It’s no secret things are getting more expensive, and people are struggling to keep up. Consequently, their outlook on the economy is generally pessimistic despite what the data says. This misalignment has been on the minds of credit union leaders — credit unions like Interra and Lake Michigan have even developed strategies to combat this “vibecession” — but to better understand how inflation is impacting member finances, it’s important to look at how it affects their budgets.

All Budgets Are Not The Same

The average American earns $101,805 annually. Of that, they spend 32.9% ($25,436) on housing; 17.0% ($13,174) on personal and public transportation; 12.9% ($9,985) on food; and 8.0% ($6,159) on health care. If the consumer has children, childcare needs to be added to this list of major expenses.

For Americans who earn less, nondiscretionary and less flexible spending — such as for housing, food, or transportation — tends to comprise a greater share of the budget. For these people, programs that make purchasing a vehicle easier can help stretch the budget further. For example, American 1 Credit Union waives credit score requirements for first-time auto borrowers.

The Uneven Impact Of Inflation

The impact of inflation on budgets is uneven across income levels and has been going back decades.

During peak inflation in 2021, income before taxes for the lowest quartile income group fell 0.4%, yet expenses climbed 7.5%. Things were not much better one quartile up. Income there grew just 0.6%, whereas expenditures increased 10.1%.

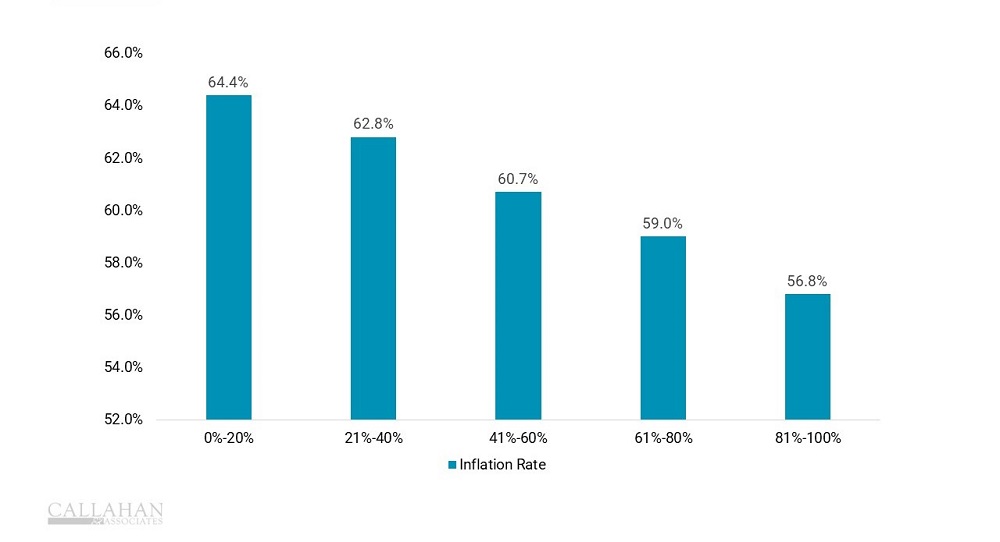

Although the discrepancy between income and expenses among income brackets has improved slightly in the past four years, the trend has been difficult to reverse. According to the Bureau of Labor Statistics, from 2005 to 2024, inflation disproportionately affected Americans in the lowest 20% of income earners, rising by 64.4% compared to 56.8% for those in the top income bracket.

CUMULATIVE INFLATION, 2005-2024

FOR U.S. CONSUMERS, BY INCOME PERCENTILE | DATA AS OF 2024

SOURCE: U.S. Bureau of Labor Statistics

That’s not to say inflation is necessarily bad. In fact, inflation can encourage economic growth and make debts easier to manage because the value of money decreases over time even as the total amount borrowed and the interest owed remain the same. This is known as the real rate of interest. However, individuals without assets — such as a home or a car — often bear the brunt of inflation through rising costs like rent and other essential expenses.

Lower income individuals also bear the brunt of inflation when it comes to savings. Higher income earners tend to hold their savings in stocks, which do well in inflationary environments. Lower income earners, however, tend to keep their savings in money market or savings accounts at their credit union or bank. The impact of inflation on these liquid accounts is significant as it eats away at buying power.

Trouble On The Horizon? Credit Unions Can Help.

The primary ways to combat inflation from a consumer standpoint include budgeting, cutting costs, paying down debts, and building emergency savings. All of these require gainful employment. Unfortunately, lower income wage earners tend to work in industries that rely on cyclical employment, including hospitality, retail, food service, construction, and more.

From a monetary policy standpoint, the primary way to combat inflation is to raise interest rates. Unfortunately, higher interest rates disproportionately affect cyclical employers. When rates go up, these businesses scuttle investments and pull back on employment opportunities. Thus, lower income wage earners have less income to earmark for higher yielding savings products.

Compounding the hurdles to saving, budgeting, and cutting costs is a reliance on credit to cover large expenses as well as everyday items. As interest rates increase, so, too, does the cost to borrow money for a car or home and even everyday items.

With potential tariffs looming and the bird flu spreading, everyday products could get more expensive in 2025. Such an outlook has prompted the Federal Reserve to signal a higher for longer course of action on rates. In the past year, CreditUnions.com has provided myriad examples of credit unions thinking creatively about how to help member wellbeing. Looking ahead, such practices will play a key role in helping consumers navigate these challenging times.