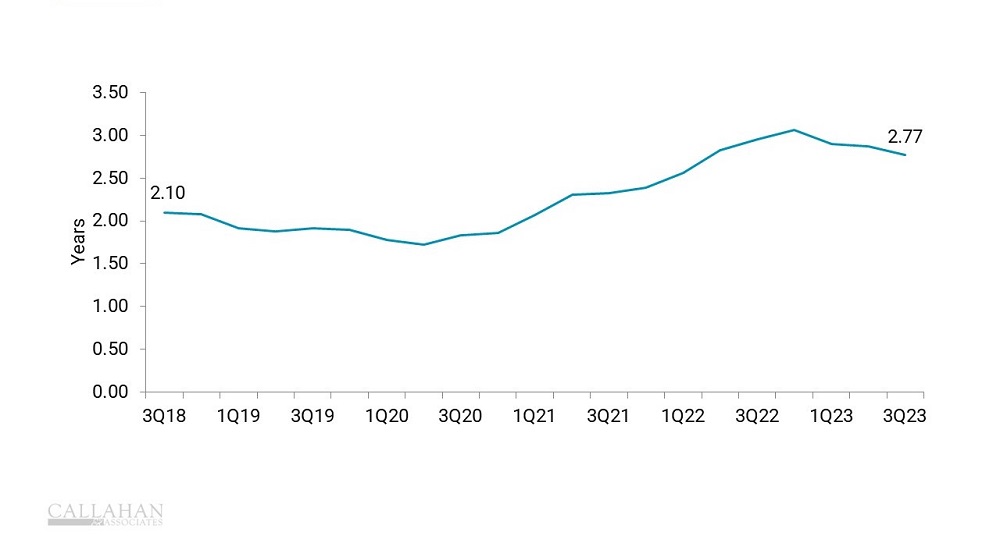

WEIGHTED AVERAGE LIFE OF INVESTMENT PORTFOLIO (INCL. CASH)

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

- There’s a small a glimmer of hope for credit union liquidity concerns. The weighted average life of credit union investment portfolios shrunk to 2.77 years in the third quarter, down from the peak of 3.06 years at year-end 2022. Investment securities reaching maturing and credit unions slowing purchases of long-term securities resulted in the shortened portfolio.

- The reduction comes while accumulated unrealized losses on available-for-sale investment securities reached $40.6 billion for the industry, a new high for this cycle.

- The shortened life of the portfolio means more funds are freed to lend or replenish cash balances, which is crucial for credit unions with mounting unrealizes losses that are unable to sell securities.