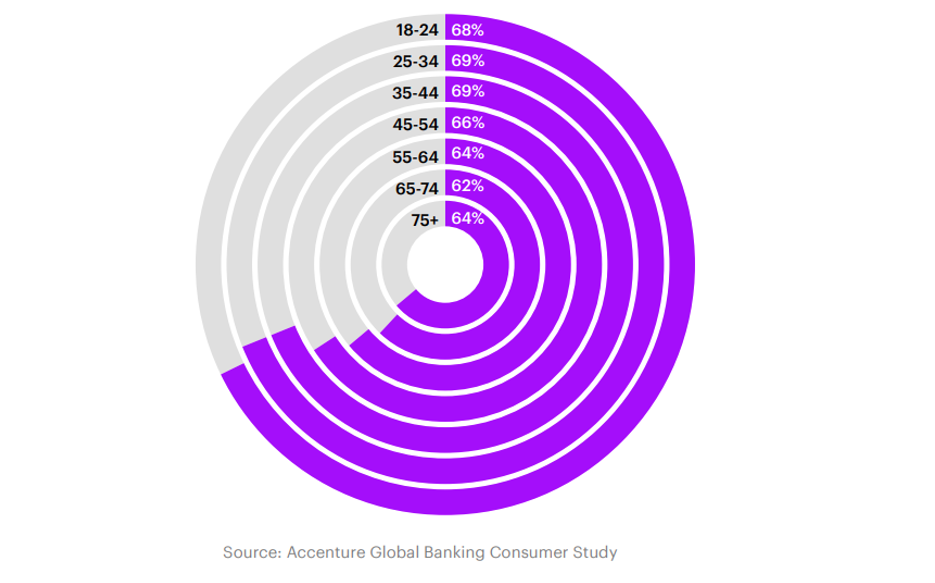

CONSUMERS OF EVERY AGE LIKE SEEING BRANCHES IN THEIR NEIGHBORHOOD

FOR ACCENTURE GLOBAL BANKING CONSUMER STUDY RESPONDENTS

SOURCE: Accenture

Strategic Insights

- Consumers Rely On More Than One Provider: In the 2023 Accenture Global Banking Consumer Study, a full 59% of respondents acquired a financial product from a provider other than their primary bank.

- Multiple Products But Fewer Ties: North American consumers hold an average of seven financial products, but fewer than half — just 3.1 — come from their main institution.

- Digital For Simple, Branches For Complex: Although 63% prefer online banking for simple tasks like checking balances, most still visit branches for complicated issues, and two-thirds value having a branch nearby for stability and accessibility.

- Branch Closures Are Slowing: A 2024 Candascent white paper notes closures accelerated during the pandemic but have since slowed; Bank of America plans to open 165 new financial centers by 2026.

- The Opportunity For Credit Unions: Branches can evolve from transaction points to hubs for advice, education, and relationship building, reinforcing the cooperative’s unique role in its community.

How Are Credit Unions Elevating Branches?

- Deep in the heart of Southeastern Texas, DuGood Federal Credit Union($567.5M, Beaumont, TX) is opening a branch to help tomorrow’s tradespeople graduate on the right financial foot with products and services designed especially for them. Read more.

- When the closure of a mega bank branch on the campus of California State University, Northridge, created a gap in financial services, Premier America Credit Union($3.3B, Chatsworth, CA) stepped in with a new space and tailored solutions to tap into the university’s significant first-generation student population and improve financial inclusion for college students. Read more.

- At Tongass Federal Credit Union($228.6M, Ketchikan, AK), small-scale, tech-enabled branches serve far-flung communities with a cost-effective model that prioritizes accessibility. This approach ensures financial services remain within reach for members who need them the most. Read more.

- University Federal Credit Union’s ($4.2B, Austin, TX) mobile branch is breaking down barriers for underserved communities by providing convenient access to essential banking services, financial education, and trusted support right where people need it. Read more.

- When Redwood Credit Union ($9.5B, Santa Rosa, CA) partnered with a local catering company to operate cafes at two locations, the credit union put quality food at a good price in the hands of the public and employees alike, marrying financial and physical wellness in California’s wine country. Read more.

When Members Feel Cared For, They Stay. Gallup research shows emotionally engaged members stay longer, own more products, and contribute more business on high-value offerings. That kind of engagement doesn’t happen by accident — it happens by design. Callahan and Gallup equip credit unions to spark behavior change that improves member financial wellbeing and drives credit union sustainable growth. The next cohort is forming now. Learn more today.