Callahan & Associates hosted its quarterly Trendwatch webinar on Thursday, detailing fourth quarter and full year 2019 industry trends. As Callahan officially releases its last call report data set of the decade, Trendwatch recaps the past 10 years to reflect on the cooperative model and its importance in the financial world in the decade following the Great Recession.

Here are three major Trendwatch takeaways:

No. 1: Credit Unions Report Third Consecutive Quarter Of Record Loan Origination Levels

In the fourth quarter, loan production at credit unions nationwide reached $158.2 billion, the largest three-month loan origination volume on record. This represents the third consecutive quarter that credit unions have reported record-setting quarterly origination balances. In the three months between April and June, credit unions originated $136.8 billion in loans; between July and September, credit unions originated $151.1 billion. The last three quarters of 2019 are now the most productive lending quarters in the history of the credit union movement.

First mortgages were the catalyst of such strong production over the past nine months. Year-end first mortgage originations were up 28.2% year over year, to $178.4 billion, as of December; another record. Total originations over the past 12 months reached $557.5 billion, which is only the second time that credit unions have surpassed the $500 billion mark in a single year. In 2018, credit union loan production was $511.2 billion through 12 months.

QUARTERLY LOAN ORIGINATIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

The last three quarters of 2019 are now the most productive lending quarters in the history of the credit union movement.

No. 2: Member Product Usage Rates Are Inching Up

Credit unions nationwide continue to push their product usage rates up as they deepen and diversify relationships with members. Share draft penetration, a good measure for the percentage of members using their credit unions as a primary institution, has grown 1.1 percentage points year over year to 58.8% as of year-end 2019. This is the industry’s highest-ever reported rate; share draft penetration has increased more than 12.0 percentage points in the past decade.

More than one in five credit union members has an auto loan tied into their credit union relationship. At 21.3%, the percentage of members with an auto loan is up 7 basis points annually. Additionally, credit unions are offering credit card solutions to an increasing proportion of their membership base. Credit card penetration has increased 13 basis points over the past year, and 3.3 percentage points over the past decade, to 17.7% as of year-end 2019.

MEMBER PRODUCT USAGE RATES

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

Credit unions continue to deepen member relationships as product usage rates increase.

Custom Historical Trends Scorecard

The 2010s have come and gone. We broke down some of the decade’s trends during Trendwatch, but what did the past ten years look like at your credit union?

Request a custom scorecard from Callahan & Associates and get 10 years of historical data comparing your credit union to a relevant group of credit union and bank peers.

Request Now Missed Trendwatch? Watch Here

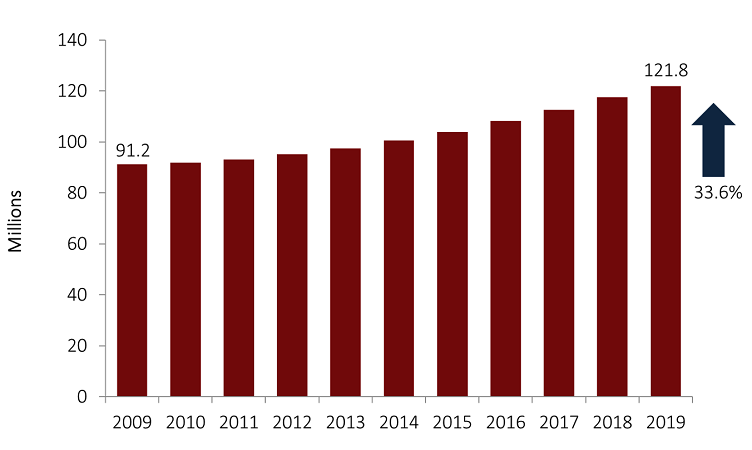

No. 3: Over The Last Decade, Credit Unions Have Continually Helped More Consumers

Over the past 10 years, credit unions have worked diligently to operate in the best interest of their members. Callahan’s fourth quarter 2009 Trendwatch culminates with bold letters exclaiming The Beginning of a Cooperative Decade. In many respects, that’s been true. Credit unions nationwide have essentially doubled the 10-year growth of banks in assets, loans, and capital.

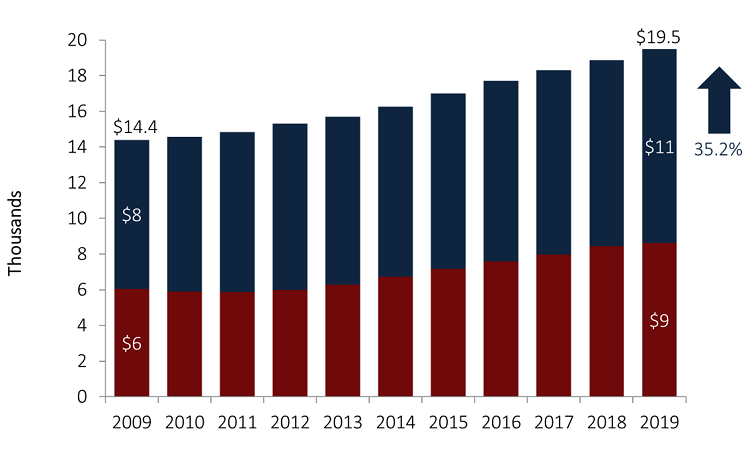

Adding members and deepening their relationships has been integral to credit unions success over the last decade. Since 2009, total membership at cooperatives across the country has increased 33.6% to 121.8 million at year-end 2019. Additionally, the average member relationship, which is the combined loan and share balances per member (excluding business loans), is up 35.2% since 2009 to $19,472 as of December 2019. Over the last decade, consumer have turned to credit unions at rates they had not before and in turn, credit unions have offered great financial services.

10 YEAR CREDIT UNION MEMBERSHIP

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

Adding members and deepening relationships has been integral to credit union success over the past decade.

10 YEAR AVERAGE MEMBER RELATIONSHIP

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

Adding members and deepening relationships has been integral to credit union success over the past decade.