MEDIAN INCOME BY RACE

FOR U.S. CREDIT UNIONS | DATA AS OF 2022

© Callahan & Associates | CreditUnions.com

- The racial and gender income gaps are widening, and poverty is rising starkly, according to new data from the U.S. Census Bureau, illuminating the increasing need for financial education and other wellness programs from credit unions and other financial services providers.

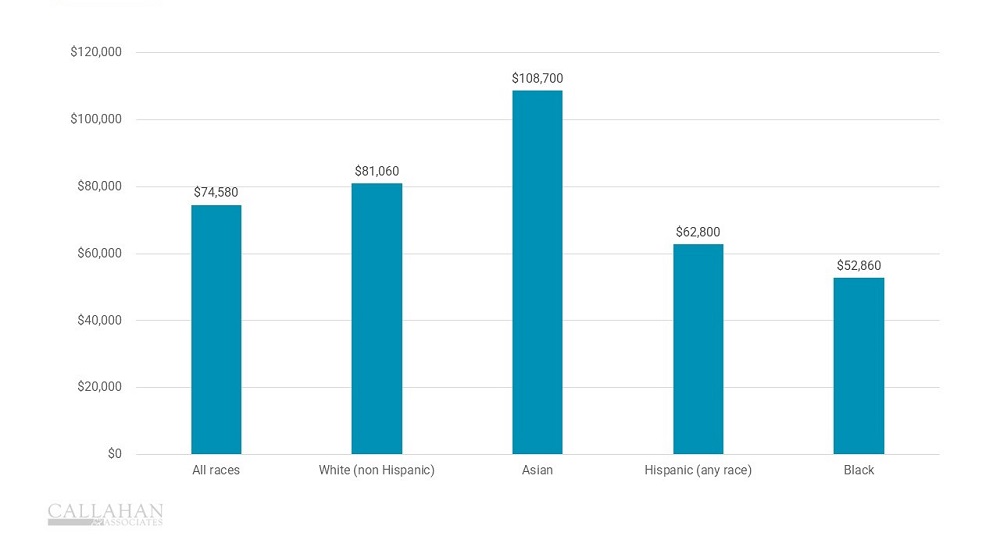

- The Census Bureau’s 2022 report on poverty and income, released earlier this month, shows Americans’ median income on average decreased by approximately 2.3% last year, to $74,580, a drop of about $1,750 per household.

- Things get worse when divided along racial lines. Median income for white households was slightly above the national rate, at $81,060, but Black households’ median income was more than $28,000 below that of whites. Asian households had the highest median income, at nearly $110,000. Median income for nearly all racial categories fell slightly in 2022 or was essentially unchanged.

- Nearly 38 million Americans — 11.5% — were living at or below the poverty rate last year, a figure essentially unchanged since 2021. However, the supplemental poverty measure, which accounts for a variety of government programs to fight poverty, rose substantially. It hit 12.4% for the year, the first time the SPM has risen since 2010.

- Blacks, American Indians, and Alaska natives had the highest poverty rates, near or higher than 20%.

How Do You Compare?

Understand your credit union’s position in the market and find the right data to help you better serve your community. Callahan & Associates’ online performance benchmarking tools can take your institution to new heights. Our credit union advisors are ready to help — are you ready to take your credit union to the next level?