Credit unions are cooperative institutions — when their members do well, they do well.

In many cases, though, such prosperity extends beyond the people who bank directly with the credit union to also include local businesses and business owners; front-line employees; city, health, and utility workers; students and educators; and more. In other words, all the people who make up a community.

Despite the fact credit unions frequently have a demonstrable positive impact on the communities they serve, many struggle to quantify their impact and weave a compelling story.

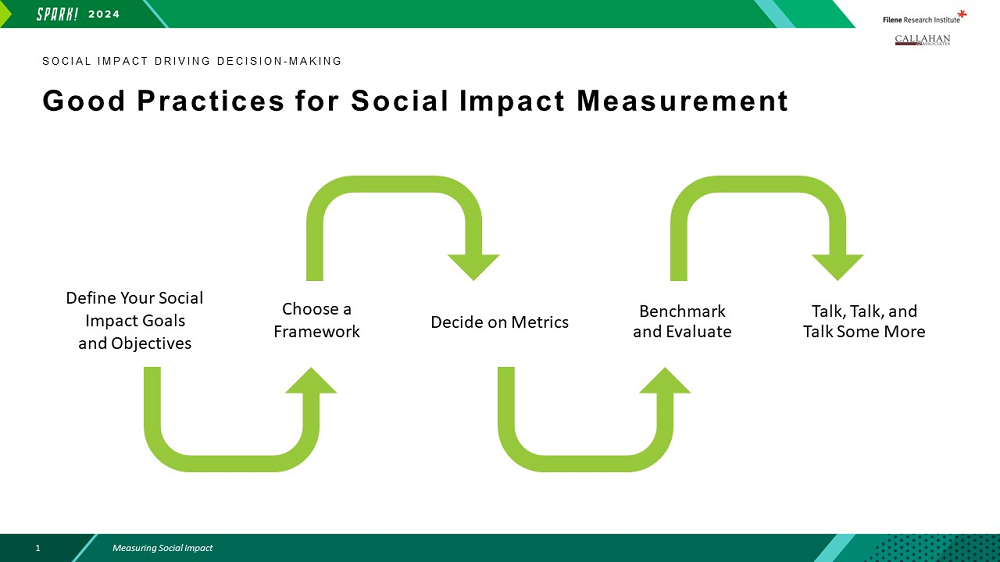

So, for all the credit unions out there addressing community needs and building communal resiliency yet struggling to tell their story, consider these five practices.

1. Define your social impact goals and objectives. This is where the story begins. Even the most thriving community can improve, whether that means reducing poverty or homelessness or improving education or equity. The first step to making an impact is to decide what the credit union will focus on and develop a deeper understanding of specific issues to address.

2. Choose a framework. After identifying a focus area, it’s time to add structure. A good framework helps organizations set targets and measure performance, keeping leaders focused and on track in the face of myriad distractions and opportunities. The right framework also offers guidance for strategic discussions.

Many organizations struggle to move beyond big ideas and into formalizing a system of rules, ideas, and beliefs that help them make decisions, plan, and execute. But there’s no need to agonize over this stage. There are a number of available frameworks, many of which provide guidelines for how to measure success. Some examples include the B Impact Assessment, the Sustainable Development Goals, and the Social Return on Investment.

Credit unions with a hyper-specific focus or niche membership might opt to create their own framework. This requires a heavier investment of resources but might prove to be the best course of action.

Does Your Mission Resonate In A Modern World? Communities today don’t need a run-of-the-mill financial services provider — they need a collaborator to help them tackle big problems. That’s where Callahan & Associates can help. Our Leading With Purpose program helps credit unions define why they do what they do, then provides inspiration to set goals and develop strategies that will make the cooperative an instrumental community resource for years to come. Ready to learn more? Watch our informational session today.

3. Decide on metrics. Identify key performance indicators on which the credit union can have a measurable, meaningful influence. KPIs generally fall into two categories: within direct control of the credit union and beyond the direct control on the credit union. For example, a credit union might track its employees’ monetary donations, volunteer hours, or overall charitable participation. These metrics all fall directly under the credit union. Metrics that reach beyond the scope of the credit union include the percentage of community members struggling with homelessness or overextended on debt.

4. Benchmark and evaluate. What gets measured gets managed, and the data collected in this step will provide a baseline to evaluate the credit union’s performance on a wider scale. Track the KPIs identified in step three and compare results to historical performance and goals to ensure the credit union’s programs are appropriately designed to have the largest possible impact. But don’t just rely on data. Look for anecdotal proof — tap into those member success stories and staff feedback — that accentuates the human element behind the credit union’s goals.

5. Talk, talk, and talk some more. Steps one through four require vision, focus, dedication, and work. Now, what to do with the results? Tell your story! Talk with members about the credit union’s successes and ask them to help spread awareness. Share best practices with other credit unions. Look for opportunities to collaborate with community organizations. Explore new ways to expand the credit union’s reach, resources, and impact.

Then, get back to work. Reach out to credit unions and other social organizations for their thoughts on how to expand — or narrow, if necessary — the credit union’s goals. Look for opportunities to adjust the framework. Identify new metrics. Community impact is a journey, not a destination.