Annual growth in auto loans was the fastest of any major loan product at U.S. credit unions, and the segment accounted for $369.8 billion in total balances at year-end 2018.

The share of the credit union loan portfolio held in auto loans increased 34 basis points year-over-year to 35.0% as of Dec. 31, 2018. Since year-end 2017, credit unions have gone from financing 19.7% of auto loans on the market to 20.5%. By the end of 2018, one in five credit union members, or 21.2%, held an auto loan with their cooperative. That’s an increase of 74 basis points year-over-year.

For more on auto lending, read Credit Unions Excel At Meeting Member’s Auto Loan Needs.

Read on to learn more about credit union auto lending.

TOTAL AUTO LOANS & 12-MONTH GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates | CreditUnions.com

Total auto loans at credit unions expanded 10.1% year-over-year and added $34.0 billion to the industry’s total loan portfolio in 2018.

AVERAGE AUTO LOAN BALANCE

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates | CreditUnions.com

Despite reporting slower growth in the auto portfolio in the fourth quarter of 2018, the average loan balance for new and used autos combined increased $265 year-over-year to $14,834.

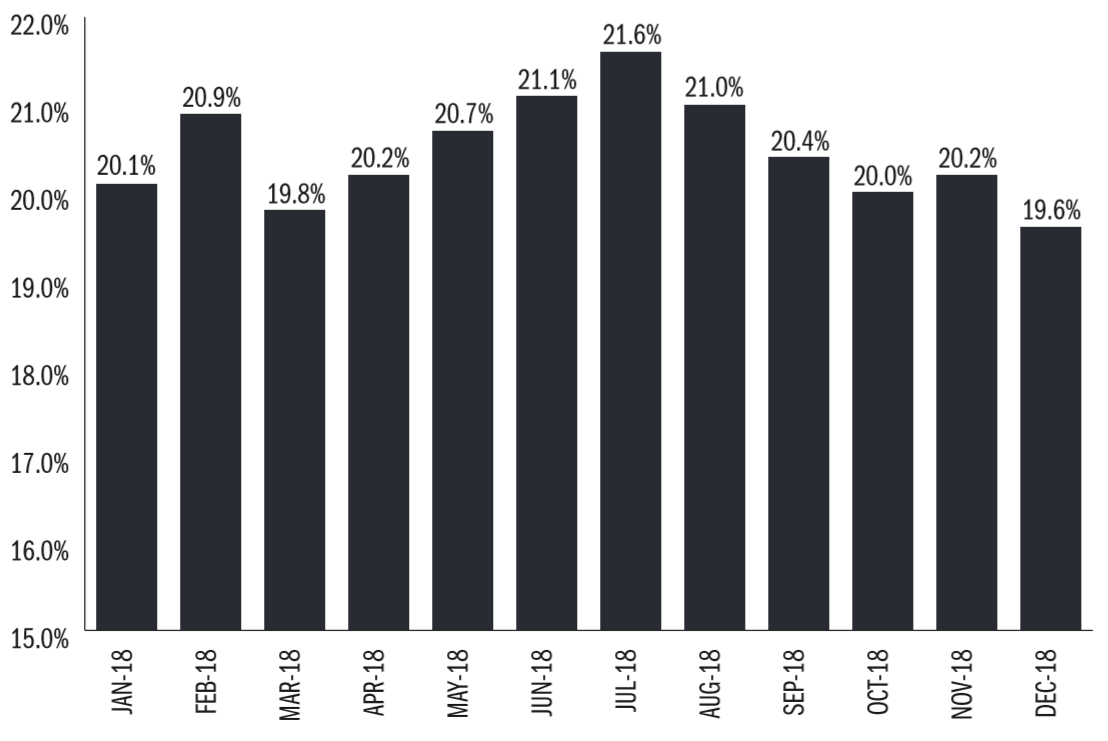

AUTO LOAN PENETRATION

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates | CreditUnions.com

One in five credit union members, or 21.2%, held an auto loan with their cooperative at the end of 2018. That’s an increase of 74 basis points year-over-year.

AUTO LENDING MARKET SHARE

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates | CreditUnions.com

Since year-end 2017, credit unions have gone from financing 19.7% of auto loans on the market to 20.5%.

INDIRECT LOANS TO TOTAL AUTO LOANS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates | CreditUnions.com

Indirect balances, which consist primarily of auto loans, increased 14.3% annually to $223.6 billion at year-end. This is down 3.5 percentage points from Dec. 31, 2017. As production slows in both the new and used auto segments, credit unions are also slowing the rate at which they originate loans through point-of-sale relationships.

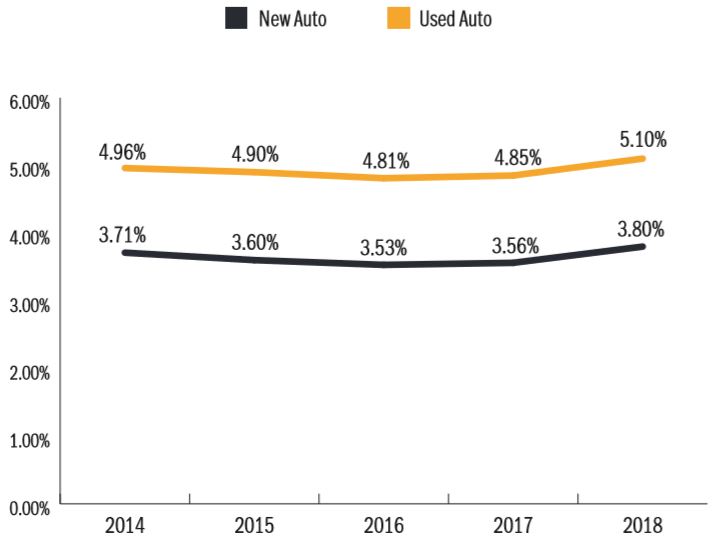

AUTO LOAN RATES

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates | CreditUnions.com

The average interest rate for both new and used auto loans have increased in 2018 for the second consecutive year, up at an annual rate of 24 and 25 basis points, respectively.