Elevated prices are placing headwinds on earnings and pushing credit unions to re-examine operational efficiency strategies.

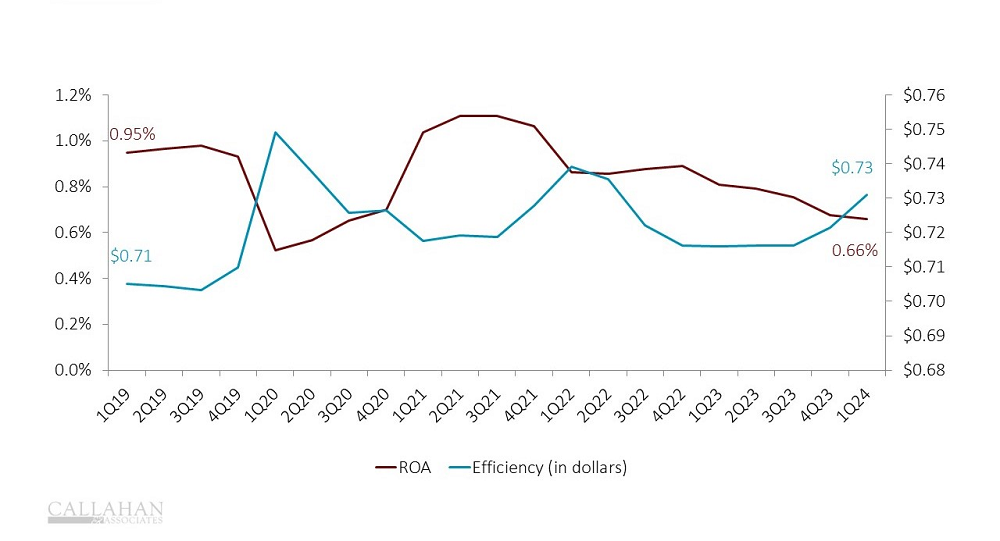

In the first quarter of 2024, operating expenses at credit unions increased a modest-yet-steady 6.0% year-over-year, according to Callahan & Associates’ analysis of first-quarter data from the National Credit Union Administration. That’s down from 11.5% in 2023 but is still a sizeable increase in expenses that reflects the impact of inflation. The operating expense ratio at credit unions has risen steadily the past few years and now accounts for 2.95% of assets. Meanwhile, return on assets has fallen from a pandemic peak of 1.04% in March of 2021 to just 0.66% in the first quarter of 2024.

ROA AND EFFICIENCY RATIO

FOR U.S. CREDIT UNIONS| DATA AS OF 3.31.2024

© CALLAHAN & ASSOCIATES | CREDITUNIONS.COM

Although the efficiency ratio remained relatively intact throughout the pandemic, it rose 162 basis points in 2023 and reached 73.2% as of March 31, 2024. The efficiency ratio, which calculates the operating expense required to generate income, indicates how much a credit union must spend to generate a dollar of revenue. A higher value generally means a credit union is less efficient in its spending. The current ratio means the credit union industry is spending 73.2 cents to earn every dollar of income.

The median credit union is feeling the efficiency pinch even more intensely. Historically, this group is less efficient than its larger peers, which benefit from economies of scale and more efficient operations. With a first quarter efficiency ratio of 81.5%, the typical credit union is facing challenges.

Have Expenses And Inefficiencies Put Your ROA In The Crosshairs? Use industry data to evaluate credit union performance and overcome market hurdles. Callahan’s performance benchmarking tool, Peer Suite, can help you do this and more. Our credit union advisors are ready to show you how. Request A Peer Suite Demo Today.

What’s Going On With Operating Expenses?

Credit unions of all sizes are increasing employee compensation to keep up with the rest of the U.S. labor force. According to the Bureau of Labor Statistics, compensation costs for civilian workers increased 4.2% year-over-year in March. However, compensation growth should soften amid a slowdown in credit union hiring.

Fearing a recession in 2023, many credit unions were careful not to bloat their rosters with extra staff. That a recession has yet to materialize could prolong this period of cautious hiring. At the median, annual employee growth was 1.6% in the first quarter of 2024. Operating expense growth for the median credit union was 5.9% year-over-year. Operating expenses comprised 3.39% of assets for these credit unions and return on assets fell to 0.55%.

Why Is ROA Declining?

The NCUA’s adoption of CECL accounting methods — which requires credit unions to project future delinquency when considering how much to set aside — is a major driver behind the increase in provisioning. With delinquency up, it’s difficult to avoid increasing provisions.

Additionally, tighter liquidity has compressed margins and interest channels are unlikely to provide earnings relief. Broadly speaking, this means the best option for credit unions to improve earnings in the near term is through better operational efficiency and lower operation costs.

What Can Credit Unions Do?

How a credit union can improve its operational efficiency depends upon the individual institution.

Myriad vendors offer technology solutions to deliver products and services at a cheaper per-unit cost. Marketing efforts, too, can play a major role in improving efficiency.

That said, most operational improvements require some type of up-front investment. Luckily, the industry is well capitalized, with an average regulatory net worth ratio of 10.8%. This gives many credit unions the flexibility to invest in strategies that will improve efficiency as well as the overall member experience.