A new survey says that personal contact in the branch still matters greatly to credit union members.

It wasn’t that long ago the first quarter of 2015 that the number of total credit union members first eclipsed 100 million. Since then, the number of credit union members has continued to climb, to more than 107 million as of thirdquarter 2016, according to data from Callahan & Associates. Clearly, credit unions have become a popular alternative to retail banks.

Why? In December, TimeTrade, a provider of appointment-driven personalization, released the results of its 2016 Credit Union Consumer Survey. In it, more than 1,000 members answered questions about their experience with their credit union.

We were looking to identify the most important things for members when choosing a credit union and how those institutions are doing matching those expectations, says TimeTrade vice president Lauren Mead in an interview with CreditUnions.com.

According to Mead, respondents were broken down evenly by generation, with roughly a quarter of respondents fitting into either Gen Z (ages 18-20), Millennial (ages 21-35), Gen X (ages 36-54), or Baby Boomer (ages 55-71).

When asked what the most important factors are when choosing a credit union, 70% of respondents chose rates, 65% chose products and services, 62% chose location/hours, 56% chose reputation, and 15% chose size. Yet, despite the fact that the initial attractionbetween consumer and credit union is based on price, it’s the personalized service credit unions offer that keeps members around and engaged.

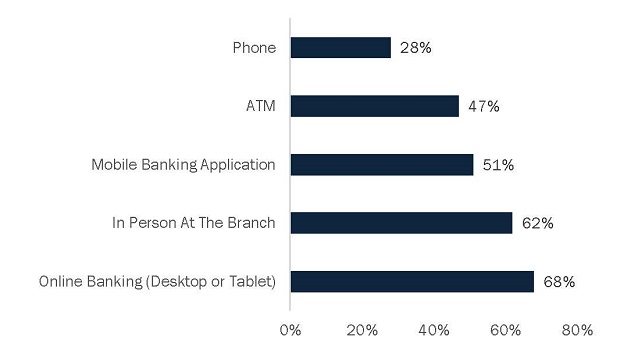

HOW DO YOU LIKE TO INTERACT WITH YOUR CREDIT UNION?

Source:2016 Credit Union Consumer Survey.

So while 68% of respondents indicated they like to interact with their credit union through online banking, 62% said they like to interact in person at a branch. In addition, 43% of respondents said they visited their credit union more than 10 times inthe past year, while 30% and 21% said they visited more than five and less than five times, respectively. Only 6% said they did not visit their credit union at all in the past year.

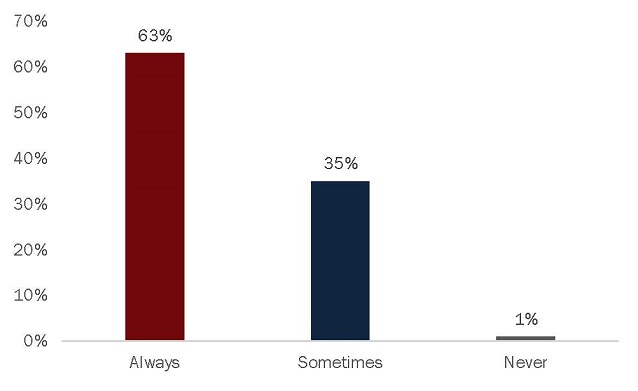

When they do make it in the branch, respondents felt as though their experiences were well met. That’s good, because 41% of respondents indicated they desire personalized service compared to 35% for bank customers, according to TimeTrade’s2016 State of Retail Banking survey. The survey found that 85% of credit union survey respondents feel as though they have a personalizedexperience when visiting their branch compared to 79% of bank consumers who feel the same and 63% feel the credit union employees they interact with are always knowledgeable and helpful.

DO YOU FEEL THE CREDIT UNION EMPLOYEES YOU MEET WITH ARE KNOWLEDGABLE AND HELPFUL?

Source:2016 Credit Union Consumer Survey.

Source:2016 Credit Union Consumer Survey.

It seems reasonable to assume that it’s this competent service that allows members to feel comfortable waiting longer times at branches and preferring teller interactions over automated transactions. Per the survey, 46% of respondents are willingto wait between five and 10 minutes to complete a transaction, while 38% are willing to wait 10 minutes or more. In addition, 67% of respondents, when asked how they felt about experimental branches without tellers where every transaction is automated,said they would rather speak with a teller.

I think consumers are going to credit unions because they value that service and credit unions are doing a great job delivering on it, Mead says. There’s always room to improve across the board but they’re really standingup, especially when compared to banks. That’s why I think they’re continuing to succeed.

Nowhere is this success more apparent than with the millennial generation. The survey offers several key data points:

- Millennials are more likely to visit a credit union branch (57%) than a bank branch (48%).

- 49% of millennials visit a credit union to open an account.

- 43% of millennials value personalized service from a credit union more than a bank (34%).

- 77% of millennials would be willing to schedule an appointment to come into a credit union.

- 88% of millennials would visit their credit union during the week if they were guaranteed a specific appointment time.

According to Mead, these data points show that while millennials are willing to embrace technology, they still value personal, face-to-face conversations before making financial decisions.

Everyone thinks they want to do everything online and they are opposed to that personal conversation, Mead says. But the data says the opposite. At certain times they do need that expert advice and that human connection. So in someways they are a little bit of a throwback demographic.