Inflation rose at a higher pace than wages and salaries in the third quarter, causing consumers to lose purchasing power. TransUnion reported record expansion in credit card balances and unsecured personal loan growth for the third consecutive quarter, due in part to Americans searching for cash to lighten the financial squeeze.

Furthermore, lending activity in the housing market continues to soften as high prices, increasing interest rates, and low inventories price many would-be borrowers out of the market. Americans bought and sold existing homes at a seasonally adjusted annual rate (SAAR) of just 4.7 million in September of 2022. That’s down 23.8% from one year ago, according to the National Association of Realtors.

This is part of the “Industry Trends” section of Credit Union Strategy & Performance, presented every quarter by Callahan & Associates. Read the latest issue or dive into a decade of archives. Contact Callahan to gain access today.

KEY POINTS

- Outstanding loan balances increased 19.1% annually to almost $1.5 trillion, the highest year-over- year growth rate for the industry on record.

- The number of loans granted year-to-date declined 9.6% from the first nine months of 2021.

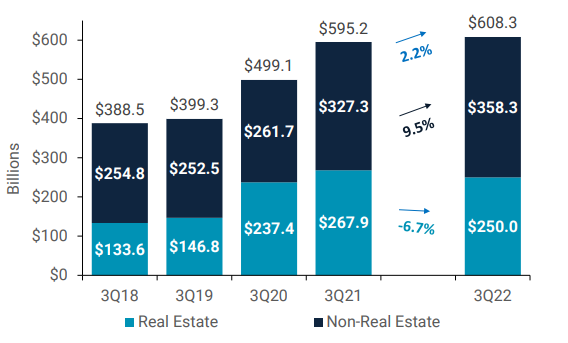

Despite this, origination balances grew 2.2% to $608.3 billion year-to-date as average loan values surged with inflation. - The industry’s delinquency ratio increased 7 basis points from one year ago. With tightened budgets, members prioritized paying loans of higher importance — such as mortgages — over credit cards. Real estate loan delinquency improved 4 basis points year-over-year; credit card delinquency increased by 44 basis points.

Year-To-Date Loan Originations

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.22

© Callahan & Associates | CreditUnions.com

QUARTERLY OUTSTANDING LOAN BALANCE GROWTH BY TYPE

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.22

© Callahan & Associates | CreditUnions.com

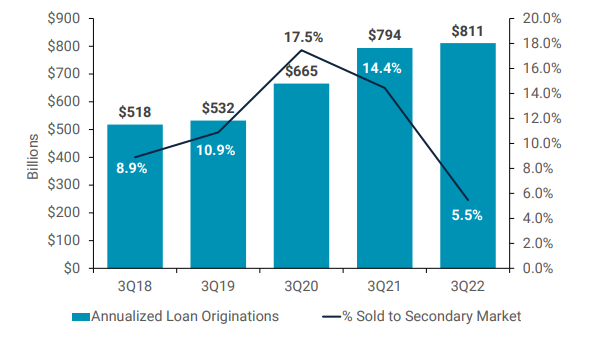

ANNUALIZED LOAN ORIGINATIONS AND % SOLD TO SECONDARY MARKET

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.22

© Callahan & Associates | CreditUnions.com

THE BOTTOM LINE

Credit unions are serving their communities and members by keeping up with loan demand. The popularity of indirect lending has returned as credit unions revamp partnerships with dealerships and fintechs to generate financing opportunities in an increasingly virtual world. However, loan growth has far outpaced the rate of share growth, leading to sudden-onset liquidity concerns for large portions of the industry. If heightened lending activity continues, credit unions will need to turn to new strategies — such as raising dividend rates on deposits or borrowing funds from other lenders — to generate liquidity.

What’s Happening In Your Market?

LEARN MORE