PRE- AND POST-PANDEMIC STRESS LEVELS OF HIGH STRESS AMERICANS

FOR SURVEY RESPONDENTS WHO RANKED THEIR STRESS >8/10 | DATA AS OF AUGUST 2023

© Callahan & Associates | CreditUnions.com

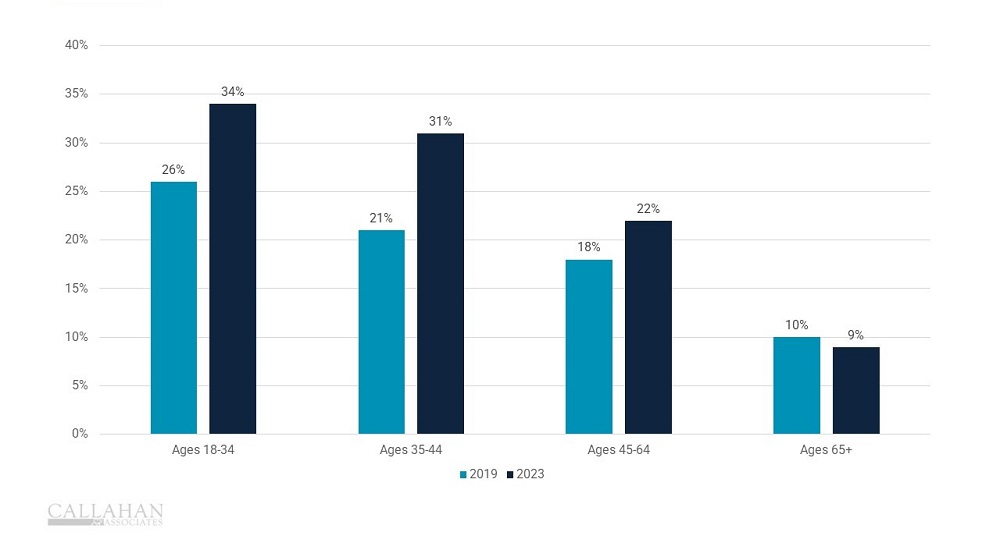

Nearly four years after the onset of the pandemic, the stress hasn’t gone away. Research from the American Psychological Association finds adults are more stressed now across nearly every area of life than they were before the pandemic began. That’s particularly true of those between the ages of 35 to 64, a period of life often considered prime borrowing years and when consumers are most likely to turn to financial institutions for assistance with buying cars and homes, saving and paying for college, setting up retirement funds, and more.

- Most Americans who rated their stress level at an eight out of 10 or higher in 2019 said things were even worse in 2023.

- Regardless of age, more than half of Americans who said they are stressed about money indicated that paying for essentials remains a major hurdle. Two-thirds of those between the ages of 35 to 44 said covering the costs of essentials is a major source of stress; 62% of 45- to 64-year-olds reported the same.

- Despite so much stress surrounding finances, many aren’t willing to talk about those problems. Barely half (52%) of adults said they are comfortable talking about money, and nearly half (45%) said they are embarrassed to discuss their financial situation.

- Nearly every age group also reported worsening health conditions since 2019, with increased chronic health or mental health diagnoses for almost all demographics.

- Women reported higher stress levels than men and said the impacts of money, family, and relationships played a higher role in their stress levels in 2023 than in 2019.

EDITOR’S NOTE: The APA conducted its 2023 “Stress In America” survey online in August 2023 during an extended period of interest rate hikes as the Federal Reserve attempted to tamp down inflation. Some prices were dropping by year-end, and the Fed indicated rate cuts could be in the cards by the close of 2024. These gradual economic improvements might not be reflected in the survey’s data.

Is Your Current Long-Term Strategy Breaking Through The Noise?

Do you want to outperform the market, attract and retain top talent, and improve your organization’s impact? You can do this and more — and Callahan can help. Join other leading credit unions that have transformed their organization and learned how to do well while doing good. Register today for 2024 sessions.

REGISTER TODAY