NEW AUTO LOANS OUTSTANDING VS. NEW VEHICLE ANNUAL INFLATION

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.22

© Callahan & Associates | CreditUnions.com

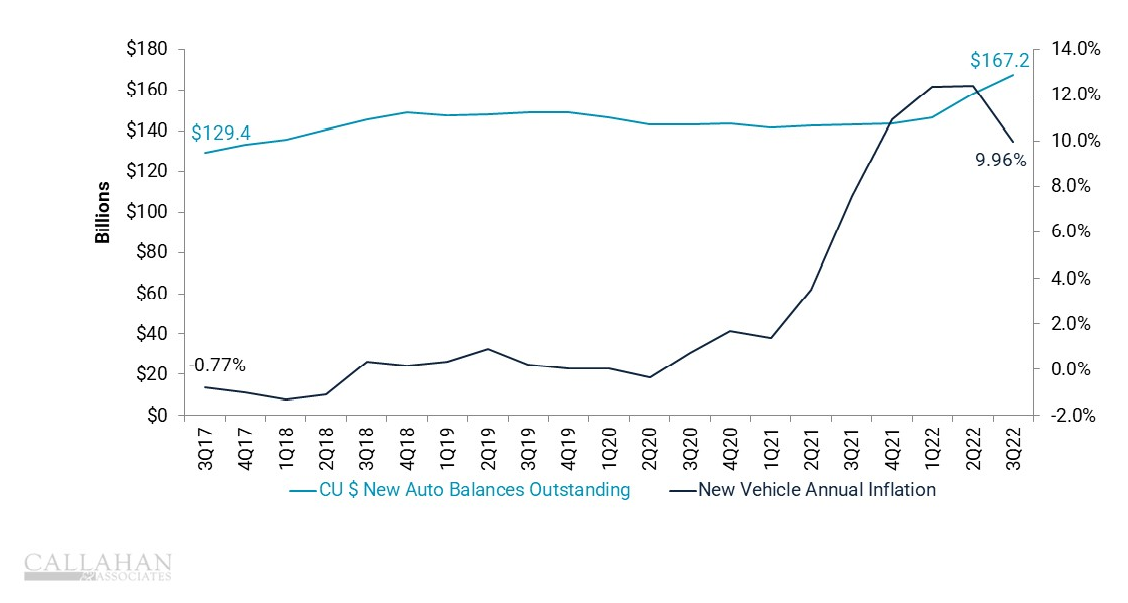

- The above graph compares the total dollar amount of outstanding new auto loans in the credit union industry against the annual percent change in the consumer price index for new vehicles. The annual rate of change to the index can be interpreted as annual auto price inflation.

- The new vehicle price index rose 1.4% during the first 12 months of the pandemic. The following 12 months, from March 2021 to 2022, the index rose 12.4%. Inflation peaked in the second quarter of 2022, rising an additional 4 basis points. The rate of new auto inflation has since decelerated to 10.0% but remains significantly higher than historical levels.

- Total new auto loan balances outstanding are rising. With dipping vehicle demand and many Americans out of work, new auto loan balances contracted as much as 3.7% during the height of the pandemic. Many cooperatives turned to indirect lending and participations to fill the gaps in lending. Combined with a recovering auto market, credit unions have reported double-digit annual growth for the past two quarters. As of Sept. 30, new auto balances were up 18.4% year-over-year.

- From the fourth quarter of 2021 through the first six months of 2022, prices rose faster than loan balances. This means there was a decreasing number of full new auto loans — excluding participations — and a possible member preference for cheaper car types amid skyrocketing prices.

- In the current inflationary environment, credit unions are keeping pace in the auto market, thanks in large part to alternative forms of loan generation. However, should prices continue to rise at an accelerated rate, an increasing number of members might be priced out of the market.