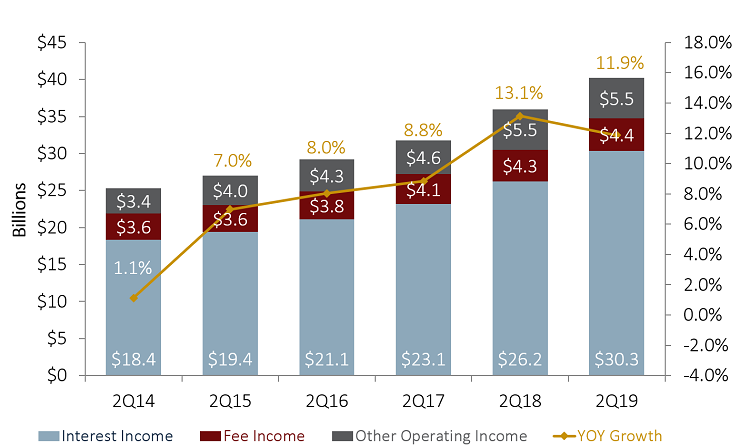

Year-to-date total income at U.S. credit unions grew to $40.2 billion in the second quarter of 2019. That’s an 11.9% increase over the midway point last year and the sixth consecutive quarter of double-digit year-over-year growth.

The Federal Reserve increased interest rates four times in 2018, and the corresponding surge in loan income has continued to pad credit union income statements. A healthy economy helped prop up loan demand despite the higher cost of borrowing. However, a decline in year-over-year revenue growth in the second quarter could signal the start of a more volatile second half of the year. Annual growth slowed from 13.1% in 2018 to 11.9% in 2019. This is the first instance of falling second quarter growth since 2013.

TOTAL REVENUE AND ANNUAL GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Interest income drove overall revenue growth, but year-over-year growth could not maintain the five-year trend.

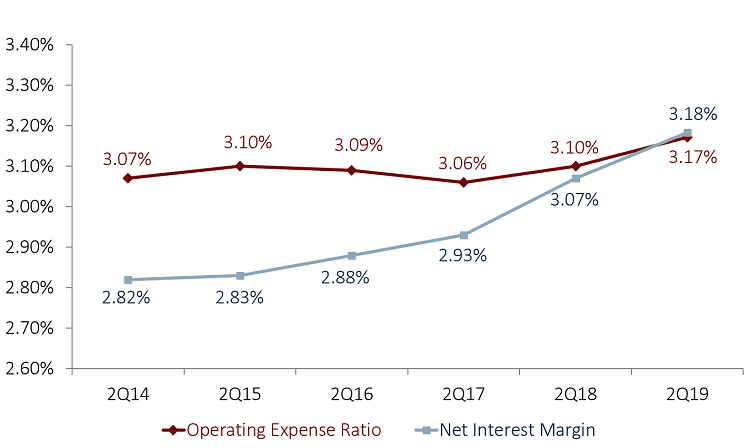

As expected given the rate environment of the past year, credit unions reported yield growth has been tempered somewhat by a comparable rise in cost of funds.

Credit unions reported yield growth on both loans and investments in the second quarter of 2019. Loan yields rose 28 basis points to 4.88% while investment yields rose 50 basis points to 2.42%. Both of these yields outpaced the 27 basis point increase in cost of funds. It is notable, however, that loan yield growth only exceeded cost of funds growth by a narrow 1 basis point margin over the past year, highlighting the competitiveness of the market and perhaps signaling a reduction in the relative elasticity of loan yields.

Income from fees and assorted operating income streams has stayed mostly flat year-over-year. Credit unions reported a modest 2.2% uptick in fee income nationwide, the lowest annual growth in this metric since 2014. Annual growth in total non-interest income in the second quarter was 1.5%, also the lowest mark since 2014.

NET INTEREST MARGIN VS. OPERATING EXPENSE RATIO

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Stickier operating expenses aren’t as volatile historically as interest rates, leaving core lending profitability tied closely to the prevailing rate environment.

The net interest margin increased 11 basis points to 3.18%, whereas the operating expense ratio grew just 7 basis points to 3.17%. The net interest margin being 1 basis point higher than the operating expense ratio meant credit unions were able to fund their operations solely through interest income and reduce their reliance on non-interest income. The resulting focus on lending partially explains the flat year-over-year revenue totals reported in non-interest income categories

The second quarter marked the second consecutive period in which net interest margin exceeded operating expense ratio. This has not occurred since 2011, as lenders have muddled through a historically low rate environment. Correspondingly, total year-to-date dividends grew 52.5% year-over-year to $5.6 billion or $47 per member as credit unions passed along their strong earnings to member-owners.

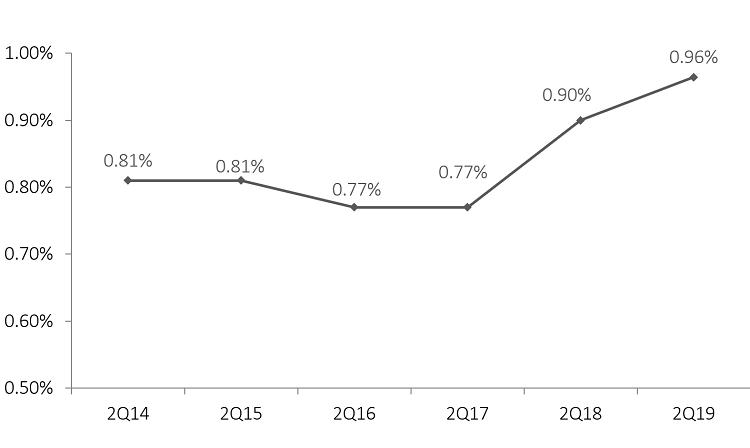

ROA

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

ROA trends in the past couple of years are closely tied to interest rate movements. The Fed began to hike rates in the second quarter of 2017.

With revenue rising faster than expenses, ROA grew 6 basis points year-over-year, to 0.96%. Such strong second quarter performance has given many credit unions the gift of flexibility. Credit unions can distribute higher earnings to members, invest them in product and services, use them for further lending, or keep them on hand for future liquidity needs. The industry might lean toward the last choice in the coming months, as an uneasy global economy continues to force the Fed to cut rates back to 2017 levels.

Whether credit unions were able to take full advantage of a favorable first half of 2019 remains to be seen, but the stage has been set for the industry to help its members weather a potential storm in the second half and beyond.