Just like the temperatures, the summer movie season has reached the boiling point. Two of the year’s most highly anticipated movies, “Barbie” and Oppenheimer,” both opened in theaters on July 21 and together grossed nearly a quarter of a billion dollars just their first weekend.

So why should credit unions care?

The two films have captured the attention of multiple demographics, but have especially resonated with young adults, thanks in part to massive social media buzz. A host of other brands — completely unrelated to either toys or nuclear weapons — have latched on to that buzz. Sports teams like the NBA’s Boston Celtics and NFL’s Los Angeles Chargers posted photos of their athletes wearing black and pink outfits in honor of the two movies. In a brand partnership with the movie, Burger King released a “Barbie Burger,” topped with a hot pink sauce. Even politicians have gotten involved in the fad, sharing on social media which of the films they were going to see first.

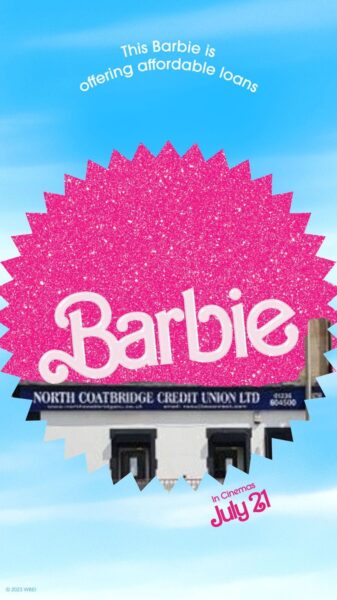

Credit union efforts to participate in the “Barbenheimer” phenomenon have ranged broadly. Across the pond, North Coatbridge Credit Union in Scotland seized the marketing moment and used the Barbie font and logo to promote home loans. In the United States, some have simply asked on social media which of the two films followers are planning to see first. Others, including Community Choice Credit Union ($794.8M, Johnston, IA), have hosted “Barbie” screenings with photo ops, credit union-branded giveaways, and more.

Capitalizing on this sort of pop culture moment can capture the attention of younger consumers who tend to stay up to date on internet trends, but it also can help businesses build relationships with existing customers. When an organization demonstrates an interest in something its customers like, it gives a personality to the company and allows people to connect and identify with the brand beyond the products or services offered. Especially because credit unions are community oriented, the effort to relate to their members reflects their commitment to continuously growing relationships and connecting with new members.

But it’s not all hot pink cars and dreamhouses. These pop culture movements live and die on social media among users, and walking the line between being in on the joke and being the butt of the joke is intimidating enough that a lot of brands steer clear of taking advantage of these marketing opportunities. Of course there’s a risk of having a joke or cultural reference fall flat — and the larger the social media following, the larger the risk — but algorithms also virtually guarantee that interested users will see the content, meaning these sorts of posts could have a limited viral effect beyond current followers. Providing context with these marketing opportunities helps bring people in on the joke and can build community.

These moments have real economic impact. As noted above, “Barbenheimer” grossed more than $230 million in just one weekend. Similarly, Taylor Swift’s “Eras Tour,” the summer’s other pop culture megalith, is expected to generate roughly $5 billion in consumer spending nationwide, driven in large part by not only concert tickets but also hotel accommodations, food, clothing, and more. When Taylor visited Cincinnati in early July, the Cincinnati Zoo offered reduced admission for fans wearing Taylor Swift gear. The zoo also sold its own Taylor Swift-related merchandise and shared photos on social media throughout the week of animals playing with the Taylor-themed toys. That weekend, hotels downtown grossed $2.6 million dollars, for a net total of $92 million in local spending.

Despite the risks, marketing and branding efforts that capitalize on internet trends and cultural moments can capture new — and younger — audiences. Why wouldn’t credit unions want to be a part of that?

Marit Hoyem is a senior at Williams College and a second-year intern at Callahan & Associates.