Saving money can be difficult. More and more, Americans struggle to feel like they’re saving enough.

In 2020 and 2021, COVID relief funds combined with reduced spending thanks to shutdowns helped Americans sock away savings, thereby increasing their average wealth. That emergency savings helped cushion tightening budgets when relief efforts ended and inflation increased the prices of everyday necessities, such as groceries, gas, and housing.

Today, many people might be in a more financially secure position; however, the majority still feel insecure about their current level of savings.

EMERGENCY SAVINGS OF AMERICANS

U.S. ADULTS| DATA AS OF 05.22.23

© Callahan & Associates | CreditUnions.com

- Americans’ wealth has increased during the 2020s. They used COVID relief funds and programs to support everyday spending and pay down debt during the pandemic. During that time, they also built a larger safety net of emergency savings.

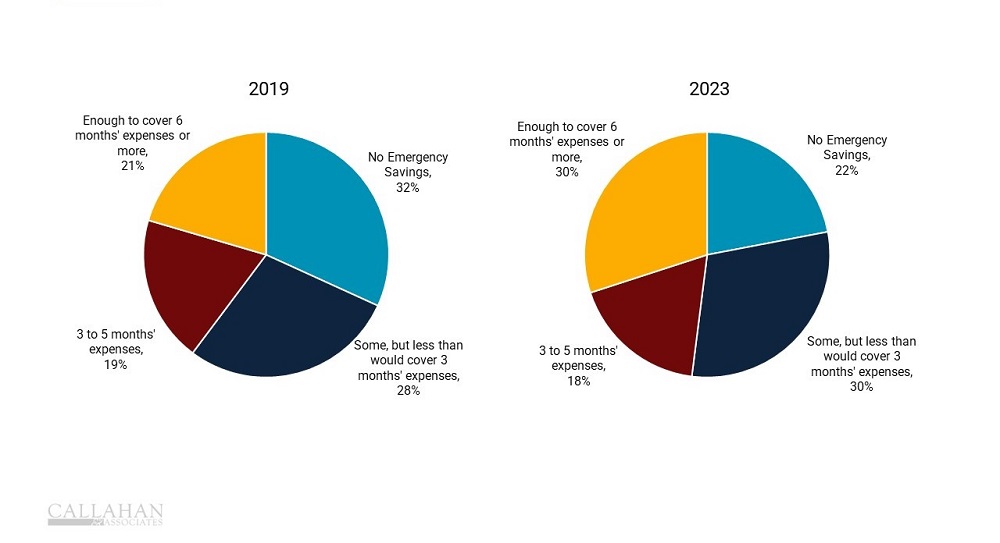

- Based on respondents’ answers to an early 2023 Bankrate survey, 30% of Americans have enough money to cover six months of expenses. That’s up from 21% in 2019. Only 22% of Americans have no emergency savings. That’s down 10 percentage points from 2019.

PERSONAL SAVINGS RATE VS. SHARE GROWTH

All U.S. CREDIT UNIONS | DATA AS OF 12.31.23

© Callahan & Associates | CreditUnions.com

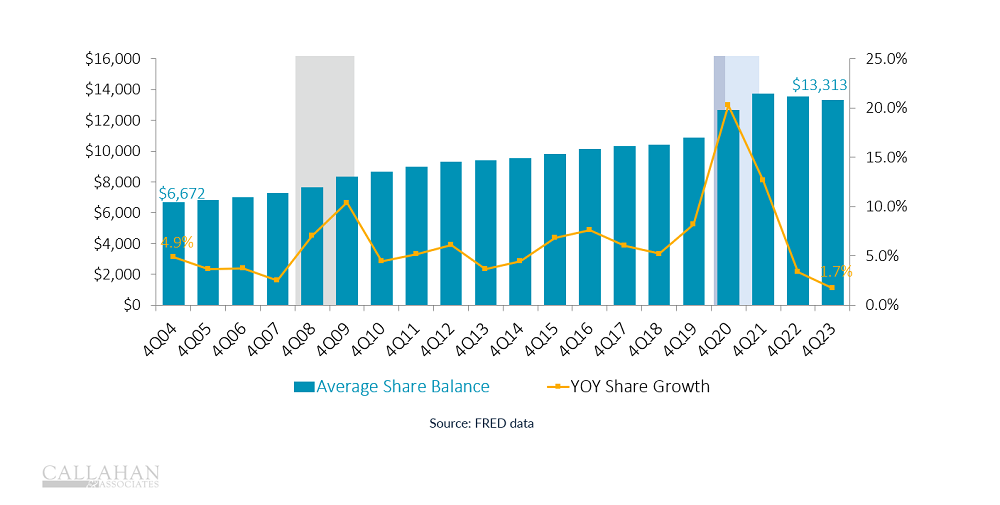

- Unfortunately, the savings trend might be turning. The personal savings rate fell to just 3.7% in December 2023. That’s down significantly from a high of 32.0% in April 2020 and 2.2 percentage points below the average savings rate from 2013-2019. Increased prices due to post-pandemic inflation resulted in less leftover income for Americans to continue building rainy day or emergency savings.

- Deposits at credit unions have followed a similar pattern. Savings rates have deteriorated since the end of COVID-era relief efforts in March 2021; inflation and high interest rates have exacerbated the trend. Although the industry reported an average annual deposit growth of 1.7%, the median credit union lost 3.0% of shares. [For more on the importance of considering median performance in analysis, read “Looking For Deeper Insights? Consider The Median.“

Are you using data to fuel strategic decisions? Callahan’s Peer Suite empowers credit union leaders to make informed, data-back decisions without wrestling with complex, manual processes. Benchmark against the peer groups your choose, automate your KPIs every quarter, and kickstart your journey to success. Request A Demo

AVERAGE SHARE BALANCE PER MEMBER VS. 12-MONTH SHARE GROWTH

ALL U.S. CREDIT UNIONS | DATA AS OF 12.31.23

© Callahan & Associates | CreditUnions.com

- Americans stashed excess funds in savings accounts during the pandemic, which drove up balances. Attracting deposits in today’s environment, however, is proving difficult. During the pandemic relief period, the average share balance per member peaked at $14,051 in March 2022. That represented an increase of $2,529, or 23.3%. The average share balance per member fell to $13,313 at year-end 2023, which is equivalent to March 2021.

- Although cost of living is the dominant factor behind reduced savings, other forces are also at play. Namely, indirect lending has underpinned a lot of new member growth the past few years. Unfortunately, these members don’t often bring many shares into the credit union, which lowers the member average.

- Of note, although savings rates are lower today, people are better prepared for emergencies thanks to the reserves they have built during the past three years.

FINANCIAL COMFORTABILITY BY GENERATION

U.S. ADULTS | DATA AS OF 12.31.23

© Callahan & Associates | CreditUnions.com

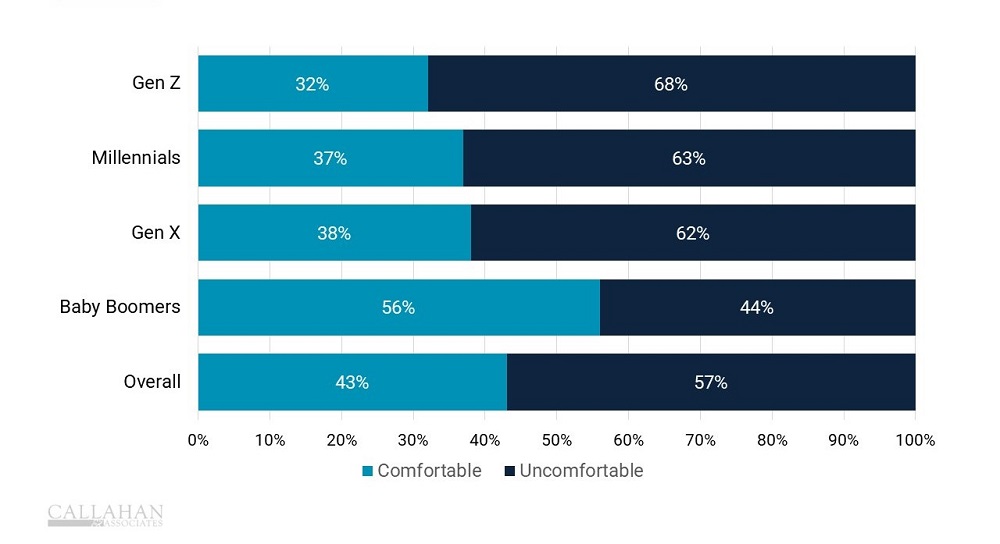

- Compared to before the pandemic, a higher percentage of Americans have set aside money for emergency savings. Better yet, Americans have more dollars allocated toward emergency savings, yet a majority still don’t feel that’s enough. According to the 2023 Bankrate survey, only 43% of Americans feel comfortable with their level of emergency savings.

- However, even that comfort is not evenly distributed. Perhaps not surprisingly, 56% of baby boomers reported comfortability with their emergency savings, the highest level across the respondents. Time is one of the key factors in building emergency savings. Baby boomers have already hit their peak earning years, are mostly empty-nesters, and have an expected set of household expenses. Younger generations are still establishing their careers and have been facing rapidly rising prices for most of their adult years.

Credit union performance data for this article comes from Callahan’s quarterly Trendwatch webinar, which includes Call Report data from 99% of all industry assets. Watch Trendwatch 2023 today on-demand.