SHARE OF RETAIL BANKING REVENUE POOL HELD BY INNOVATIVE PLAYERS

FOR U.S. RETAIL BANKING| DATA AS OF 2021

© Callahan & Associates | CreditUnions.com

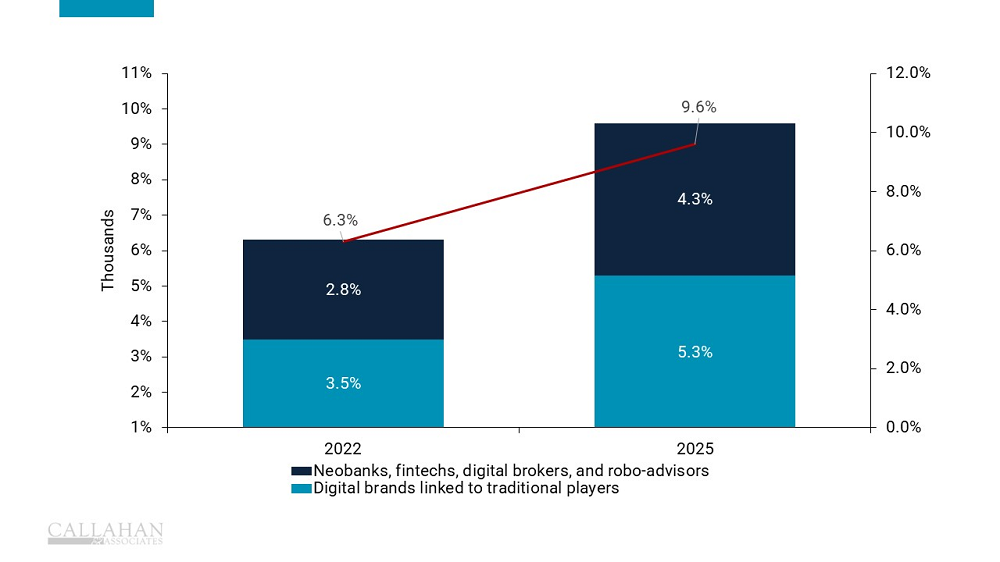

- Don’t expect fintech growth to slow down anytime soon. These players in the retail banking sector are poised to take 9.6% of revenue by the end of next year, according to a recent McKinsey study.

- McKinsey’s projection represents a compounded annual growth rate of 17.0% from 2022 to 2025, according to the study. Roughly half of the 9.6% includes revenue from digital brands linked to traditional players — such as Vantage West’s virtual brand HUSTL or the credit union-backed fintech Dora — and half includes neobanks, fintechs, digital brokers, and robo-advisors.

- Technology investments continue to be a major focus for credit unions, who are spending heavily in CUSOs and member-facing tools alike to modernize and appeal to digital consumers. That’s none too soon as one study from market research firm Keypoint Intelligence estimates just 5% of millennials and 4% of Gen Z are credit union members.

- Currently, 83.7% of credit unions offer online banking. Among those credit unions with more than $100 million in assets, just six (0.3% of the industry) do not offer online banking. As for mobile applications, 97.4% of credit unions with more than $100 million in assets offer an app. In the digital age, there are few prerequisites quite as necessary as online banking.

Is Your Bottom Line Booming? Better technology helps credit unions better serve members, and performance insights help credit unions make the most of technology investments. With data from Callahan & Associates, you can uncover new areas of opportunity, support strategic investments, and more. Contact an advisor today.