The NCUA is releasing third quarter performance data for credit unions, and Callahan & Associates predicts membership has expanded 4.5% year-over-year. That’s 45 basis points higher than this time last year and is the highest growth rate in membership since 2003. In total, 5 million members have joined the credit union movement in the past 12 months, bringing the total to 116.9 million.

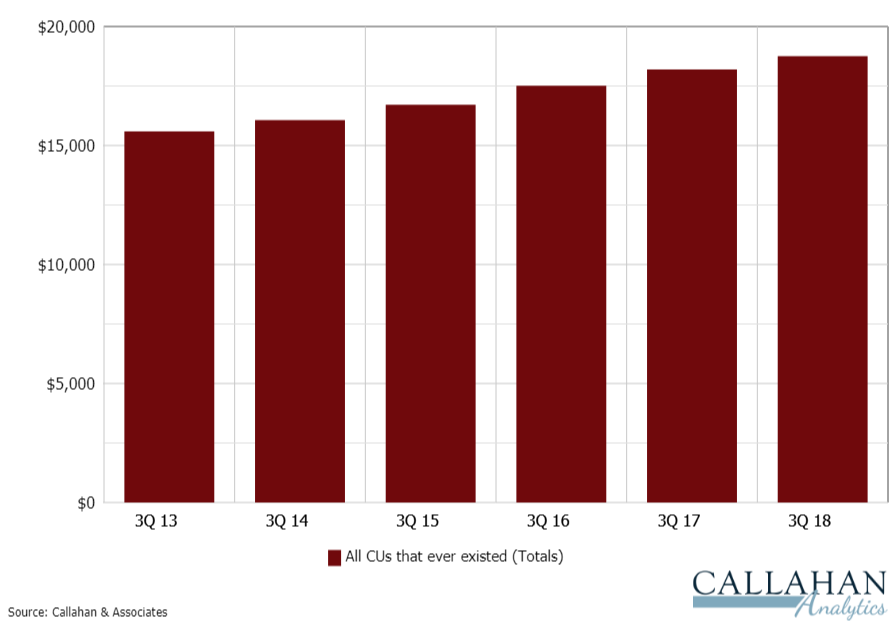

In addition to attracting members, credit unions have improved their relationship members old and new. The average member relationship is on track to hit $18,684, that’s $489 more than in third quarter last year. Consumer confidence in the market is currently strong, which is evident in credit unions’ improving member relationship. Loan balances per member are on track to increase 4.9% year-over-year to $8,301. The average share balance per member on track to hit $10,383 represents a more tempered annual growth of 0.5%.

AVERAGE MEMBER RELATIONSHIP (EXCLUDING BUSINESS LOANS)

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.18

Callahan & Associates predicts credit union members added $489 to their average member relationship in the past year, which is on track to hit $18,684.

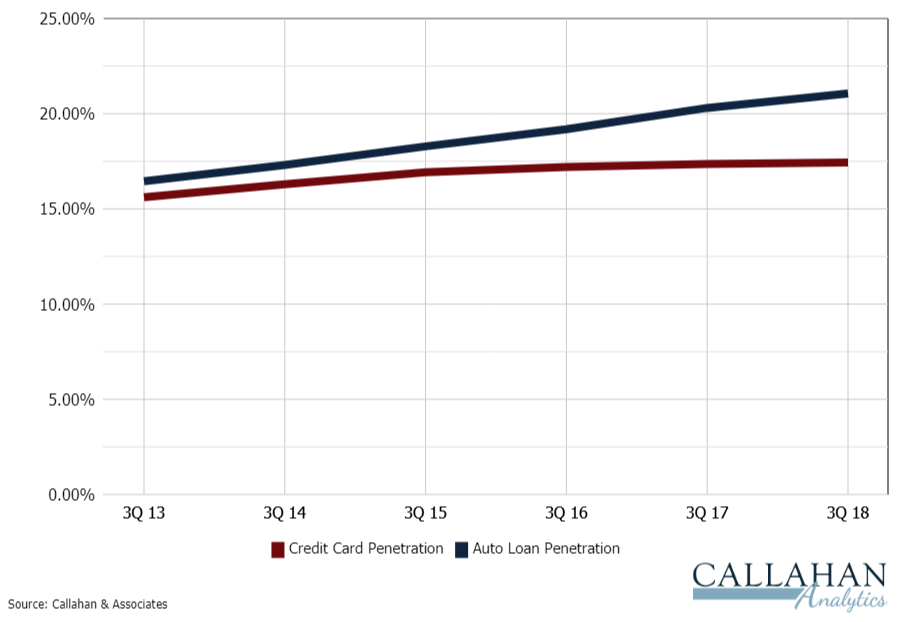

Members are diversifying the way they interact with their credit union, and Callahan predicts improvement in share draft, credit card, and auto loan penetration in the third quarter of 2018. According to early data, 57.8% of credit union members had a share draft account as of September 30, 2018. That’s up from 57.0% in September 2017. The backbone of a member’s relationship with the credit union, share draft account penetration hit an all-time high of 57.8% 5.5 percentage points higher than five years ago.

Credit card penetration is also on the rise and is set to eke out an annual increase of 4 basis points. Three consecutive quarters of increases has help penetration reach 17.4%. Elsewhere in the loan portfolio, auto penetration is set to increase 75 basis points to 21.1%. Growth in the indirect channel is slowing, but credit unions are making up for it through direct methods.

AUTO AND CREDIT CARD PENETRATION

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.18

More credit union members are engaging with their credit union through credit card and auto loans.

Source: Callahan & Associates.

Are You Growing, Too?

Five million members have joined the credit union movement in the past year. It takes seconds to pull data comparing your credit union’s member metrics versus local and national peers in Callahan’s Peer-to-Peer. Let us show you how.

ContentMiddleAd