Callahan & Associates hosted its first quarterly Trendwatch webinar of the decade on Thursday, detailing first quarter trends and early effects of the coronavirus pandemic on credit union financials. This Trendwatch outlined how credit unions are financially positioned to face the crisis, drawing insights from credit union leaders who were pivotal in navigating their respective institutions through past crises.

Here are three takeaways from Thursday’s webinar:

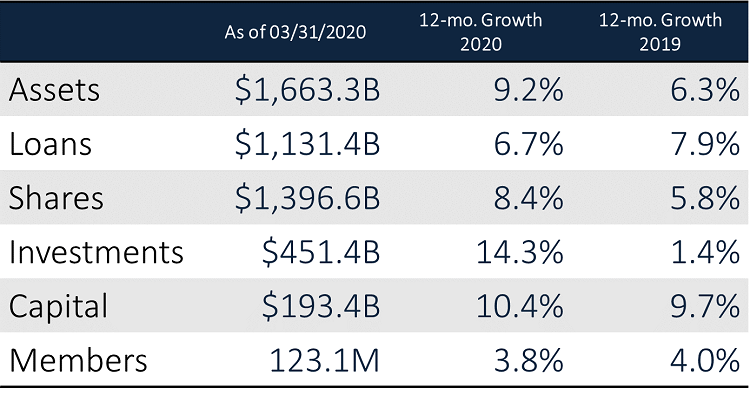

1. The Credit Union Balance Sheet Continues To Expand

The credit union balance sheet is projected to expand 9.2% year-over-year, largely driven by deposit inflows, up 8.4% annually, and mortgage balance growth, up 11.2%. Total auto loan growth slowed 9.1 percentage points over the past year to 2.5% as of March 2020. This is due to decreased participation in the indirect channel across the industry as well as dampened consumer loan growth. Correspondingly, slowing consumer demand has resulted in growing investment balances across the industry, up 14.3% annually to $451.4 billion as of the first quarter.

BALANCE SHEET TRENDS

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

The credit union balance sheet remains strong, up 9.2% year-over-year, as a growing membership base continues turning to credit unions for financial services.

2. Both Total Membership And Member Relationships Expand Year-Over-Year

Total membership increased 3.8% over the past year as credit unions nationwide now provide financial services to 123.1 million members. Not only are an increasing amount of people turning to cooperatives for financial solutions, but they’re also increasing the level of relationship they bring with them. Average member relationship, the sum of retail loan and share balances per member, is up 3.2% annually to $19,756 as of the first quarter. Total share balances per member increased 4.5% year-over-year as members look for channels to allocate savings. The percentage of credit union members with a checking account included in their relationship increased 1.8 percentage points over the past year and is nearing 60.0% for the first time.

MEMBER RELATIONSHIPS

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

As credit unions nationwide serve more people, those members continue to increase and diversify their relationships, putting the industry in a stronger position than the last time the country entered an economic crisis.

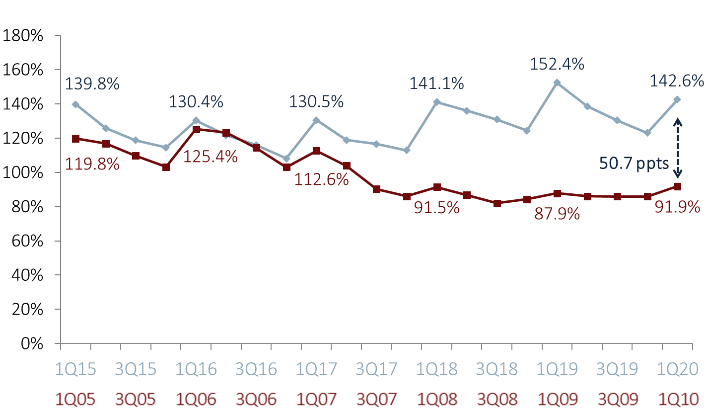

3. Credit Unions Are In A Unique, Favorable Position To Face The Coronavirus Crisis

Credit unions are well positioned to face the financial challenges that the novel coronavirus poses. As of the first quarter, the coverage ratio at U.S. credit unions is 142.6%, 51.1 percentage points above what it was in the first quarter of 2008. That means for every $1 of delinquent loans, credit unions have allocated almost $1.43 in their allowance account. Additionally, coming off several years of strong increases to industry earnings, average net worth ratios and excess capital, beyond the level required by the NCUA’s well capitalized threshold, continue to expand. Total net worth increased 7.7% annually to $183.0 billion as of March 2020. For perspective, holding net worth at its current level henceforth, total credit union assets would need to expand 57% for the industry to drop below the NCUAs 7% well capitalized net worth threshold.

Lastly, the experience of credit union leaders nationwide, like Doug Fecher (president and CEO, Wright-Patt Credit Union) and Julie Renderos (executive vice president and CFO, Suncoast Credit Union), cannot be overstated. Having navigated their respective institutions through crises in the past, their insights and expertise, shared through the cooperative model, put credit unions in a unique position to thrive.

COVERAGE RATIO

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

As of the first quarter, for every $1 of delinquent loans on the balance sheet, credit unions have allocated almost $1.43 in their allowance account.

Customize A Data Scorecard With 1Q20 Data

1Q20 industry data is here and we want to send you a custom scorecard. Pick 10 ratios most important to your credit union and we’ll compare you to relative credit union and banking peers.

Learn More