The total loan portfolio at U.S. credit unions is on track to reach $1.1 trillion. In 2018 alone, the industry added $88.9 billion to the portfolio, according to year-end projections from Callahan & Associates.

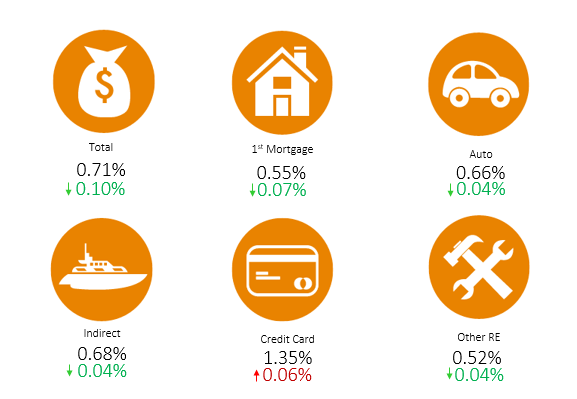

Notably, as the loan portfolio has grown, delinquency and charge-offs have decreased. Analysts at Callahan & Associates project overall delinquency declined 10 basis points across 2018 to 0.71% as of Dec. 31. This is the lowest fourth quarter rate since 2006, when credit unions reported a rate of 0.64%.

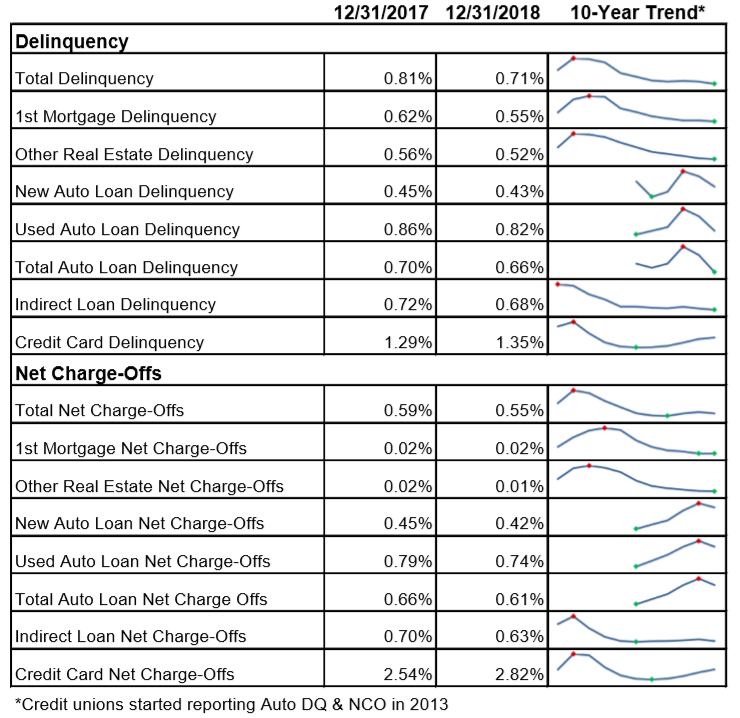

See how asset quality has improved over the past 10 years.

After hitting 1.78% in fourth quarter 2009 as a consequence of the Great Recession, asset quality for the industry has improved substantially in the past decade. Net charge-offs and delinquency are down 29 and 58 basis points, respectively, to 0.55% and 0.71%.

ANNUAL CHANGE IN DELINQUENCY

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

© Callahan & Associates | CreditUnions.com

Asset quality improved across every major loan product, with the exception of credit cards.

Credit unions recorded improved asset quality in every major segment of the loan portfolio aside from credit cards. From the fourth quarter of 2016 to the fourth quarter of 2017, credit card delinquency increased 15 basis points. That annual growth was down to 6 basis points as of the fourth quarter of 2018, when credit card delinquency was 1.35%.

Credit card balances at credit unions swelled to $62.2 billion at year-end, with the average credit card loan balance at $3,023. Credit card utilization was down 140 basis points over the past five years to 31.8%. That decrease can be the result of credit unions extending larger lines of credit or members spending less. From the fourth quarter 2013 to the fourth quarter 2018, unfunded credit card commitments increased 54.1% whereas the actual dollar amount of outstanding balances increased by 44.6%, demonstrating that limit expansion is outpacing draws.

ContentMiddleAd

Auto loans accounted for 35.1% of the total loan portfolio at credit unions in the fourth quarter of 2018. Behind first mortgages, autos represented the second-largest segment of lending. Growth slowed for all segments of the loan portfolio apart from other real estate. At 10.3%, auto loans were the only segment for which credit unions recorded double-digit growth. New auto loan growth of 11.9% surpassed used auto loan growth of 9.3%. Five years ago, credit unions captured 15.0% of the auto finance market. Today, credit unions fund one out of every five auto loans nationwide 20.5% of the market according to Experian Automotive.

In a rising rate environment, auto loans are attractive. According to the DMV, auto loan terms range from 48 months (four years) to upwards of 84 months (seven years), whereas real estate loans have terms of up to 30 years. The shorter loan duration of auto loans allows credit unions to more actively manage interest rate risk.