Year-over-year growth rates for credit union membership continues to climb, and Callahan & Associates projects memberships will have grown by 4.2% from year-end 2015 to year-end 2016. That’s according to the performance data from 5,847 credit unionsrepresenting 99.6% of the industry’s assets

One credit union, Bitterroot Community FCU ($11.3M, Darby. MT), has posted 21.2% membership growth over the past year and it has posted this growthorganically.

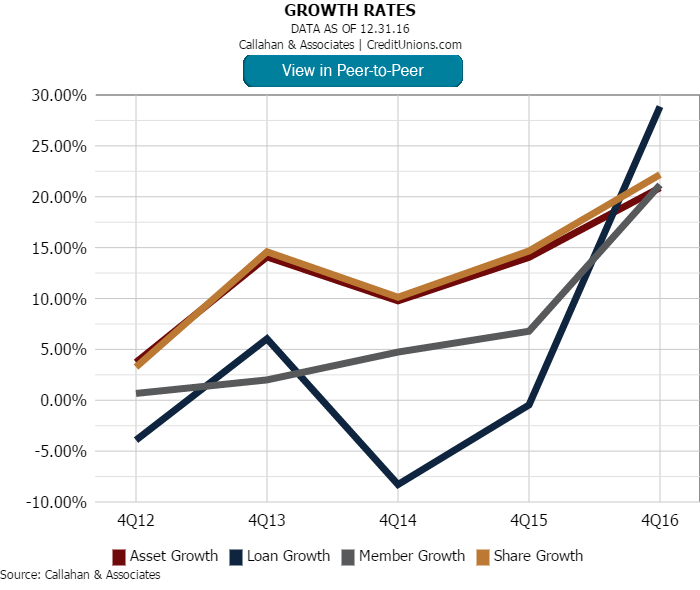

Bitterroot Community doubled its branch footprint from one to two in April of 2016, which caused a rise in operating expenses and a dip in net worth. However, the opening of a new branch had a positive impact on loans, shares, members, and assets.

As of fourth quarter, operating expenses at the small credit union increased by 25.4% over the past year, yet Bitterroot Community remains well-capitalized with a net worth ratio of 7.31%. In fact, its operating expense ratio of 4.09% is not too muchhigher than 3.51%, the average for credit unions between $10 and $12 million in assets.

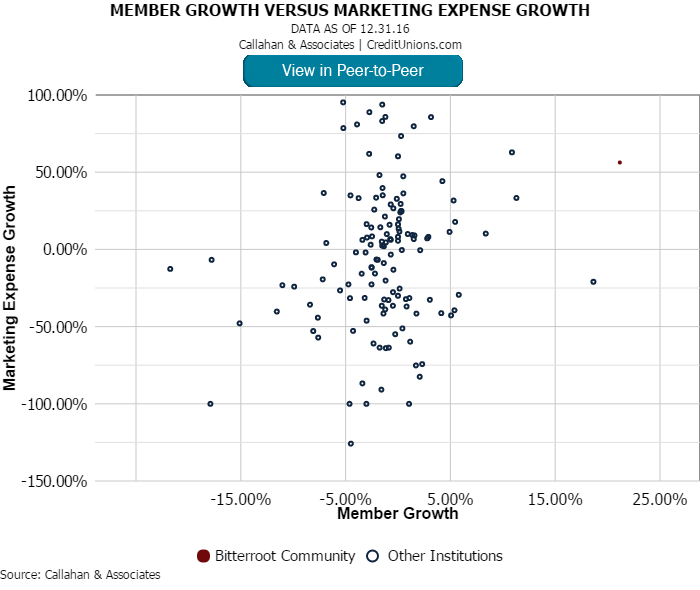

Although Bitterroot Community spent a little more than one-and-a-half times the amount on marketing than it did last year expenses aimed to integrate into its new community of Hamilton, MT the credit union increased membership by21.2%.

Whereas the average credit union of this size lost 25 members in 2016, Bitterroot Community netted a positive 290 members. With its branch expansion into the area affiliated with its community charter, Bitterroot Community now reaches 4.2% of its potentialmembers, up from 3.4% at this time last year.

It might be difficult to determine for certain what kind of returns a credit union will see from opening a new branch; however, the gains at Bitterroot Community underscore how allocating the right amount of marketing resources when building a new branchcan lead to big membership gains.

Bitterroot Community also exemplifies the role small credit unions are playing in attracting members to the cooperative financial movement. These new members will soon learn the credit union difference, because as Kathy Transue, CEO of Bitterroot Community,says, [Bitterroot Community] tries hard to make every member feel like family!