For credit unions to have a meaningful impact on members and communities, they must first focus on the people who directly serve those members and communities. For that reason, the first section of Callahan’s 2020 Community Impact Framework is focused on employee impact.

Anecdotes about the Great Resignation are common these days, and based on conversations at Callahan’s Virtual Roundtables, credit unions are not immune to the employee exodus. Hiring woes can lead credit unions to focus a lot on recruitment and retention, but are they also focusing on having a meaningful impact on employees’ lives?

When Callahan set out to define what is means to have a meaningful employee impact, our goal was to find metrics that would answer the following questions: Are we providing employees with the tools they need to take care of themselves and their families? Are we providing opportunities for growth? Are we providing employees with a sense of purpose and connection to a greater mission?

To answer these questions, Callahan identified several categories as a jumping off point:

- Minimum Wage

- 401(k) Benefits

- Career Advancement

- Employee Giving

- Volunteer Support

- DEI

The data credit unions have submitted to Callahan’s Community Impact Framework is already offering interesting insights. Here are some high-level takeaways.

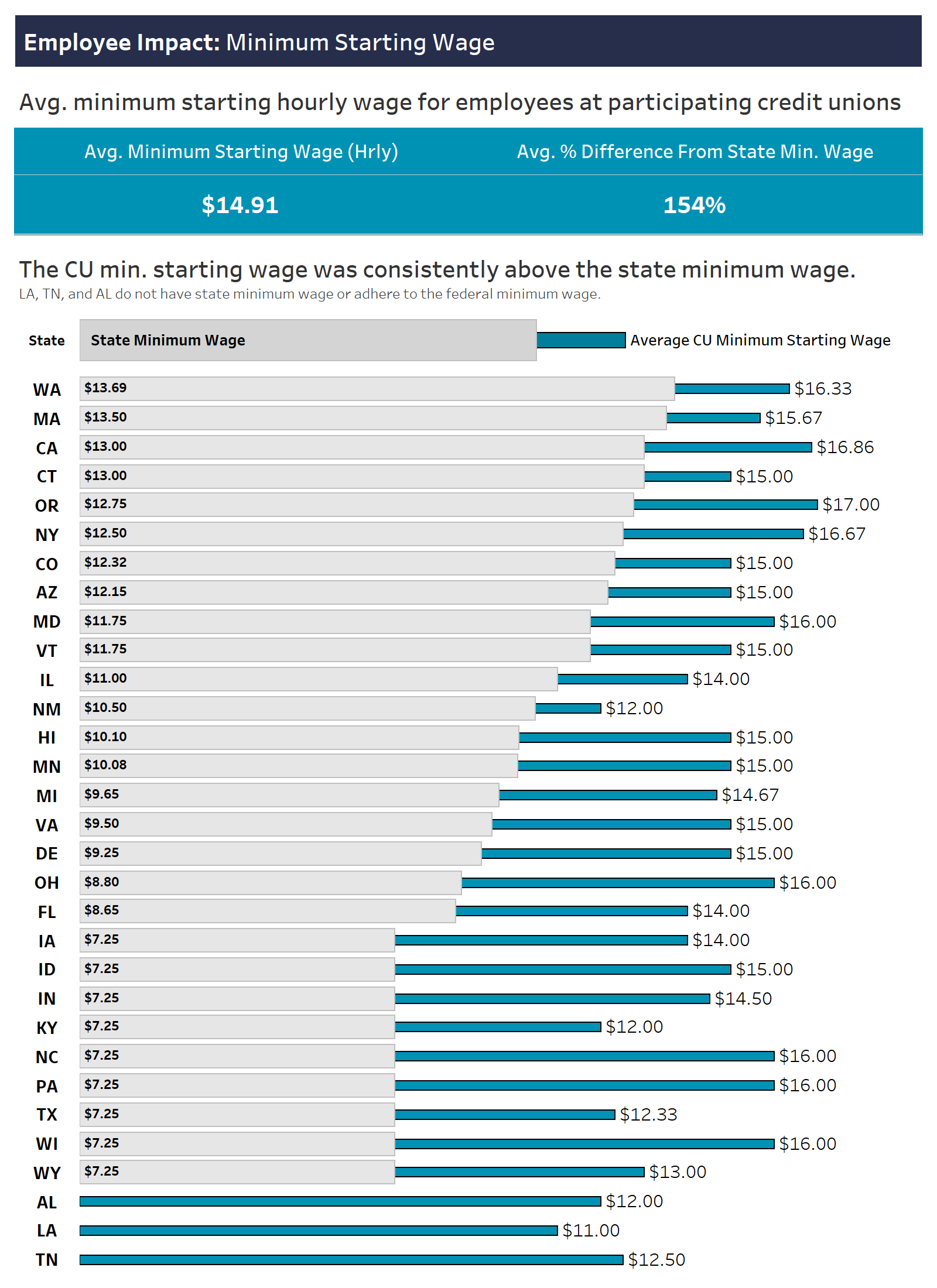

The average credit union minimum wage for entry level positions is higher than the state’s average minimum wage for entry level positions for all the states represented in the Community Impact Framework so far.

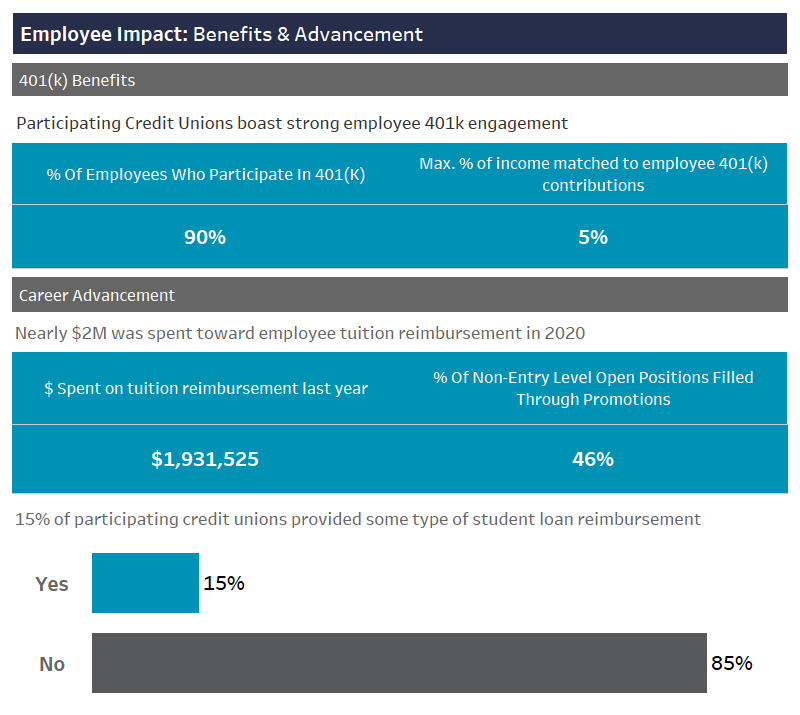

Additionally, participating credit unions filled 46% of their open positions with internal hires. These credit unions also contributed roughly $2 million in tuition reimbursement; however, only 15% provided any form of student loan reimbursement.

Want full access to the 2020 Community Impact data? That’s available only to credit unions that have submitted their own data. If you would like access to the data set, download this template and send your data to impact@callahan.com

According to a study by Inc., Millennials will comprise 75% of the workforce by 2025. Another study in 2016 found 65% of Millennials were looking for a job connected to purpose. These data points suggest credit unions should not underestimate the importance of purpose.

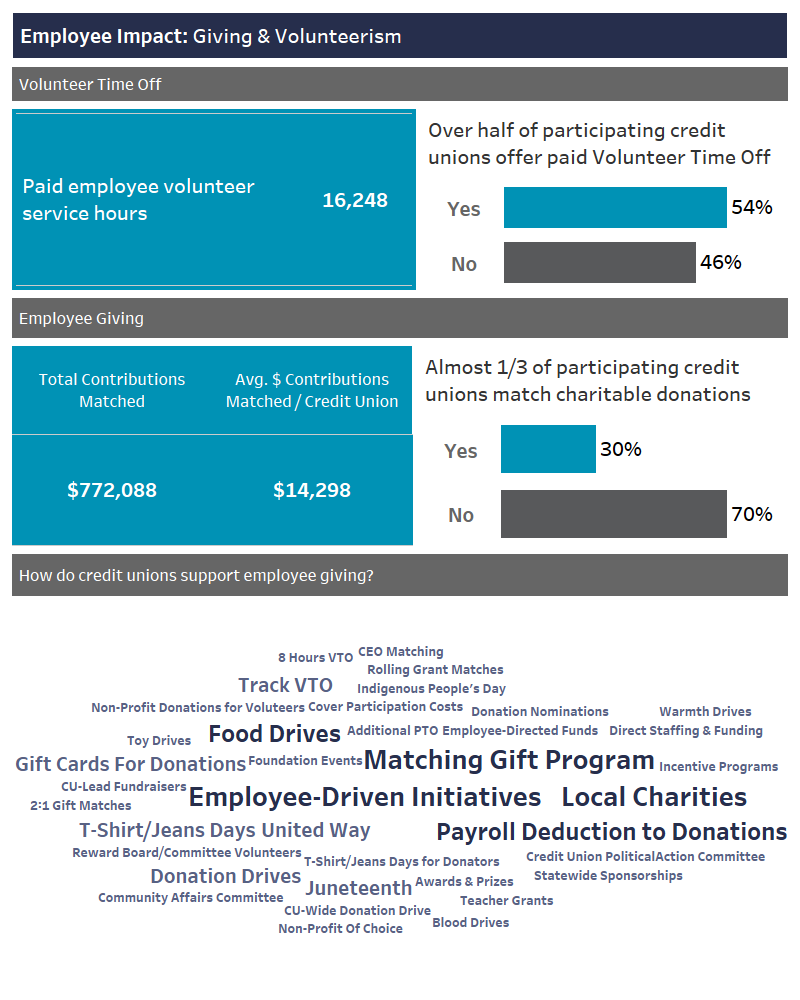

In the data Callahan has collected, 54% of credit unions report offering volunteer time off; 30% match employee donations, with local charities and employee-governed donations serving as the most common areas of focus. What isn’t clear is whether employees connect meaningfully to a sense of purpose through these efforts.

What do you think? Does this data reflect an opportunity for credit union employees to have a meaningful impact on their communities? What do you see when you look at these numbers? If you could evolve this dataset to better achieve Callahan’s goal of defining what it means to have a meaningful employee impact, how would you do it?

Credit unions are an invaluable asset to their members and communities. The goal of Callahan’s impact initiative is to empower credit unions to better articulate their value through a mission-focused lens with the help of new metrics and best practices. Join today or submit your data and reflections to impact@callahan.com.

Are Credit Unions Having A Meaningful Impact On Employees?

For credit unions to have a meaningful impact on members and communities, they must first focus on the people who directly serve those members and communities. For that reason, the first section of Callahan’s 2020 Community Impact Framework is focused on employee impact.

Anecdotes about the Great Resignation are common these days, and based on conversations at Callahan’s Virtual Roundtables, credit unions are not immune to the employee exodus. Hiring woes can lead credit unions to focus a lot on recruitment and retention, but are they also focusing on having a meaningful impact on employees’ lives?

When Callahan set out to define what is means to have a meaningful employee impact, our goal was to find metrics that would answer the following questions: Are we providing employees with the tools they need to take care of themselves and their families? Are we providing opportunities for growth? Are we providing employees with a sense of purpose and connection to a greater mission?

To answer these questions, Callahan identified several categories as a jumping off point:

The data credit unions have submitted to Callahan’s Community Impact Framework is already offering interesting insights. Here are some high-level takeaways.

The average credit union minimum wage for entry level positions is higher than the state’s average minimum wage for entry level positions for all the states represented in the Community Impact Framework so far.

Additionally, participating credit unions filled 46% of their open positions with internal hires. These credit unions also contributed roughly $2 million in tuition reimbursement; however, only 15% provided any form of student loan reimbursement.

Want full access to the 2020 Community Impact data? That’s available only to credit unions that have submitted their own data. If you would like access to the data set, download this template and send your data to impact@callahan.com

According to a study by Inc., Millennials will comprise 75% of the workforce by 2025. Another study in 2016 found 65% of Millennials were looking for a job connected to purpose. These data points suggest credit unions should not underestimate the importance of purpose.

In the data Callahan has collected, 54% of credit unions report offering volunteer time off; 30% match employee donations, with local charities and employee-governed donations serving as the most common areas of focus. What isn’t clear is whether employees connect meaningfully to a sense of purpose through these efforts.

What do you think? Does this data reflect an opportunity for credit union employees to have a meaningful impact on their communities? What do you see when you look at these numbers? If you could evolve this dataset to better achieve Callahan’s goal of defining what it means to have a meaningful employee impact, how would you do it?

Credit unions are an invaluable asset to their members and communities. The goal of Callahan’s impact initiative is to empower credit unions to better articulate their value through a mission-focused lens with the help of new metrics and best practices. Join today or submit your data and reflections to impact@callahan.com.

Daily Dose Of Industry Insights

Stay informed, inspired, and connected with the latest trends and best practices in the credit union industry by subscribing to the free CreditUnions.com newsletter.

Share this Post

Latest Articles

Tech-Grown CEOs Share Fintech Partnership Strategies (Part Two)

Tech-Grown CEOs Share Fintech Partnership Strategies (Part One)

Virtual Cards: More Than Just A Trend

Keep Reading

Related Posts

Digital Wallet Usage Skews Younger, But Becoming More Ubiquitous

3 Ways The Balance Sheet Is Adjusting To New Borrowing Habits

Macroeconomics: First-Quarter Trends Or Headwinds?

Virtual Cards: More Than Just A Trend

Best Of 2025 (So Far): Building Vibrant Communities

Aaron PassmanBest Of 2025 (So Far): Fostering Financially Strong Credit Unions

Aaron PassmanView all posts in:

More on: