GROWTH IN MEMBER SHARES, NON-MEMBER DEPOSITS, AND BORROWINGS

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.23

© Callahan & Associates | CreditUnions.com

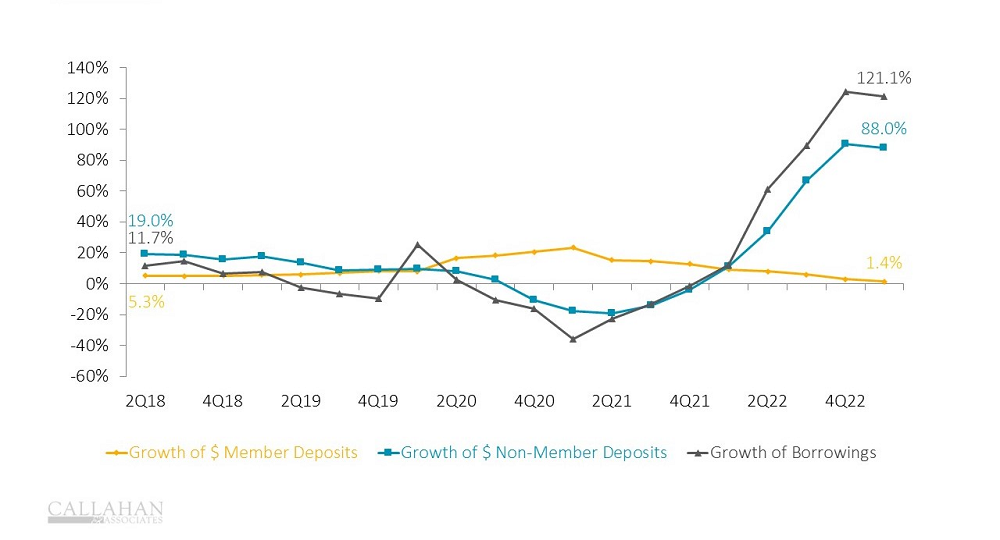

In January 2020, an amended NCUA rule went into effect that allowed federally insured credit unions to “receive public unit and nonmember shares in an amount up to 50 percent of the credit union’s net amount of pain-in and unimpaired capital and surplus less any public unit and nonmember shares, or $3 million, whichever is greater.” Previously, the limit was 20% of total shares. The additional flexibility has provided useful in an environment in which the liquidity cushion credit unions have enjoyed for years has evaporated.

• Credit unions have been shoring up liquidity, and growth in non-member deposits and borrowings has consequently skyrocketed. According to first quarter data, the two have grown 88.0% and 121.1%, respectively, year-over-year.

• Total member shares reached nearly $1.9 trillion as of March 31. Of that, nonmember deposits totaled $23.4 billion, and borrowings were up to $104.2 billion. Credit unions are using these newfound funds to manage their liquidity pipelines; as such, the loan-to-share ratio declined 44 basis points from last quarter after eight quarters of increases.

• To attract funds from current members, many credit unions are running specials on longer-term deposits like share certificates. However, when members seeking higher returns take advantage of these specials, the credit union must then manage the resulting rise in cost of funds.

Liquidity On Your Mind? Request Your Performance Scorecard.