Credit unions are assessing the impact they have on their membership — both for the sake of the member as well as the future of the industry — and taking note of the tangible benefits they provide. Their findings suggest credit union impact is particularly evident in times of need.

Take, for example, the fact that credit unions provide financial services to nearly 144 million people. Members today are bringing more to their credit union than ever before, but their needs are also becoming more nuanced. At the same time, market competition is fierce despite the fact credit unions have retained their physical footprint while banks close their doors. What do these considerations and others mean for the longstanding credit union value proposition?

Credit Unions Support Members

During the recent run up of the effective federal funds rate, credit unions raced to compete on savings rates. Given the credit union focus on giving back to members and supporting communities, inroads made in savings led to increased dividend benefits per member.

In 2024, credit unions paid $264 per member on average in dividends; that’s a sizeable increase from $184 in 2023. Although larger credit unions were most pressured to raise rates to attract funds, smaller cooperatives gave back more to their savers, too. Indeed, the median credit union paid $122 per member in 2024, an increase of $52 over 2023.

This extra dividend income can go a long way for members, especially when 40% of Americans can’t cover a $1,000 emergency expense. Higher dividend rates encourage members to save even if they struggle to put money aside.

Meanwhile, despite a recent slowdown in interest earnings, credit unions have refused to nickel-and-dime members through fee income. During the pandemic, fee income fell — both as a percentage of assets and per member — and credit unions are reluctant to bring fees back. In 2024, the credit union industry collected $71 in fee income per member. That was up from $70 one year ago but down from $75 before the pandemic. For the median credit union, it was $52, up from $51 one year ago.

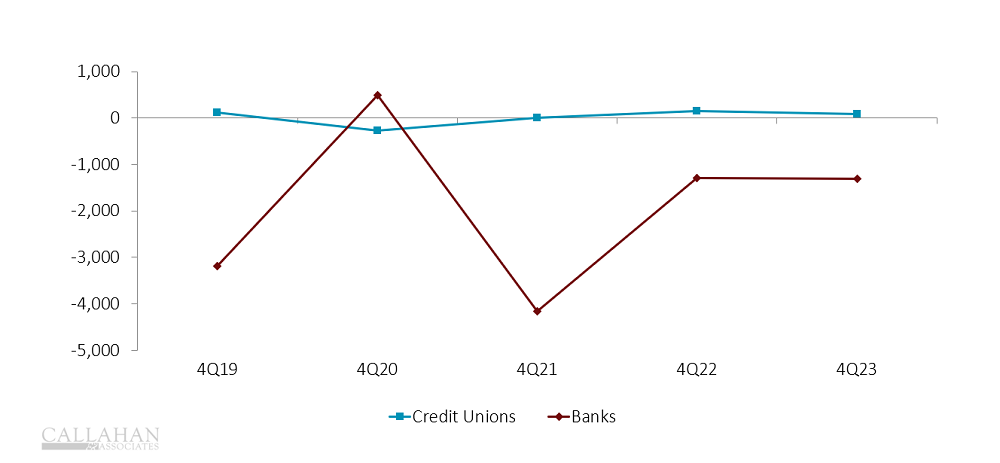

YEAR-OVER-YEAR CHANGE IN BRANCHES

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

Identify communities in your region that have few or no bank branches. With Peer Suite you can view your branch footprint against the Fed Communities Banking Deserts Dashboard and start identifying your areas of opportunity today.

Credit union branches are a conduit to serve member needs and build community. Credit union branch numbers have remained remarkably consistent during the past five years, even as banks pulled out of locations they deemed unprofitable and created banking deserts among vulnerable populations. As stewards of the underbanked, many credit unions are stepping up to serve these areas, understanding the lasting impact physical branches can have on the financial and economic health of a community.

Even as credit unions continue to provide more value to members, they generally have been able to maintain stable earnings and capitalization without significantly increasing fees. That’s sustainable growth at work.

Members Support Credit Unions

Credit unions are navigating an evolving financial landscape that requires them to balance business strengths with mission-driven service. Meanwhile, members are rewarding that focus by deepening their relationship. The average member relationship, which excludes commercial loans, grew from $23,685 to $23,918 in 2024. At the median credit union, it rose from $17,092 to $17,465.

More Americans are joining the movement as well. Membership grew 2.2% in the fourth quarter of 2024, although it fell 0.47% for the median. Credit unions achieved that 2.2% growth despite generally pulling back from indirect lending and certificate promotions, two reliable ways to attract new members. The jump in membership represents 3.0 million more Americans and is a sign that people need what credit unions offer.

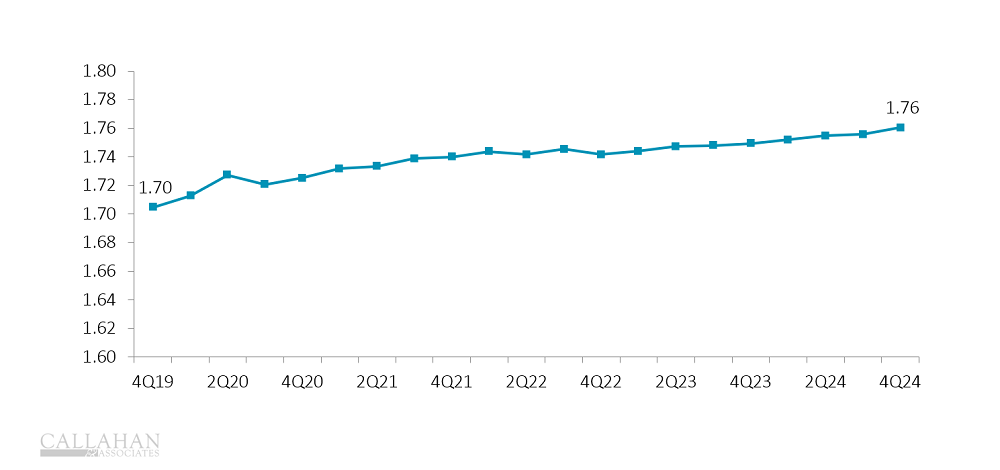

Furthermore, these members increasingly are opening share drafts accounts, which presents a solid proxy for determining who they use for their daily financial needs. Share draft penetration reached 62.4% in the fourth quarter, a rate that’s continually trending upwards. On the lending side, penetration declined year-over-year across most products; however, most of this decline was the result of a strategic pivot away from indirect lending programs. After all, softer indirect lending might slow some loan generation, but it also allows credit unions to direct their limited resources toward core members in need.

TOTAL SAVINGS AND CHECKING ACCOUNTS PER MEMBER

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

Ultimately, every credit union must assess for itself whether it is fulfilling its promise of positive impact. The steady rise in membership, especially on the deposit side, suggests more members are recognizing the value credit unions for their day-to-day finances. Deposits might be a liability on the balance sheet, but they are quintessential to member finances and the foundation of their relationship with the credit union. Meanwhile, with growing dividends, low fees, and ready accessibility, credit unions shine bright as beacons of stability even as economic headwinds ripple across the United States.

Is Your Strategy Delivering On Impact? Credit unions face growing pressure to achieve strong financial results while proving their commitment to members and the community. Saying you make an impact isn’t enough — you need the data to back it up. Peer Suite empowers leaders with data-driven insights to showcase their unique value, validate their business model, and strengthen their strategic direction with clear, evidence-based findings. Learn more.