Approximately 5,400 credit unions representing 91.6% of industry assets are reporting into Callahan & Associates FirstLook program.

The membership total for these FirstLook credit unions is 96 million strong. Callahan estimates the industry’s total membership base will reach 105.2 million when the NCUA releases first quarter 2016 data.

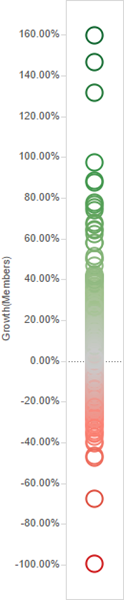

YEAR-OVER-YEAR MEMBERSHIP GROWTH DISTRIBUTION

For all FirstLook credit unions* | Data as of 3.31.16

© Callahan & Associates | www.creditunions.com

*Data excludes outliers Lutheran Credit Union (MO) and The Finest FCU (NY).

Source: Peer-to-Peer Analytics by Callahan & Associates

That is a 3.9% increase over last year’s first quarter total of 101.2 million members.

The credit union industry as a whole is performing well, but individual data sets as well as macroeconomic trends paint a more complete picture of the successes within the cooperative industry.

Of the 5,403 credit unions reporting into Callahan’s FirstLook program, 2,704 or slightly more than half posted positive year-over-year growth. Of those who posted negating growth, 4.6% posted growth poorer than -10.0% whereas 5.4% of credit unions reported growth greater than 10.0%.

FirstLook data predicts first quarter year-over-year member growth will be stronger that last year’s 2.8%. Additionally, 2016’s first quarter member growth will contribute to the steady increase in membership the industry has posted for the past several years.

Register Today For Trendwatch

This must-attend quarterly event for credit union leaders covers performance trends, industry success stories, and areas of opportunity. Callahan bases its analysis on data gathered through its FirstLook program, which means attendees will find insight they won’t find anywhere else weeks before the official NCUA data release.

Member Growth At The Finest FCU

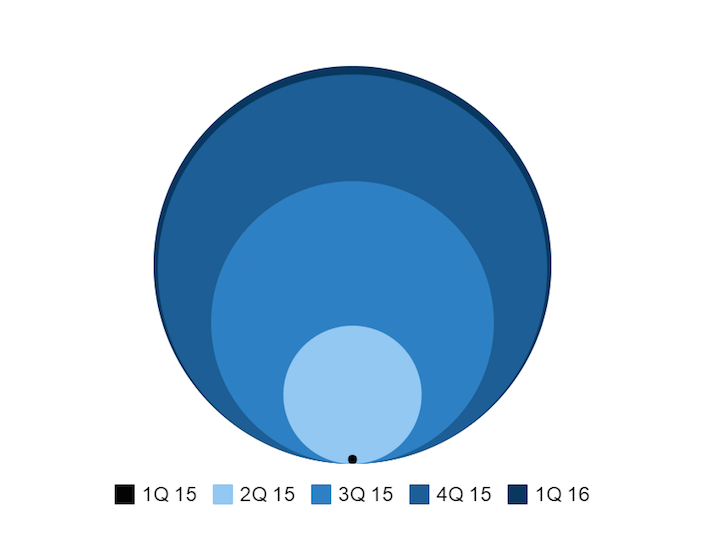

The Finest FCU ($5.0M, New York, NY), posted 195,700.0% year-over-year growth rate for the first quarter of 2016.

Far from being a reporting error, the Finest FCU’s member growth brought to light an interesting story about how a new credit union grew from one member to 1,958 members over the span of a single year.

The Finest FCU currently ranks ninth in total members for credit unions with $2 million to $5 million in assets. President and CEO Keith Stone has a lot to share about the credit union’s strategy for increasing its member roster.

The Finest FCU currently ranks ninth in total members for credit unions with $2 million to $5 million in assets. President and CEO Keith Stone has a lot to share about the credit union’s strategy for increasing its member roster.

The Finest FCU was chartered in January 2015 and opened its doors on May 13, 2015. It is headquartered in New York City, but its field of membership includes law enforcement and affiliates from across the state.

Our board of directors has collectively more than 250 years’ experience in the NYPD, active and retired, Stone says.

The Finest FCU’s first member was Detective Steven McDonald, a retired NYPD officer who was gravely injured on the job in 1986 and who remains active in organizations that help the NYPD community.

With its team of four full-time and two part-time employees, The Finest FCU has been able to attract new members not through a large marketing team but by presenting its services at graduation events for new police officers. The credit union offers small, low-interest loans for rookies to buy uniforms and equipment.

According to Stone, The Finest FCU is helping the new law enforcement officials at the time they need it the most.

The Finest FCU participates in a shared branching and shared ATM network and also offers a host of mobile offerings, such as a mobile application, to cater to the needs of its members, typically police officers working non-traditional hours.

The Finest FCU’s personal service and understanding is emblematic of the spirit of the cooperative financial institution industry. As Stone reflects on the credit union’s first year and new member growth success, he stresses three things:

1. The importance of conveying a clear and concise message to potential members.

2. The credit union’s duty to its members to put safety and soundness’ above profits and growth.

3. The importance of knowing and responding to member needs.

TOTAL MEMBERSHIP

The Finest FCU | Data as of 03.31.16

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates