The first quarter is a critical period for attracting deposits. Credit unions use this money to fund lending activities for the whole year, so starting off strong is in every institution’s best interest.

Most of the share growth for credit unions occurs in the first quarter of each year, said Callahan & Associates co-founder and chair Chip Filson in a 2015. That rings as true today as it did then.

Share growth is generally highest in the beginning of the year due to federal and state tax refunds, year-end bonuses, and other income that members deposit at their credit union.

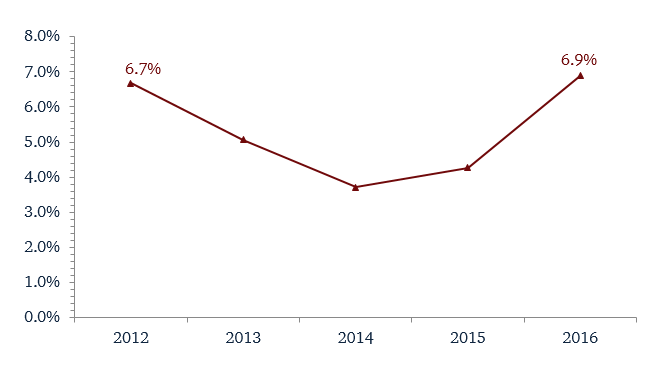

According to FirstLook estimates from Callahan & Associates, total shares reached $1.1 trillion in the first quarter for the credit union industry. That’s a 6.9% increase year-over-year. Regular shares, including other shares and non-member deposits, comprised 36.9% of total shares, followed by money market accounts at 22.6% and share drafts at 14.8%.

YEAR-OVER-YEAR TOTAL SHARE GROWTH

For all FirstLook credit unions | Data as of 03.31

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

For America’s Christian Credit Union ($326.3M, Glendora, CA), a special partnership within its closed field of membership is driving growth.

In 2008, the credit union partnered with Christian Care Ministry a not-for-profit organization focused on health and wellness to fill a healthcare gap in the region.

Christian Care Ministry manages a program called Medi-Share in which members share one another’s medical bills rather than pay premiums to an insurance company. As health-sharing ministry members, Medi-Share participants are exempt from the mandate to purchase insurance under the Affordable Care Act. However, regulators are not supportive of the Ministry holding funds in one pool.

Enter America’s Christian Credit Union.

To participate in Medi-Share, members must open a checking account with America’s Christian and deposit funds. This keeps insurance regulators content and gives the credit union more opportunities to expand its banking relationship with members.

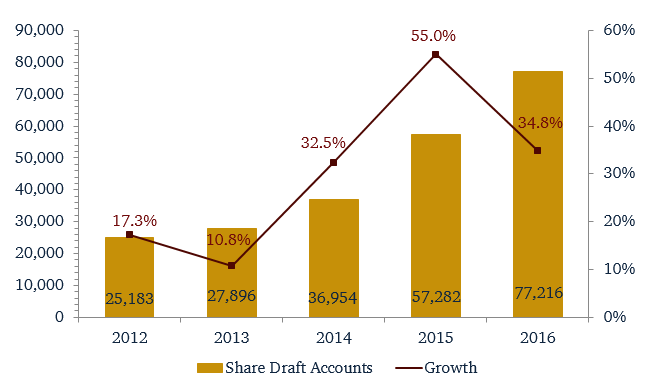

NUMBER OF SHARE DRAFT ACCOUNTS & YEAR-OVER-YEAR GROWTH

For America’s Christian Credit Union | Data as of 03.31

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

The partnership began with 200 accounts and has grown rapidly ever since. In one period alone, America’s Christian converted 12,000 accounts. At first quarter, America’s Christian posted 12-month member growth that exceeded 32.0%, which drove share draft growth to 34.8%.

This increase in membership has also spurred loan demand at the credit union.

This evolved more than anyone could’ve imagined, says Terri Snyder, executive vice president and chief operations officer at America’s Christian. We’re hitting 95% of target, and approximately 40% of loan business is coming from this membership now.